Ignoring Key 1.3600 Level As DXY Rallies

- The GBP/USD pair drops as expected after escaping from the channel’s body.

- It could register a larger drop if it makes a valid breakdown below the 61.8% retracement level.

- The pair could resume its upwards movement if it comes back above the median line (ML).

Our GBP/USD forecast notes that the pair plunged in the short term as the Dollar Index has managed to rebound and recover after its sell-off. The currency pair is in a temporary correction after its swing higher.

The rate could test and retest the immediate downside obstacles before resuming its upwards movement. 1.3580 stands as today’s low, the price could try to rebound as the Dollar Index reaches a resistance zone.

3 Free Forex Every Week – Full Technical Analysis

In the short term, the GBP/USD pair dropped by 1.23% from 1.3748 to today’s low. From the technical point of view, a minor decline was somehow expected.

If you want to try out automated forex trading check out our comprehensive guide to getting started.

The current retreat could help the buyers to catch a new bullish momentum. Fundamentally, the GBP received a helping hand from the UK data, but the currency remains sluggish in the short term.

The Unemployment Rate dropped from 4.2% to 4.1% even if the specialists expected the indicator to remain steady at 4.2%, the Average Hourly Earnings dropped from 4.9% to 4.2% matching expectations, while the Claimant Count Change was reported at -43.3K versus -38.6K expected.

Surprisingly or not, the USD remains strong even if the US Empire State Manufacturing Index was reported at -0.7 points versus 25.0 expected.

GBP/USD Forecast: Price Technical Analysis – Sell-Off

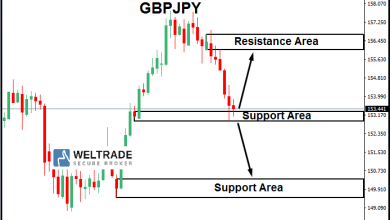

As you can see on the h4 chart, the pair registered a valid breakdown from the up channel pattern, so the downside movement is natural. Now, it’s almost to hit the 61.8% retracement level which stands as a static support. Its failure to stabilize above the ascending pitchfork’s median line (ML) signaled that it could develop a strong drop.

Actually, a larger downside movement could be signaled if the rate stabilizes under the median line (ML). Still, it remains to see how it will react around the 61.8% retracement level. Registering only false breakdowns and consolidating may announce that the retreat could be over. The GBP/USD pair could extend its upwards movement only if it comes back above the median line (ML).

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source link