EUR/USD Technical Analysis: Gains May Remain Limited

At the end of last week’s trading, the price of the EUR/USD currency pair moved upwards towards the resistance level 1.1365. This is after bearish pressure on the pair, reaching the support level of 1.1272, and the gains came in response to the US jobs report. A discrepancy was noted in the numbers between adding new jobs less than expected, an increase in average wages, and a decline in the US unemployment rate to a record number.

Prior to this, the EUR/USD exchange rate had not been able to benefit from data revealing a further increase in price pressures in the Eurozone towards the end of the year. It could benefit if the prospect of prolonged inflation overshoot is to influence the central bank’s policy stance European Union (ECB) in the coming months. The single European currency, the euro, rebounded above the 1.13 level on Friday, but stopped rising after Eurostat data showed that the consumer price index in the euro area rose to a new record high of five percent in December.

“Another slight rise in inflation in the eurozone means that the highest rate has been reached since 1985,” says Bert Colin, chief eurozone economist at ING Bank. “This rise is mainly due to the rise in food and commodity prices, which were affected by the rise in transportation costs and shortages,” he added.

According to official figures, Eurozone inflation rose from 4.9% to 5% when the consensus among economists was to see it falling to 4.8%. The more significant core inflation held steady at 2.6% when many forecasters were looking to ease back to 2.5%. Anders Svendsen, economist at Nordea Markets, says: “The 5.0% y/y estimate for HICP inflation in the eurozone in December is likely to be peak. Inflation will fall until 2022 but will remain above the ECB’s target, at least in the first half of the year. Core inflation will be key to the ECB’s outlook.”

Core inflation often tends to attract more attention from policy makers because it ignores changes in the cost of energy and food and regulated price components such as tobacco, which can be influenced by non-economic or other international factors.

Findings could motivate the “hawkish” members of the ECB’s Governing Council when it comes to the prospects for the bank’s quantitative easing programs and interest rates, although these members have been too few in number to change the bank’s policy stance thus far. The effects of the second round of high inflation on wage growth are still mostly absent for the time being. This limits GDP growth somewhat, but it also means that the ECB still has time to see how quickly current supply-side inflation decreases over the course of the year before deciding to take further action.

European Central Bank policy makers have mostly seen that eurozone inflation pressures are likely to fade on their own during 2022, which may be why the EUR/USD rate has stalled above 1.13 in the wake of Friday’s data rather than climbing further.

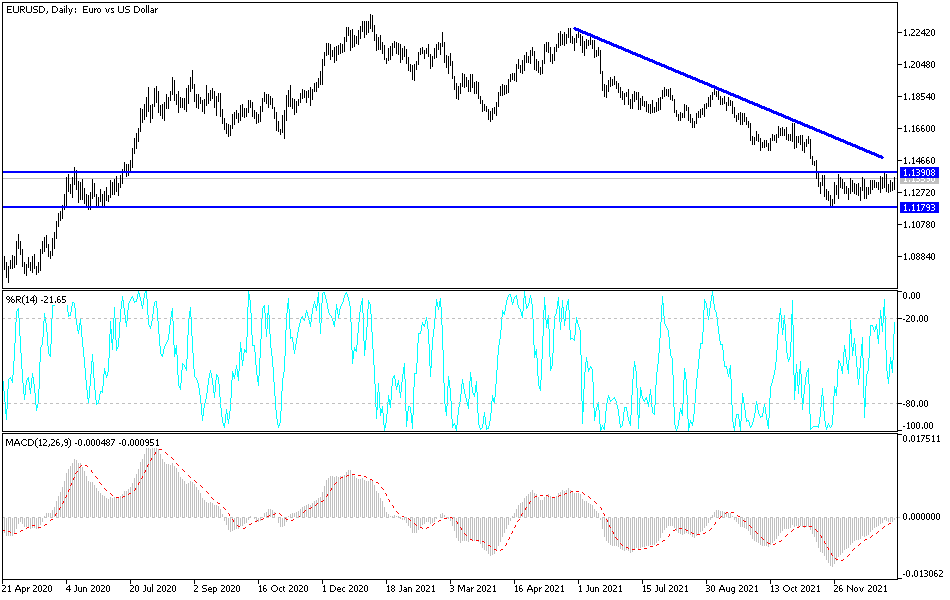

According to the technical analysis of the pair: Despite the recent performance, the general trend of the EUR/USD currency pair is still bearish. The attempts to rebound higher still face obstacles and threats. Concern about the severe outbreak of the Corona Omicron variable and its restrictions threaten the future of the bloc’s economic recovery and impede the European Central’s attempts in tightening his policy. The date of raising US interest rates is closer than expected. According to the general performance, moving towards and below the support level 1.1300 will bring the bears the momentum to move towards the next stronger support levels 1.1255 and 1.1180, respectively.

On the upside, and according to the performance on the daily chart, the resistance levels 1.1485 and 1.1660 must be breached to change the general trend, which is still bearish.

Source link