Aussie Stuck at Key Resistance Level

There is a likelihood that the pair will keep rising as bulls target the next key resistance level at 0.7250.

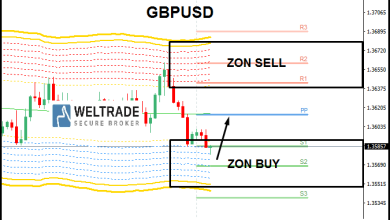

Bullish View

- Set a buy-stop at 0.7230 and a take-profit at 0.7300.

- Add a stop-loss at 0.7170.

- Timeline: 2 days.

Bearish View

- Set a sell-stop at 0.7200 and a take-profit at 0.7140.

- Add a stop-loss at 0.7260.

The AUD/USD pair was little changed after more signs emerged that the Australian economy was doing well. It is trading at 0.7210, where it has been in the past few days.

Australian economic recovery

Data released recently showed that the Australian economy is doing relatively well. For example, according to the Australian Bureau of Statistics, unemployment has moved to 4.2%, which is lower than where it was before the pandemic started. The job recovery has been supported by both manufacturers, miners, and service providers.

On Monday, data by Markit revealed that the manufacturing sector was robust this month. The manufacturing PMI rose from 55.1 in January to 57.6 in February. Similarly, the services PMI rose from 46.6 to 56.4 as the government ended its Covid restrictions. Therefore, the situation will continue to do well in the coming months.

The next key mover for the Australian dollar will be the upcoming wage price index (WPI) data that will come out on Wednesday. With inflation rising, this is the number that the Reserve Bank of Australia (RBA) has been focusing on mostly.

Therefore, if wage growth continued to accelerate, there is a likelihood that the RBA will embrace a more hawkish tone. Analysts expect that it will hint about rate hikes in its June meeting.

The AUD/USD pair will also react to the upcoming US consumer confidence data that will come out in the afternoon session. This is an important number since consumer spending is the biggest part of the American GDP.

While retail sales jumped in January, analysts expect that consumer confidence waned in February as worries about inflation remained. Precisely, they expect that confidence fell to about 113. The pair will also react to the latest US flash PMI numbers.

AUD/USD Forecast

On the 4H chart, we see that the AUD/USD pair has moved sideways in the past few days. This price action happened after the pair hit the descending trendline that is shown in blue. This line connects the highest points since January this year.

The recovery is still being supported by the 25-day and 50-day moving averages. The pair also seems like it has formed an inverted head and shoulders pattern. Therefore, there is a likelihood that the pair will keep rising as bulls target the next key resistance level at 0.7250.

Source link