EUR/USD Technical Forecast 2022

The gains of the EUR/USD currency pair may remain a target for selling until the plans to contain the epidemic, the European energy crisis, disruption of supply chains, and the US Federal Reserve start raising US interest rates.

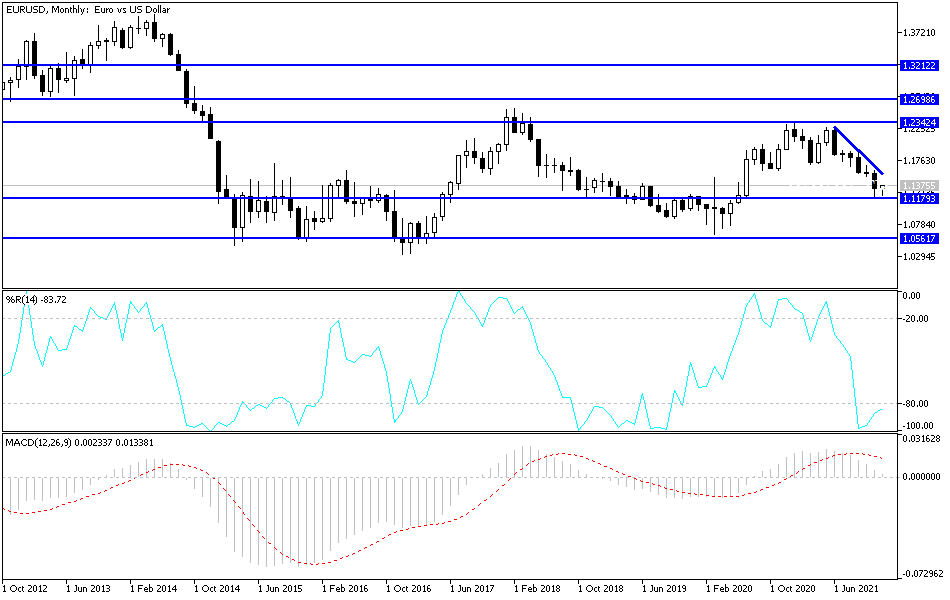

On different days in January 2021, the price of the euro currency pair against the dollar, (EUR/USD) jumped to the vicinity of the resistance 1.2350, its highest since April of the year 2018. This is in light of the optimism of global financial markets and investors about the arrival and rapid spread of vaccines facing the Corona virus. This paves the way for a strong economic recovery path, and therefore the increasing demand for tightening global central bank policy. With the beginning of last March, the currency pair collapsed to the vicinity of the support level 1.1704, with the outbreak of the fast-spreading delta variable from India, which increased the markets’ panic again and was good for more buying the US dollar as a safe haven.

In the second quarter, the EUR/USD pair returned to recovery again, as global inflation levels increased above the goals of the global central banks, forcing banks to indicate according to market pricing. The approaching date of tightening policy to stop the sharp rise in inflation due to the disruption of global supply chains and the rise in crude oil prices. The price of the currency pair rebounded towards the resistance level 1.2266, and with the continued focus of investors on the extent of the discrepancy between economic performance and the future of monetary policy between the euro area and the United States of America, investors returned to buying the US dollar.

The new Corona variant, Omicron, appeared from South Africa, with a rapid spread of the delta variant, and therefore the strong demand for buying the US dollar returned as a safe haven, in addition to the clear indications from US Federal Reserve officials that the date for raising interest rates was approaching. Accordingly, the EUR/USD currency pair collapsed again. It reached its lowest support level 1.1186 during the trading of the year 2021 and closed the year’s trading around the support level 1.1375.

Forecast of the EUR/USD currency pair for the year 2022:

The general trend of the most popular currency pair in the forex market, EUR/USD, will remain bearish, as long as financial markets and investors are differentiating between the future of economic recovery and the future of monetary policy between the Eurozone and the United States of America. The US dollar is still the strongest in this aspect, as it has become one of the most important safe havens since the outbreak of the epidemic.

The most important landing stations for the EUR/USD currency pair for this year are 1.1180, 1.1000 and 1.0610, respectively. The most important bullish rebound stations for the euro-dollar currency pair for this year are 1.1630, 1.1945 and 1.2330. Those levels are clearer on the monthly chart. In the short and medium term, the support levels will be 1.1280 and 1.1000 the most important, and the resistance levels 1.1700 and 1.2000 the most important. The gains of the EUR/USD currency pair may remain a target for selling until the plans to contain the epidemic, the European energy crisis, disruption of supply chains, and the US Federal Reserve start raising US interest rates.

Source link