EUR/USD Technical Analysis: Bears’ Control Strong

The EUR/USD exchange rate recovered in early January last week when global market volatility and heavy selling in US bonds wrecked the yield advantage that could keep the US dollar and Euro weak. This week, the EUR/USD is settling around the 1.1300 psychological support level. The dollar was broadly bought last week as the greenback seemed to draw a line below the massive New Year’s selloff that enabled the euro to climb back towards the 1.15 resistance during the early days of January, with the dollar rising amid increased volatility in global stock markets.

While data from the Chicago Futures Trading Commission last week indicated that investors had significantly reduced their bets on the dollar during the previous period, global market volatility revived the desire for a US currency that could benefit once again in the coming days from the market focus on the central bank policy.

On the other hand, the upcoming corporate earnings reports may prolong the recent international market volatility, which will be beneficial for the Dollar and headwinds for the Euro. However, the bulk of the attention will be on the Fed’s decision tomorrow which is the highlight of the week. It is also the first opportunity for the US central bank to address the acceleration of inflation in the US in December to a new multi-decade high of 7%.

Earlier this month, there was a jolt to the dollar longs, although this proved to be short-lived as the dollar bulls were unable to resist a drag from another higher move in US bond yields.

While the US central bank intends to remove stimulus and raise US interest rates quickly, the European Central Bank is ready to act by removing the accommodation if inflation proves more persistent. It has expressed similar concern about reducing stimulus prematurely. As sentiment indicators are not likely to show much upward momentum in the short term due to the still troubling COVID-19 related restrictions, our forecast for EURUSD 1.12 may soon be reached soon.

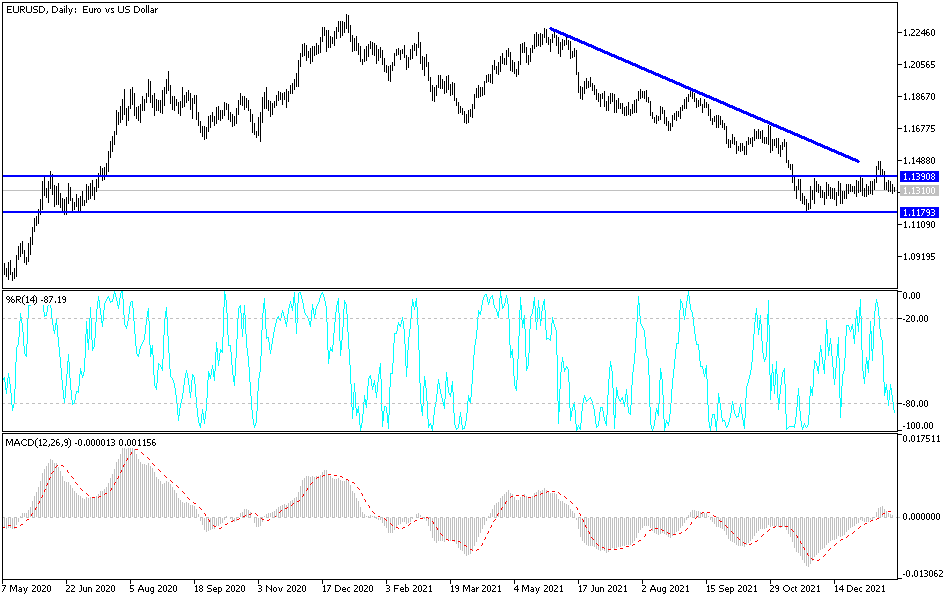

According to the technical analysis of the pair: There is no change in my technical view of the performance of the EUR/USD currency pair. The control of the bears is still the strongest, and the move around and below the psychological support 1.1300 confirms this. Currently, the closest support levels are 1.1255 and 1.1180, respectively. On the other hand, there will be no opportunity for an upward rebound for the currency pair without moving towards the resistance levels 1.1485 and 1.1660, otherwise the general trend of the EUR/USD will remain bearish.

The euro will interact today with the announcement of the German IFO reading, and the dollar will interact with the US consumer confidence reading.

Source link