Wage Price Spiral Takes Off, Companies Point at it: Albertsons Shares -8%, JP Morgan’s Dimon Sees “Huge Pressure” on Labor Market

The Fed finally sees it too.

By Wolf Richter for WOLF STREET.

For businesses, there is a good side to inflation: They can jack up prices and get away with it without losing customers because customers bought into the inflationary mindset and are paying whatever; and thereby companies can raise their revenues without having to actually sell more.

And there is a bad side to inflation for businesses: Their costs are surging, not just the costs of products and services, but also the costs of labor. And those surging costs are now squeezing margins.

Shares of supermarket conglomerate Albertsons Companies [ACI] got whacked down 8% at the moment after the company, which also owns Safeway, reported stellar sales growth of 8.4% in its third quarter, ended December 4, driven by increases in retail prices, incremental sales from administering vaccines in its pharmacies, and from buying and opening additional stores.

That’s the good side of inflation: the company is able to charge higher retail prices and thereby increase its revenues.

Then comes the bad side of inflation: Cost increases. Labor costs are now surging, as companies need to offer sharply higher wages and salaries in order to hire and retain employees amid massive churn as record numbers of workers quit their jobs to jump to new jobs for better pay and better working conditions.

Albertsons noted the effects of cost increases on its gross margins, which declined by 40 basis points to 28.9% due to an “increase in product and supply chain costs driven by the current inflationary environment.”

And its selling and administrative expenses were hit by “higher employee costs.” It further clarified: “The increase in employee costs was the result of additional labor to support the increase in fresh sales, market-driven wage rate increases, and higher equity-based compensation expense.”

At the other end of the wage scale, the biggest Wall Street banks have had to raise their already huge pay packages to hire and retain across the board, from junior bankers and analysts to executives, and those increases make the wage increases at grocery stores pale in comparison.

JP Morgan Chase CEO Jamie Dimon said in a Fox News interview today that, for the first time in his life, there is “huge pressure” on the labor market. “The price of labor is going up, we’re going to have to deal with it,” he said.

And this is now everywhere the same song: There is enormous pressure in the labor market as companies are trying to hire people in order to meet demand that has been stimulated by over $10 trillion in monetary stimulus and fiscal deficit spending in less than two years in just the US alone.

But millions of potential workers refuse to be drawn into the labor market for a variety of reasons, ranging from not being able to find daycare to sitting on so much wealth from the Fed-engineered bubbles in stocks, cryptos, and real estate that they see no need to put their nose to the grindstone ever again – that’s what they hope. And many people have found the financial freedom to start their own businesses.

The labor market has changed because people got kicked out of a rut and started thinking about priorities, and how to do things differently, and those $10 trillion in monetary and fiscal stimulus are still floating around out there.

Under this enormous pressure, the price of labor has started soaring, which is a good thing, except it now provides further and sustained fuel for the already soaring prices as customers that earn more can spend more, and they’re paying those higher prices now that the inflationary mindset has taken over, and price resistance has collapsed.

This is a classic wage price spiral, with the worst inflation in 40 years. But it’s different this time because the Fed is still fueling inflation by printing money and repressing interest rates, after having wasted a year proclaiming, ridiculously, that surging inflation was temporary.

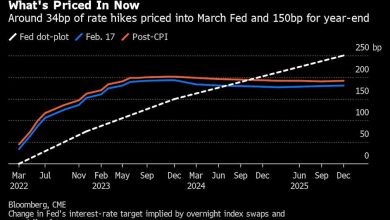

This most reckless Fed ever has had some kind of come to Jesus moment late last year when it did acknowledge the problem it had set off. And now it’s trying to act way too slowly, way too late, and way too timidly to break up this spiral without causing the whole house of cards – the magnificent asset bubbles everywhere – that its money-printing and interest-rate repression created to come crashing down all at once.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Classic Metal Roofing Systems, our sponsor, manufactures beautiful metal shingles:

- A variety of resin-based finishes & colors

- Deep grooves for a high-end natural look

- Maintenance free – will not rust, crack, or rot

- Resists streaking and staining

To reach the Classic Metal Roofing folks, click here or call 1-800-543-8938

Source link