GBP/USD Price Breaks 1.3580 Support amid Dismal UK Retail Sales

- As political unrest in the UK continued, GBP/USD declined on Friday.

- Retail sales data showed little sign of improvement in the UK.

- The weak demand for the US dollar deterred bearish traders from making new bets and helped contain losses.

After the UK macro data was released, the GBP/USD price remained on the defensive and was last seen near 1.3585, its weekly low.

–Are you interested to learn more about CFD brokers? Check our detailed guide-

In the first half of Friday’s trading, the pair extended the previous day’s sharp pullback from the 1.3660 area. Due to the political crisis in the UK, the British pound continues to fall. Prime Minister Boris Johnson has called for his resignation amid a series of Downing Street parties.

However, the fall in monthly retail sales in the UK further undermined the pound sterling, pulling the GBP/USD pair down for the second consecutive day. According to the UK Office for National Statistics, total retail sales fell 3.7% in December, whereas the market expected a 0.6% drop.

Meanwhile, rising Bank of England bets on further rate hikes, and the news that the UK will lift COVID-19 restrictions next week helped limit losses for the GBP/USD pair. One of the factors preventing traders from making aggressive bearish bets around major currencies was the weak demand for the US dollar.

The mixed fundamentals suggest caution before positioning for an extension of the recent pullback from around 1.3700 average or the highest level since last October. Furthermore, investors may choose to remain on the sidelines ahead of the upcoming FOMC meeting on January 25-26.

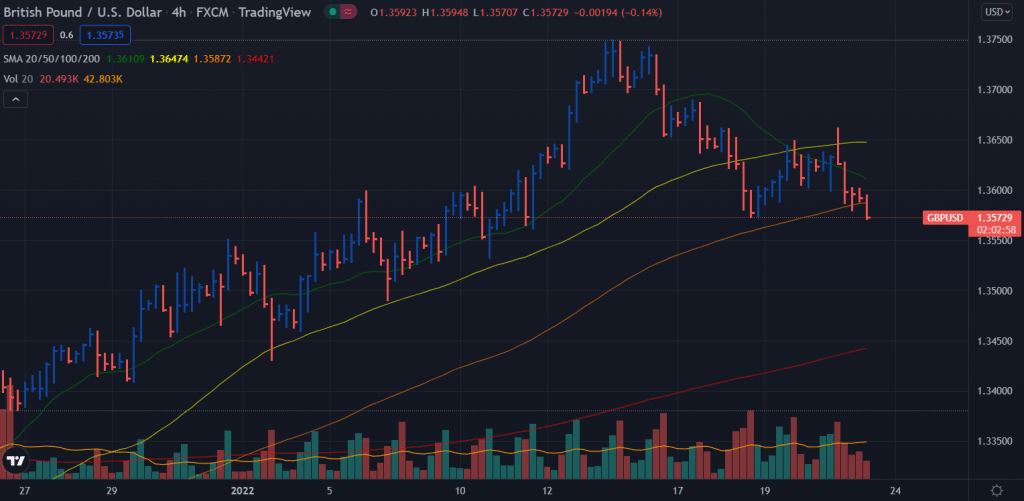

GBP/USD price technical analysis: Bears eying 1.3540

The GBP/USD price falls below the minor support of 1.3580 and is now aiming for a bearish run towards 1.3540. Further decline may lead towards a 1.3500 handle. On the upside, the pair will find stiff resistance around the 1.3650 area.

–Are you interested to learn more about forex brokers? Check our detailed guide-

The average daily range for the pair is 39% which is normal. The volume data is not strongly supporting the bears. It means we can see some uplift around 1.3550 area.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Source link