Will Gains Halt from Omicron?

In the first trading session of 2022, the price of the GBP/USD currency pair suffered a setback. As a result, it fell towards the 1.3430 support level, before settling around the 1.3475 level at the time of writing the analysis. The decline came from strong gains recorded by the currency pair towards the 1.3550 resistance level recorded at the end of trading year 2021.

The highly transmissible omicron variant has caused the number of new daily cases to rise in Britain over Christmas and the New Year, with a new daily high of 189,000 on December 31. That’s about 1 in 25 people in England – or about 2 million people – infected with COVID-19 in the week before Christmas, the Office for National Statistics estimated. In London, the number was 1 in 15. British Prime Minister Boris Johnson warned that the country’s health system will remain under pressure for weeks amid the current rise in Corona virus infections but indicated that there will be no tightening of measures soon to slow the spread of the virus.

There have been 157,758 infections reported in England and Scotland, and 42 deaths in England. The figures for Wales and Northern Ireland have not been published. For his part, Johnson said during a visit to the vaccination center in Aylesbury: “I think we have to realize that the pressure on the NHS, on our hospitals, is going to be great for the next two weeks, maybe more.” Johnson was speaking after the Sunday Times reported that a group of hospitals in the eastern county of Lincolnshire had declared a “grave incident” due to the “severe and unprecedented” shortage of staff.

Johnson’s government removed nearly all coronavirus restrictions in July but reversed course last month and launched “Plan B” for England. Plan B requires face coverings to be worn in indoor public spaces, requiring proof of vaccination or a negative test to enter nightclubs and requiring people to work from home if they can. Johnson on Monday urged people to stick to those rules and get a booster vaccine, as the government seeks to shore up a staff shortage.

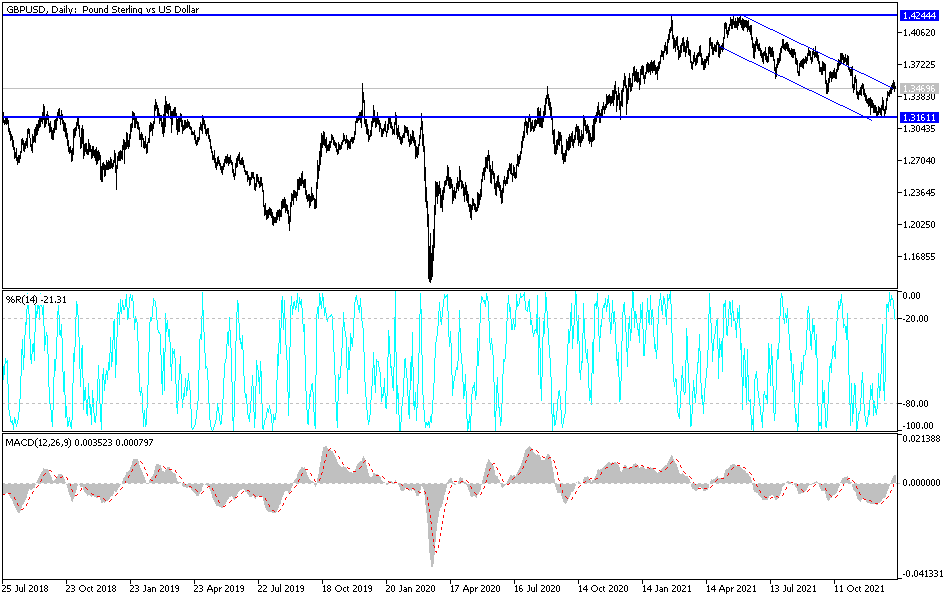

Technical analysis: GBP/USD may be ready to resume long-term selling after this latest pullback. The price is approaching a strong area of interest around the 1.3500 handle and descending trend line on the daily chart. This also happens to align with the 100 SMA dynamic inflection point, adding to its strength as resistance. A slightly larger correction may continue to test the 61.8% Fibonacci level at 1.3580 before reversing to the swing low at 1.3160. So far, the 100 SMA remains below the 200 SMA to confirm the continuation of the downtrend and that selling is more likely to resume than reverse. The RSI has a bit more room to go up before reaching an overbought area, so the correction may continue.

Stochastic has already reached overbought territory, indicating that the buyers have exhausted their steam and could soon let the sellers take over.

Today, the British Manufacturing Purchasing Managers’ Index will be announced, along with net lending to individuals and the number of mortgage approvals. From the United States of America, the ISM Manufacturing PMI and the number of job opportunities available will be announced. The dollar’s strongest focus this week will be on the announcement of the contents of the minutes of the last meeting of the US Federal Reserve tomorrow and the US jobs numbers on Friday.

Source link