BTC/USD Forex Signal: Range-Bound with Bullish Bias

At this stage, the outlook of Bitcoin is neutral.

Bearish View

-

Set a sell-stop at 46,000 and add a take-profit at 45,000.

-

Add a stop-loss at 47,000.

-

Timeline: 1-2 days.

Bullish View

-

Buy the BTC/USD pair and set a take-profit at 47,000.

-

Add a stop-loss at 45,700.

The BTC/USD pair remained under pressure in the evening session even as the Bitcoin hash rate surged to an all-time high. The pair declined to 46,490, which is above the key support level at 45,700. It has dropped by 32% from its all-time high of 68,880.

Bitcoin Activity is Strong

The BTC/USD pair has struggled in the past few weeks even as on-chain data show that activity within the network is improving. For example, the number of non-zero accounts has continued rising while transactions have increased.

Additional data showed that the hash rate has jumped to an all-time high. According to BTC.com, the hash rate surged to an all-time high of 203.5 exahashes per second. Hashrate is an important metric that points to the combined computational power that is used to mine and process transactions. A higher rate is a sign of more activity within the network and a sign of its security.

The hash rate has jumped by about 50% in the past 12 months. It declined sharply in the third quarter after China launched a steady crackdown of Bitcoin mining in the country. It then recovered as more countries like the United States and Kazakhstan embraced the industry.

Another key metric known as mining difficulty rose at the start of the week. The difficulty is expected to rise by about 2.5% this week, a few points below the all-time high.

A bullish case can be made even as the BTC/USD struggles. While a hawkish Fed is bearish for Bitcoin, there is a possibility that the situation has already been priced in by the market. Also, there is a likelihood that it will gain more institutional support as it gains more regulatory clarity.

BTC/USD Forecast

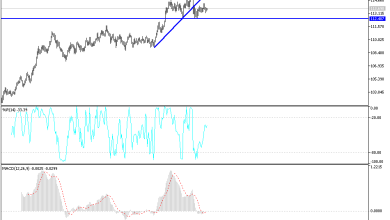

The four-hour chart shows that the BTC/USD pair has formed a strong support at 45,700. It struggled moving below this level in December. The pair also moved below the 25-day and 50-day moving average while the Relative Strength Index (RSI) has formed a bullish divergence pattern.

Therefore, at this stage, the outlook of Bitcoin is neutral. A drop below the support at 45,700 will signal that there are more sellers, who could push the pair to the next key support at 42,000. On the flip side, a move above the resistance at 48,000 will signal that there are bulls, who will push the pair higher.

Source link