USD/JPY Technical Analysis: Profit Taking Operations

Throughout the transactions of the past week, the price of the USD/JPY currency pair is moving amid an upward momentum.

It has succeeded in moving towards the 116.35 resistance, the highest in five years, and from the middle of the week’s trading until its end. The price of the dollar-yen pair is exposed to profit-taking operations and can occur at any time. As a result, it moved towards the level of 115.53 and closed the first week of 2022 trading around it. The US dollar gave up some of its gains after the US job numbers were announced at the end of 2021. The numbers were mixed but did not affect expectations of the imminent date of raising US interest rates.

According to official figures, the US unemployment rate fell in December to 3.9% – a pandemic low – even as employers added a modest 199,000 jobs. This is evidence that they are struggling to fill jobs as many Americans are reluctant to return to the workforce. The drop in the unemployment rate, from 4.2% in November, indicates that many people found work last month. In fact, despite the slight increase in hiring reported by companies, 651,000 more workers said they were employed in December compared to November.

Data reported by the Labor Department on Friday reflected the state of the US labor market in early December — before the surge in COVID-19 infections began to disrupt the economy. Economists have warned that US job growth could slow in January and possibly February due to cases of Omicron, which have forced millions of newly infected workers to stay home and quarantine. The economy is still 3.6 million jobs less than it was before the pandemic.

The yen is a popular asset during turbulent times.

Currently, steady employment is driving strong consumer demand which has remained resilient despite the chronic shortfall in supply. Consumer spending and business purchases of equipment are likely to drive the economy to a solid annual growth rate of about 7% in the final three months of 2021. Americans’ confidence in the economy rose slightly in December, according to the Conference Board, indicating that spending may have been healthy. For most of the past month.

Wages also rose sharply in December, with average hourly earnings jumping 4.7% from a year ago. This increase in wages is a sign that companies are competing fiercely to fill their open positions. A record wave of resignations, as many workers seek better jobs, is helping to raise wages. However, lower unemployment and rapid wage gains may drive up inflation as companies raise prices to cover rising labor costs. Price increases have already jumped to a four-decade high, prompting a sharp shift by the Fed, from keeping rates low to supporting employment to moving toward raising interest rates to combat inflation. Most economists expect the Fed to raise the benchmark short-term interest rate, now pinned near zero, in March, and to do so an additional two or three times this year.

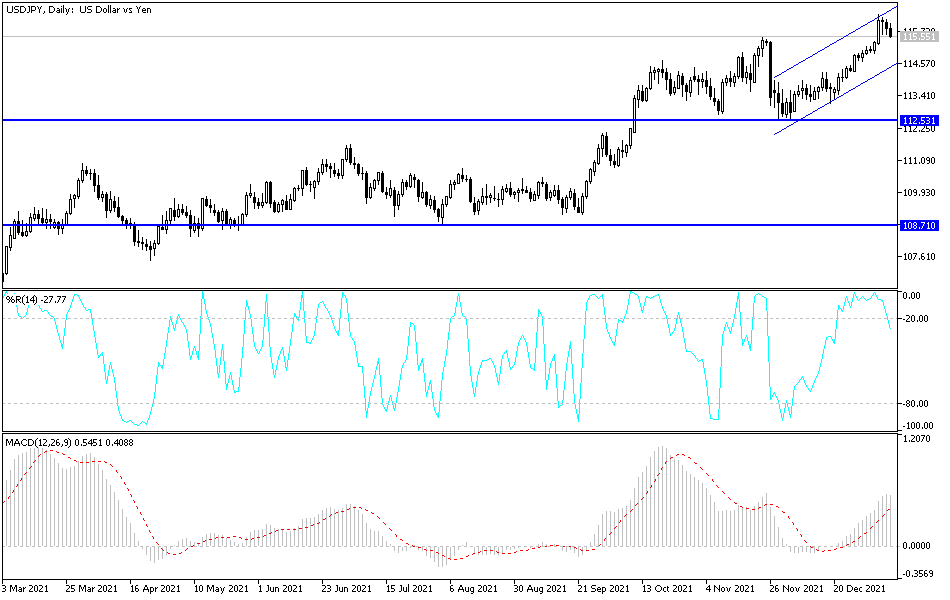

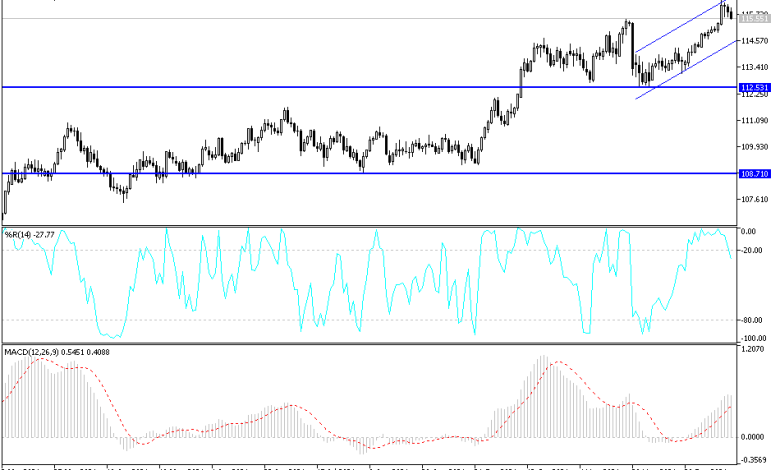

According to the technical analysis of the pair: Despite the recent performance, the general trend of the USD/JPY currency pair is still bullish, as long as it is stable above the resistance 114.20, according to the performance on the daily chart. The bulls are currently 115.85, 116.20 and 117.00, respectively. On the other hand, and over the same period, the support 113.15 was broken, the most important for the return of the bears’ control and a change in the general trend.

Today’s economic calendar is devoid of influential US data, and therefore investors’ appetite for risk or not will have the strongest impact on the performance of the dollar-yen pair.

Source link