General Trend is still Bullish

The performance of the GBP/USD currency pair remained distinct last week, as the strong bullish momentum continued, and succeeded in moving towards the 1.3749 resistance level, the highest for the currency pair in two and a half months.

What contributed to the strong gains for the currency pair recently was strong selling against the US dollar against the other major currencies. Especially after the US Federal Reserve hinted at the content of the minutes of the last meeting of the bank and the statements of monetary policy officials, which followed, led by Jerome Powell.

The British pound took some impetus from expectations of the future of tightening the Bank of England policy, in addition to the easing of fears of the new Corona variable, despite its wide spread. The sterling did not notice much of the criticism of British Prime Minister Johnson and his government. A leading independent economic think tank says British Prime Minister Boris Johnson remaining in office could cause greater economic repercussions than if he were to leave. Capital Economics sees little prospect of a shift in material policy under a new PM which could allow the economy to continue to recover over the coming months.

In contrast, the way Johnson is trying to re-establish Conservative support may open the door to some unfriendly policy options in the market. Johnson’s future as prime minister is increasingly uncertain due to the constant speculation of allegations of breaches of the law by him and his office during major lockdowns in the past two years. This issue has not been recorded materially in the financial markets and the economy, but that does not mean that economists are not watching.

Chief UK economist at Capital Economics is looking for two potential flashpoints over the coming days: The first is the release of Sue Gray’s report on what happened and whether the rules were broken. The implications for Johnson of being accused of breaking the law cannot be underestimated. Another hot spot to watch is the resignation of cabinet members, which is usually a source of pressure on the prime minister.

It has found that the British economy has done well when uncertainty has risen in the past, including after the 2010 elections that resulted in a hung parliament.

In terms of financial markets and sterling, Capital Economics joins a group of analysts who say the BoE’s policy is the most important going forward. There are high demands for the government to spend large sums to “up the bar”, but financing this is difficult given that the tax burden is at its highest level in 70 years.

The new prime minister may have an interest in maintaining the current course of policy.

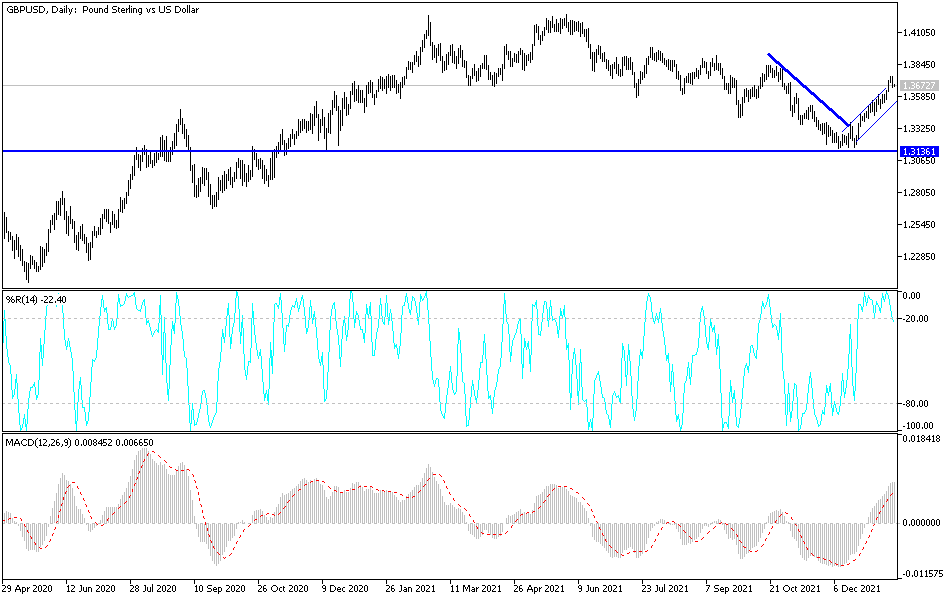

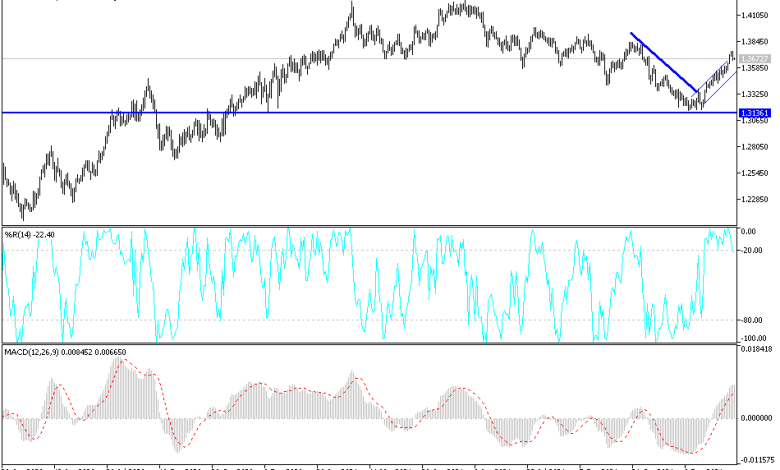

According to the technical analysis of the pair: On the daily chart below, the price of the GBP/USD currency pair is still moving steadily inside its ascending channel and the bulls are trying to break through the upper line from that channel as the factors of its gains are still valid. The breach of the resistance 1.3775 is important to move towards stronger ascending levels 1.3830 and the psychological top 1.4000, respectively. Bearing in mind that the move towards these areas moves the technical indicators towards strong overbought levels, and unless the sterling gains momentum, profit-taking may start at any time.

On the other hand, confidence in the current upward move may be shaken by returning to the support area 1.3490 and below it.

Source link