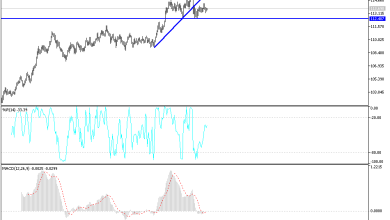

EUR/USD Forex Signal: Looking Bearish

The FOMC put new strength into the US dollar.

My EUR/USD signal from Wednesday last week was not triggered as there was insufficiently bearish price action when the price first reached the resistance level identified at $1.1352.

Today’s EUR/USD Signals

Risk 0.75%.

Trades may only be entered between 8am and 5pm London time today.

- Short entry following a bearish price action reversal on the H1 timeframe immediately upon the next touch of $1.1229, $1.1250, or $1.1261.

- Put the stop loss 1 pip above the local swing high.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Ideas

- Long entry following a bullish price action reversal on the H1 timeframe immediately upon the next touch of $1.1195 or $1.1155.

- Put the stop loss 1 pip below the local swing low.

- Adjust the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

EUR/USD Analysis

I wrote in my last forecast on 19th January that I had no bias on the day’s direction. I was looking to scalp reversals from $1.1317 or $1.1352. This was a pretty good call as the price mostly remained within these boundaries during the London session and it may have been possible to scalp a few short pips off $1.1352 when it was first reached.

The technical picture today is very clear – we have a bearish situation whose immediate trigger is yesterday’s more hawkish than expected policy statement from the US Federal Reserve. The Fed showed it is more worried about inflation than before and Jerome Powell evaded questions about a faster pace of rate hikes. This has boosted yields on the US dollar and made it a more attractive currency to buy. We have seen the results over the past few hours, with the price falling firmly and cleanly to new lows as it broke through several likely support levels.

It may be that the market will pause or be affected by US Advance GDP data today if the number released is a big surprise. Yet it seems very unlikely we will see anything other than a strong US dollar today. For this reason, I am looking to only take short trades in the EUR/USD currency pair today.

There are three resistance levels close by that can give swing traders good opportunities to enter after a retracement and failed test from below. I see the most attractive level as $1.1250 as it is a key half and quarter-number.

Concerning the USD, there will be a release of Advance GDP data at 1:30pm London time. There is nothing of high importance scheduled regarding the EUR.

Source link