Americans Borrowed More to Buy Much Less: What Happened with Auto Loans Is Truly Amazing

Undeterred by spiking prices and shortages.

By Wolf Richter for WOLF STREET.

Consumers borrowed bravely in December, amid shortages of all kinds, particularly new vehicle shortages, and amid skyrocketing prices of new and used vehicles, and sharply higher prices on other goods and services. Undeterred, consumers bought not what they wanted to buy, but what there was to buy. And enough consumers borrowed to do so in order to make banks smile again.

Balances on credit cards and other revolving credit jumped by 6.6% year-over-year, to $1.04 trillion, not seasonally adjusted, according to the Federal Reserve Board of Governors today. This has come up a long way from 2020 and through mid-2021 when consumers, awash in free money, slashed their rip-off-credit-card balances to the detriment of the banks that suddenly weren’t earning 29% or whatever on those slashed credit-card balances. But consumers are now atoning for those sins:

In reality, the people that charge up their credit cards and pay usurious interest on their cards are a subset of consumers because a lot of consumers carry no credit card debt. They just use their cards as payment devices and pay them off every month.

But still, even these efforts in December 2021 didn’t beat the borrowing binge of December 2019 because enough people were still flush with cash, and they were earning more money too, and they didn’t need to borrow as much on their rip-off credit cards. Credit card balances in December were 4.9% below December 2019.

I’ve been screaming for a year-and-a-half about the seasonal adjustments during the pandemic when the well-established seasonality was upended. So here we go.

On a seasonally adjusted basis, revolving credit balances rose to $1.04 trillion – yes, same as not-seasonally adjusted because December is the month when seasonal adjustments get pegged to not-seasonally adjusted data, as you can see in the chart below. In the not-seasonally adjusted data (red), the peaks are in December. The seasonally adjusted data (purple) rides on top of all the Decembers:

What happened with auto loans & leases is truly amazing.

The number of new vehicles sold in December plunged 28% from a year earlier, amid the worst new vehicle shortage in history, as dealers had very little for sale on the lot.

But vehicles were sold for ridiculous prices that often included addendum stickers of thousands of dollars on top of MSRP. In addition, automakers, having gotten hammered by the chip shortage and not being able to produce large numbers, prioritized their costliest models and equipment packages. As a result, the average transaction price, as tracked by J.D. Power, spiked by 20% year over year in December, to $45,700:

Used vehicle retail sales declined about 6% year-over-year in December, according to Cox Automotive. But prices went even crazier than new-vehicle prices and jumped by 37% year-over-year, according the CPI for used vehicles:

The amazing thing is how this collapsed volume in unit sales – down 28% for new vehicles and down 6% for used vehicles – and the huge price increases fused into the phenomenon of consumers borrowing more to buy a whole lot less.

Total auto loans and leases outstanding in the third quarter rose 3.4% from a year ago, to a new record of $1.22 trillion, despite the plunge in volume. This is another aspect of inflation: consumers borrow more to buy less:

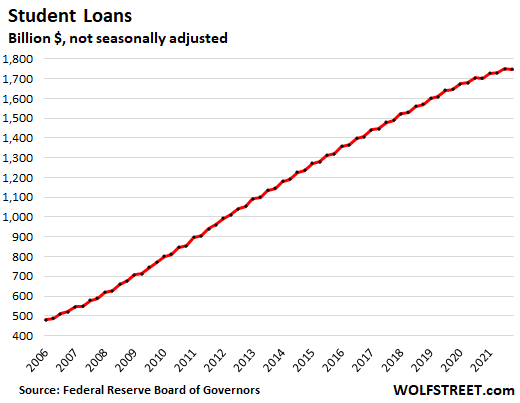

Student loans still in forbearance.

Automatic student loan forbearance has been extended for the umpteenth time, this time through May 1, 2022. We’re going to call it the Spandex forbearance program. It means 0% interest on balances and no payments due. Global loan forgiveness has been averted so far, but numerous specific student-loan forgiveness programs have been in effect for years, and more have been added during the pandemic.

By now, no one is paying down their student loans anymore. They just borrow, betting that they’ll never have to pay off those loans. Even in prior years, loan payments were often so small that they didn’t even cover the interest, and the balances kept growing, despite years of declining enrollment, and even more sharply declining enrollment during the pandemic.

In Q4, balances ticked down by a tiny $2 billion from the prior quarter, not because anyone made any payments, but because various programs of loan forgiveness removed more loans from the tally than new loans were added.

The balance in Q4 of $1.75 trillion, the second highest ever, was nevertheless up 2.7% from Q4 in 2020:

All these forms of consumer credit combined – revolving credit, auto loans, and student loans – rose 5.9% year over year in December to a record $4.43 trillion, seasonally adjusted and not seasonally adjusted (December is the month when seasonal adjustments get pegged to not-seasonally adjusted credit). So consumers did their part flawlessly. They’re borrowing more to buy less. And little by little, they’re making sure that banks and auto lenders are once again able to maximize their profits.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Source link