EUR/USD Technical Analysis: Bullish Rebound Attempts

US Central Bank Governor Jerome Powell hints that a faster increase in inflation may negatively affect the recovery of the US labor market. The bank will be forced to raise interest rates to stop inflation in the era of the epidemic. These concerns helped the price of the EUR/USD currency pair to move up to the resistance level 1.1378 at the time of writing the analysis and before the US inflation figures were announced. Despite the currency pair’s gains, the euro still lacks strong momentum factors compared to the pound sterling against the dollar. European countries are still suffering from epidemic restrictions, and health reports indicate fears that Europe will be a strong active focus for the new Corona variant.

Shortages at US grocery stores have intensified in recent weeks as the rapidly spreading omicron variant and severe weather – have piled into supply chain struggles and labor shortages that have plagued retailers since the start of the coronavirus pandemic. With US households under pressure due to rising costs of food, gas, rent, cars and many other items, the US Federal Reserve is under pressure to rein in inflation by raising interest rates to slow borrowing and spending. Meanwhile, the economy has recovered enough that the Fed’s ultra-low interest rate policies are no longer needed.

Accordingly, Powell said during a hearing of the Senate Banking Committee, which is considering his nomination for a second four-year term, “If we have to raise interest rates more over time, we will.”

Questions Powell faced on Tuesday from Democratic and Republican senators underscored the stark challenge Powell faces if he confirms a new term as expected. They pressure him to raise interest rates to bring down inflation, even though borrowing costs have not increased so much that the economy is collapsing into a recession. In his testimony, Powell rejected suggestions by some Democratic senators that interest rate increases would dampen employment and possibly leave many people, especially low-income and black Americans, without jobs. An increase in the federal interest rate usually increases borrowing costs on many consumer and business loans and has the effect of slowing the economy.

Powell argued that rising inflation, if it continues, also poses a threat to the Fed’s goal of getting nearly everyone back into a job. Low-income families have been particularly hard hit by soaring inflation, which has wiped out the wage increases many received.

“High inflation is a serious threat to the maximization of employment opportunities,” he said.

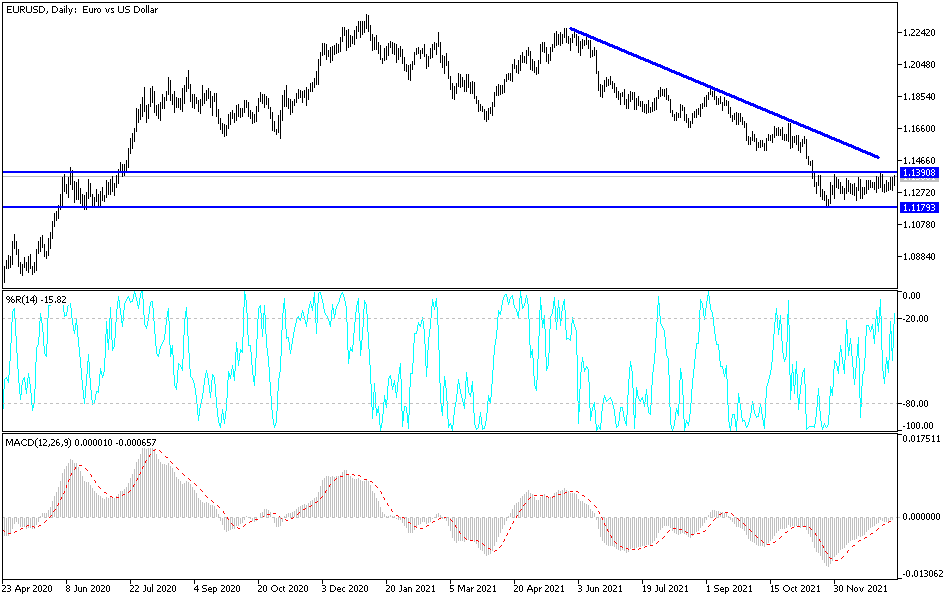

According to the technical analysis of the pair: Despite the recent performance, the price of the currency pair EUR/USD is still in a neutral position according to the performance on the daily chart. It may be in favor of the bearish bias if it moves towards the 1.1300 support again, which increases the bears’ control over the performance. It gives the currency pair the opportunity for further downside collapse. On the upside, the bulls need to break through the resistance levels 1.1390, 1.1455 and 1.1660 to make a real turn in the general trend which is still bearish. The divergence between economic performance and monetary policy tightening will continue to pressure any gains for the euro.

As for today’s economic calendar data. From the Eurozone, the industrial production rate will be announced. From the United States, the consumer price index, the traditional measure of inflation, will be announced.

Source link