The flaws in the Fed’s approach to inflation

The writer is Professor Alfred Lerner of Banking and Financial Institutions at Columbia Business School and a former Governor of the US Federal Reserve.

The US Federal Reserve has been assaulted by reality. Current inflation is now above 6 percent, a level not seen in nearly 40 years, and is proving far more persistent than Fed policymakers expected. Why is the Fed’s monetary policy lagging behind in tightening monetary policy to control inflation?

Three loopholes in the Fed’s monetary policy led to an overly expansionary monetary policy.

First, insufficient emphasis has been placed on demand shocks. The Fed based its view that the spike in inflation would be short-lived on the vast negative supply shocks Covid-19 has imposed on the economy.

Although negative supply shocks are surely one of the sources of the inflation surge, the Fed has not paid enough attention to very strong positive demand shocks.

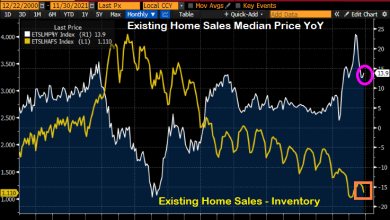

The pent-up demand from households that couldn’t spend during the pandemic and the extraordinary expansionary fiscal policy promoted by the Biden administration has led to a strong demand for goods and services. It is true that inflation will be temporary when it results from supply bottlenecks that dissipate over time. But strong positive demand shocks translate into persistent high inflation, which we are experiencing now.

The second flaw is the Fed’s view of the Phillips curve, the theory that unemployment and inflation have an inverse relationship. Officials said the Phillips curve is dead because unemployment is below its “natural rate” (where the economy is at a full employment level). This supposedly meant that higher employment rates are no longer a major factor driving inflation up.

Research I presented with coauthors at the United States Monetary Policy Forum several years ago suggests that the Phillips curve is not dead, but rather in hibernation.

A weak link between unemployment and inflation depends on the Fed taking preventative action against rising inflation, a policy it has now abandoned.

Instead, the Fed pledged to maintain an expansionary monetary policy until full employment is achieved. A summary of economic projections from the Federal Open Market Policy Committee suggests that this will occur at a natural unemployment rate of around 3.5%.

Unfortunately, previous economic research indicates that the natural unemployment rate is a notoriously difficult number to estimate. Indeed, other indicators of stress in the labor market, such as the high number of unfilled jobs and rising wages, suggest that we have already reached full employment, so the natural unemployment rate is above the target level of 3.5%.

Underestimates of the natural unemployment rate have led to serious inflationary policy errors in the past: the so-called high inflation period of the late 1960s and 1970s is a classic example, where the Fed assumed that the natural unemployment rate was around 4 percent. percent when subsequent evidence showed it to be a few percentage points higher.

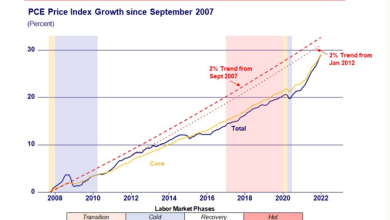

A third flaw is the Fed’s poor execution of the new “medium” inflation targeting framework. Shifting the Fed to an average inflation target, where the target is 2% on average over a specified horizon, say five years, is a policy that I have advocated and many other economists have advocated.

However, the Fed has been reluctant to disclose the horizon of the average, which actually makes the 2% inflation target less credible. A long horizon means that inflation can stay above the 2 percent level for a very long time without raising the average much.

The Fed’s reluctance to provide more information on the horizon of the average inflation target therefore weakened the Fed’s credibility in keeping inflation close to 2%. Inflation expectations may now no longer be anchored, making persistent high inflation much more likely.

While U.S. CPI inflation is very likely to decline from its current level of 6.8% as supply bottlenecks due to Covid decline, it will continue to significantly exceed the Fed target. The Fed must recognize the flaws in its monetary policy framework and return to more preventative policies to control inflation. If not, the result will not only be persistent inflation well above the 2 percent target, but possibly much higher interest rates to lower inflation, which will hurt. seriously to the economy.

Source link