Ethereum Forecast: February 2022

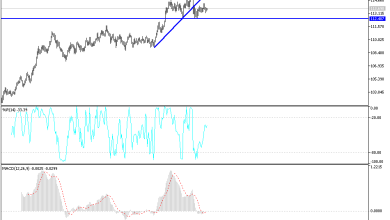

ETH/USD is set to begin February’s trading with a raging battle as short-term optimism is confronted by mid-term results and perspective.

Ethereum has enjoyed what could be described as a week of polite gains before the month of February gets underway. As of this writing, ETH/USD is hovering near the 2600.00 level, this after it fell to a low of nearly 2160.00 on the 24th of January. Traders who have been watching ETH/USD know, however, that while the last week of results has been favorable for upwards momentum, the mid-term trajectory has been the opposite.

Record values in the second week of November 2021, when ETH/USD touched the 4875.00 vicinity and allowed speculators to dream about 5000.00 per token seems like a distant memory. However, only three months of trading have taken place since those apex prices, and ETH/USD has provided traders with another example of volatility and a downward trend, which has likely hurt many bullish speculators if they were trying to time potential reversals higher.

The broad cryptocurrency market has seen a strong dose of nervous sentiment, and while some analysts try to correlate the results of the trading to results coming from the selloff in U.S. technology equities, this is still only theory. The results of ETH/USD and its major counterparts have effectively been slammed lower and now traders must decide how to wager. Day traders likely view the recent move higher by Ethereum as an opportunity to perhaps catch a potential leg upwards. If they want to be buyers, they are advised to keep their targets realistic and not reach for the moon.

The downward trajectory of ETH/USD from a mid-term perspective remains within the lower depths of its range. The ability of Ethereum to create a bounce higher the past week has not taken it past significant mid-term resistance levels, and in fact ETH/USD is still confronting a lower price range displayed in August of 2021. Behavioral sentiment within cryptocurrencies remains an important part of the marketplace and its results are still difficult to correlate with outside economic forces most of the time.

The month of February will prove to be crucial for ETH/USD as its now lingers near important support ratios. If Ethereum remains within its current price range and is not able to adequately penetrate higher resistance levels above 3000.00 and sustain buying momentum, bearish traders may believe that there will be more opportunities to ignite selling positions while aiming for support levels when reversals are predicted.

ETH/USD Outlook for February

Speculative price range for ETH/USD is 1650.00 to 3490.00.

If ETH/USD is not able to hold its current price level and sinks below the 2500.00 again, traders will likely look for lower depths near 2450.00 to 2350.00. Speculators are reminded not to overextend their positions and make sure their use of leverage is appropriate. If the 2350.00 begins to appear vulnerable and is broken lower, ETH/USD may be ready to retest lows seen during its violent selloff on the 24th of January. If those lower marks are penetrated and ETH/USD suddenly finds itself testing the 2000.00 value, this may prove to be another signal that additional selling could be generated.

Optimistic bullish traders of Ethereum certainly are still within the cryptocurrency marketplace. Day traders may be able to continue to look for upside momentum with quick hitting trades that use take profit positions to cash out of the market with fast hitting results. Until ETH/USD is able to significantly push through the 2800.00 to 2900.00 and show that it has upwards force, traders may want to remain skeptical about upwards price action and perceive it as a potential ‘false rally’. However, if ETH/USD is able to lift through the 3000.00 juncture and sustain momentum, then bullish traders could not be blamed for thinking additional positive trajectory will be delivered.

Source link