Step Aside “Transitory” Inflation: The Fed Wants To Be Dead Wrong About “Easing Supply Chains” Next

In 2021 the reverse-Robinhood wealth transfer mechanism better known as the Federal Reserve destroyed what little credibility it has by claiming, arrogantly and foolishly, that inflation is transitory for months and month, only to see inflation keep rising in a very non-transitory fashion, until one day Powell bit the bullet and admitted that the Fed – and assorted macrotourist hangers on – had been dead wrong all along and it was now time to “retire” the word “transitory.”

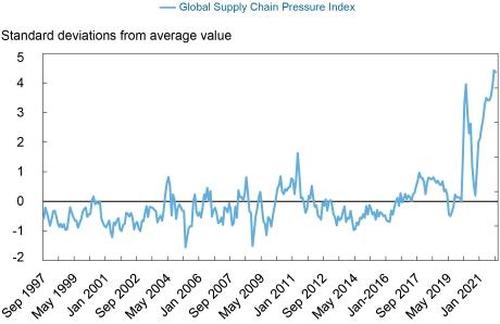

So having learned absolutely nothing from 2021, and eager to continue exposing its career academics in charge of the world’s biggest economy as a bunch of idiots, on Tuesday the New York Fed released a new index meant to evaluate the pressure on global supply chains. The Global Supply Chain Pressure Index (GSCPI) surged early in the pandemic when China imposed lockdown measures, but pressures eased as production resumed , then picked back up during the winter of 2020 as COVID-19 infections jumped.

The good news: the historically high pressures on global supply chain networks that have contributed to shortages of key goods and materials and a surge in inflation – the same inflation that the Fed claimed all along was “transitory” mind you – may have peaked.

“More recently, the [index] seems to suggest that global supply chain pressures, while still historically high, have peaked and might start to moderate somewhat going forward,” the researchers wrote in a blog post which we will certainly timestamp and revisit in six months time at which point we fully expect global supply chains to be orders of magnitude worse than they are now.

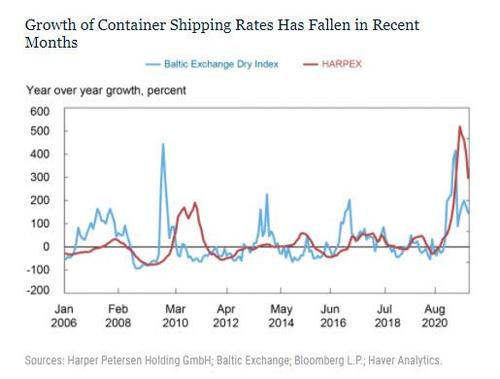

Cynicism aside, the Fed’s supply chain index is based on 27 variables such as shipping rates…

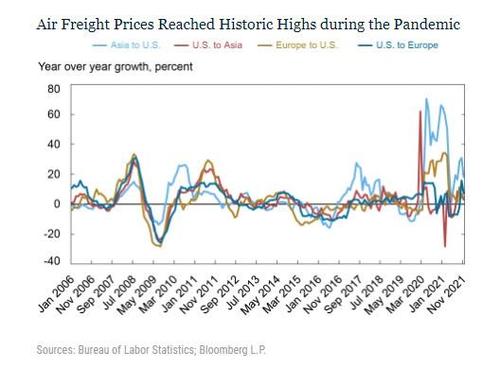

… and air freight costs between the United States, Asia and Europe.

Researchers – who apparently had access to a Bloomberg terminal where the information is literally one click away – found “enormous growth” in shipping costs since the beginning of the recovery from the lows at the start of the pandemic. But that growth has started to slow in recent months.

The researchers also noted that container shipping rates rose more significantly during the most recent economic recovery than after the Global Financial Crisis. But the costs of shipping raw materials, such as coal or steel, rose “on par” with the post-GFC recovery, they added.

Fed researchers said they adjusted for shifts in demand, but noted that the index is “not a perfect” measure and likely still reflects some demand factors. Such as Biden’s trillions made possible by… the Fed’s monetization of the US debt and deficit following the US descent in post-covid MMT idiocy.

One thing that the career academics at the NY Fed who have never had to actually ship any product from Point A to Point B in the world got right is that the index, drawing on data going back to 1997, shows global supply chain pressures are substantially higher now than in previous times of stress.

For example, pressures rose in 2011 after two natural disasters, including an earthquake in Japan and flooding in Thailand. The index rose again during the U.S.-China trade war in 2017 and 2018. But those spikes “pale in comparison to what has been observed since the COVID-19 pandemic began,” researchers wrote.

Of course, even the Fed can get something right. But, more importantly, is it right that global supply chain pressures have peaked and it’s all downhill from here?

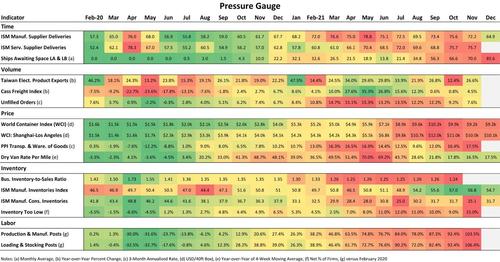

Well, let’s look at the evidence. First, as the latest Wells Fargo Supply Chain pressure gauge (yes, the private sector was well ahead of the Fed in coming up with a supply chain congestion index), it’s about as ugly as it has ever been across virtually every vertical: time, volume, price, inventory and labor.

So yes, one can easily claim that just because a series is at its all time high it is bound to reverse, but one can also be very wrong if said series keep rising. Which, incidentally, is what the far more likely case because as Citi’s economists wrote at the end of December, there are no signs of easing in supply chain congestion:

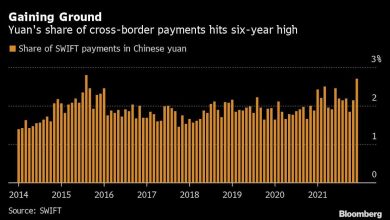

We update our weekly freight data tracker which covers both sea and air freight. In sea freight, US West Coast port congestion has continued to decrease compared to last week. The seven day moving average of vessel capacity at port/anchorage for this week is 0.80m TEU vs. last week’s 0.82m TEU. It is a similar on the US East Coast, with the seven day moving average for this week at 0.71m TEU vs last week’s 0.74m TEU.

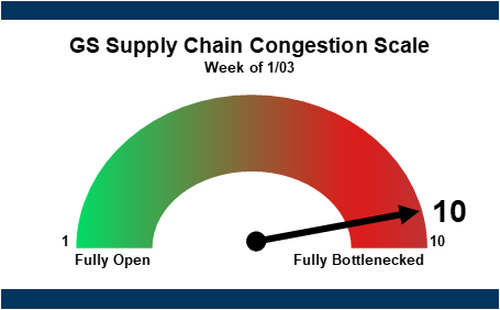

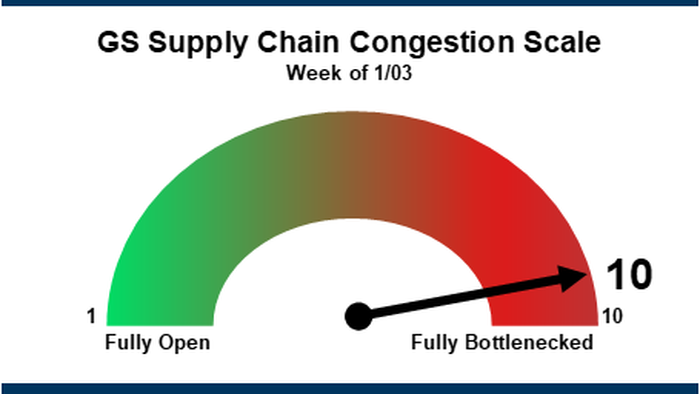

Or how about Goldman: yes, the vampire squid which has spawned its share of NY Fed presidents desperately tries to pain a rosy picture, writing in its own weekly “GS Supply Chain Congestion Scale monitor” the following silver lining:

Our weekly congestion index showed sequential improvement once again, and the pace of improvement was greater last week. The 2.7% sequential decline in Week 8 versus Week 7’s 0.3% decline comes with significantly better intermodal rail traffic volumes and continued easing of ocean container shipping rates.

… which is great until one reads the fine print, to wit:

With 97 container ships still waiting to dock, we think those inland trends did not improve materially over last week – but we also take the lack of significant coastal buildup as a sign that things are not getting worse either…. our overall congestion scale remains at level ‘10’ or ‘fully bottlenecked.’

And Goldman is also kind enough to point out the weakest link in all projections of improvement: the Chinese New Year…

… we continue to see the recent sequential improvements as indicative of where supply chains could head by mid year-2022 (barring any major re-spikes in shipping ahead of Chinese New Year).

… and spiking new cases which most likely will lead to new port shutdowns, and even greater transportation bottlenecks.

Chinese mainland on Tuesday reports 41 new locally transmitted #COVID19 cases https://t.co/sp90YXexI7 pic.twitter.com/O91Wa2atR6

— China Xinhua News (@XHNews) January 5, 2022

Oh and incidentally, for the benefit of our friends at the Fed who are taking the modest dip in shipping rates and extrapolating a full-blown normalization, some advice: back in October we warned that what so many then viewed as a major inflection point in shipping rates and a “clear” indication that the worst was behind us, was just a headfake (see “A Dip In Shipping Rates: The End Of The Nightmare, Or Just The Eye Of The Hurricane“). And sure enough…

Fresh highs for shipping freight rates from China #inflation 🚢↗️🚀 https://t.co/o6lVhikA13 pic.twitter.com/m25nj4edtc

— David Scutt (@Scutty) January 3, 2022

Then again, NY Fed economists shouldn’t feel too bad: after all upward failing Bloomberg macrotourists such as this one were all too quick to make a similar flawed extrapolation and take the drop in lumber prices as a victory for camp transitory, not to mention trolling an entire audience too dumb to realize it…

When I was tweeting about lumber going up, some people were snarking that that was the sign of the top. And now I’m tweeting about it going down and people are saying that’s the sign of the bottom. Folks, I just like to tweet whether the line is moving up or down.

— Joe Weisenthal (@TheStalwart) June 28, 2021

… and are now pivoting so fast the heads of their last three remaining viewers are spinning so fast…

Lumber prices are very close to their highs from last spring pic.twitter.com/kyrEKfsAQA

— Joe Weisenthal (@TheStalwart) January 4, 2022

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link