Risk-on, Mixed Data Pushing Aussie to 0.72

- The AUD/USD is resuming its intraday high despite mixed Australian data.

- In November, retail sales in Australia rose 7.3%, but the trade balance fell to $9,423 million.

- Risk appetite is improving due to weaker yields, a faster transition in the economy, and the news from Omicron.

The AUD/USD price analysis shows a new daily high around 0.7195, rising 0.15% on the day as mixed data at home and cautious market optimism challenged immediate moves.

–Are you interested to learn more about AI trading brokers? Check our detailed guide-

In Australia, retail sales grew by an expected 3.9% and by the previous 4.9% to 7.3% m/m, while the trade balance increased to $9.423 billion from the previous $11.220 billion and expected $10.600 billion. According to details, exports and imports increased by 3.0% to 2.0% and 6.0%, respectively.

Due to the pair’s status as a risk barometer, cautious market optimism can also be considered a catalyst for the recent gains in AUD/USD.

The remarks prepared for Powell’s speech today suggest that his remarks could make it difficult for him to gain favor with Congress. According to the Fed chief, the economy is growing faster than in previous years, and the labor market is strong, backing up his pledge to avoid inflation.

The comments on Merck’s official slogan, “Expect the Molnupiravir mechanism to work against Omicron or any Covid variant,” can also be considered positive examples of risk-taking.

In addition, the stable inflationary expectations in the US based on the Federal Reserve Bank of St. Louis’s (FRED) 10-year break-even rate are also bearish ahead of the US consumer price index (CPI) data on Wednesday.

Despite these events, US stock futures are showing slight gains, while the yield on US Treasury bonds extends the previous day’s pullback from an annual high by no more than 1.757%.

Future AUD/USD traders will pay close attention to Fed Chairman Powell’s readings to better understand the rate hike, which in turn could affect the Australian dollar. First, however, it is important to monitor the market’s reaction through returns and stocks to determine a clear direction.

–Are you interested to learn more about Canada forex brokers? Check our detailed guide-

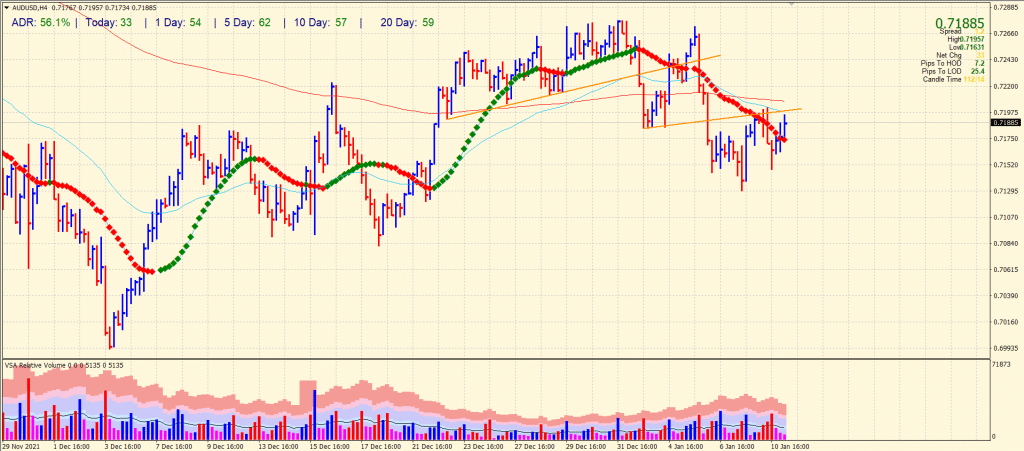

AUD/USD price technical analysis: Bulls still not out of the woods

The AUD/USD price found rejection by the minor trendline and 20-period SMA along with 0.7200 handle. Although the pair is now above 0.7200 handle, the volume for the down wave increases while the volume for the up wave decreases. It indicates that the bears still have higher dominance. Furthermore, the average daily range is 56% so far, which is higher than the average. Hence, further higher volatility can be expected. Overall, the trend is choppy, and the price may remain playing within the 0.7100 to 0.7200 range.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source link