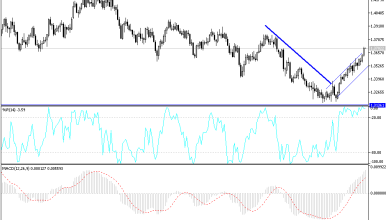

AUD/USD Forex Signal: Consolidating Below 0.7170

The pair remains prone to sharp downwards price movement.

Previous AUD/USD Signal

Last Tuesday’s AUD/USD signal produced a losing short trade from the bearish rejection of the resistance level I had identified at 0.7170.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be taken before 5pm Tokyo time Wednesday.

- Short entry following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7100, 0.7170, or 0.7188.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6963, 0.6926, or 0.6885.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

I wrote last Tuesday that the price was trading in a range between 0.7102 and 0.7170, with a prospect of sudden breakdown caused by deteriorating risk sentiment due to worries over the Fed’s tightening of monetary policy and the prospect of a military conflict between Russia and Ukraine. I was therefore looking to take a short trade from another bearish rejection of 0.7170, which set up, but turned out to be a losing trade. The price also ended up above 0.7170 so this was not a successful call.

The price has shown a little volatility late in the Asian session following the Reserve Bank of Australia’s monthly policy release, which as expected ended the Bank’s QE (asset purchase) program and left rates unchanged at 0.1%. The recent price action has had the effect of invaliding former key levels nearby, leaving the price looking likely to consolidate within a wide range between 0.7100 and 0.6963.

The price of this currency pair reached an 18-month low at the end of last week, some pips below the huge round number at 0.7000. The price is therefore certainly in a long-term bearish trend but is in an area that could well see a long-term bullish reversal. This means there could be good trading opportunities here.

I am prepared to take either a short trade from a bearish reversal at 0.7100 or a long-term long trade from another bullish bounce at 0.6963. If the short trade is taken, it should be carefully monitored due to choppy price action in the area it will have to move through to be profitable.

Regarding the USD, there will be a release of ISM Manufacturing PMI data at 3pm London time. There is nothing of high importance scheduled today concerning the USD.

Source link