«A hawkish Fed could provoke an equity crash»

Louis-Vincent Gave, co-founder and CEO of Gavekal Research, talks about the most important investment topics in the new year and reveals where he would invest now.

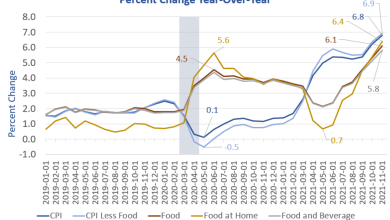

«Inflation will return with a vengeance», said Louis-Vincent Gave in this interview with The Market one year ago. At the time, hardly any forecaster had expected annual inflation in the U.S. to rise all the way to 6.8%.

For Gave, co-founder and CEO of Gavekal Research, the key question this year is how the Federal Reserve will respond to high inflation. A hard tightening – which he does not expect – would hit highly valued growth stocks and encourage a rotation towards Europe and Japan.

In an in-depth conversation with The Market NZZ, which has been edited for clarity, Gave also talks about policy shifts in China, the outlook for gold and commodities – and he says what an investment portfolio has in common with a rugby team.

«The Fed will say they are worried about inflation, but deep down, all the policy settings were put in place to get this result»: Louis-Vincent Gave.

When you look at the macro picture today, what are the most important developments?

The starting point is that inflation has come back. Financial markets haven’t really responded massively to the high inflation readings though, at least until now. We haven’t seen a big impact on currencies, bond yields stayed the same, gold did nothing, and US growth stocks continued to outperform. Most of these asset prices have not moved the way one thought they would in the face of higher inflation.

Why is that?

I see two possible explanations. The first is that markets are still under the premise that this inflation is transitory. But I have a hard time believing that, as even central banks have given up on it.

And the second explanation?

At the end of the day, markets don’t really care about economic numbers. They care about policy. Last year, we had accelerating inflation, but the policy framework stayed the same, with very easy fiscal and monetary policy in the US, the Eurozone and Japan. So markets just continued to rip higher. This is thus the big question for 2022: Do policy makers start to shift their policies on the back of higher inflation? Will we see tighter fiscal and monetary policy? When it comes to fiscal policy, there is the realization within parts of the Democratic party that continuing to spend crazy money amid rising inflation could cost them votes. Maybe they shouldn’t commit to trillions of infrastructure spending at a time when businesses already can’t find workers.

So the rising dollar and flattening yield curves are signalling market expectations that policy will be tightened significantly?

I think this is what’s happened, yes.

Will policymakers really tighten significantly?

My inclination is that they won’t. They just can’t. If the Fed tightens too much, they will end up with an equity market and a real estate crash. I think the Fed will try to continue on the side of always being late. And this is based on my core belief that today’s inflation rate is not a bug. It’s a feature. It’s what they want. It’s how you deal with an excessive amount of debt. So they will say they are worried about inflation, but deep down, all the policy settings were put in place to get this result. It’s just like the 1950s and 1960s: You know, we came out of World War II with very high levels of debt to GDP, and we took care of it through 15 years of negative real rates. It’s the same plan this time around.

We have seen a hawkish turn by the Fed lately, at least verbally. So you think they will be all bark and no bite?

I think so. For now, what the Fed is presenting us is that a faster tapering is hawkish. Well no, a faster tapering just means they are being less dovish. They are still injecting liquidity, just at lower amounts.

But because of their talk, the market has started to price in three rate hikes this year. Do you see that happening?

No. I don’t think they will end up delivering three rate hikes in 2022. Before they could get there, the equity market would crack and they would have to back off.

Is that a scenario you see? The Fed will attempt to tighten, the equity market will revolt and the Fed will back down again?

Yes. Everything in their track record suggests that. Remember in 2018, when Jerome Powell came in and said I don’t care if equity markets fall, we need to normalize monetary policy? Well, within six weeks in late 2018, the market fell by 18%, and Powell backed off.

Powell didn’t have to deal with a CPI print of 6.8% back then, though. Won’t that complicate matters?

True, the inflation picture adds a big unknown. But remember that inflation moves in ebbs and flows. We just had a big spike, but because of base effects, chances are it will roll over next year. It will remain high, partly because of the tight labor market and energy costs, but I’d say it will drop to somewhere between 3 and 4%. This will be enough to give the Fed cover to say they can take their time with rate hikes. Again, I don’t think the policy choice is to put the inflation genie back in the bottle. Inflation is the solution to the problem they have, which is excessive debt. Obviously, they don’t want 10% inflation, but let’s not kid ourselves: If they could engineer 4% inflation and have it stay there for a decade, they would be happy.

Given this backdrop, wouldn’t you say that the bond market would have to revolt and claim higher rates?

If you asked me a year ago, I would have said yes, for sure. But now my conviction is shaken, to be honest. We have 6.8% inflation and the bond market just yawns. Why? I think one reason is that pension funds, life insurance companies and banks don’t have a choice but to buy government bonds. They are being forced by regulation. This is almost textbook financial repression. Back in the 50s and 60s, we also had capital controls, which we officially don’t have today. But it’s getting harder to move large amounts of money across borders, your ability to escape financial repression is disappearing. In the old days, you could be sure that at least Switzerland had a sound currency and positive real rates. But where should you go with your money today? Everybody has got negative real rates. The Swiss franc is still a strong currency, but Switzerland is offering negative real – even negative nominal – rates, just like everyone else.

But you would agree that ten year Treasury yields at 1.6% make no sense in today’s environment?

Absolutely, I think that buying Treasuries at 1.6% when inflation is at 6.8% is madness. Any bond market rallies are there to be sold.

Could it be that the bond market is pricing in a significant growth slowdown?

«It feels a lot like the early 1970s, when we had the Nifty Fifty stocks»

Frankly, I can’t get my head around the growth slowdown thesis. I know the arguments, of course: There will be less government spending, fewer government transfers, and with that, there will be less consumer spending. But as I see it, since Covid hit, the balance sheet of the US consumer in aggregate has gone up by something like $34tn, which is more than 1.5 times GDP. Basically everything Americans own has gone up in price: Stocks, their house, bitcoins, even their second hand cars. Members of the American middle class have gotten richer. And those are the ones that have a big impact on the economy, because it’s them that go on that extra holiday or buy that extra car. When they decide to spend 15 or 20% of their capital gains, consumption is going to be very strong. And that’s even before the fact that there is a lot of pent-up demand for many goods, not least for automobiles. It seems like everyone I know is waiting for a car these days. Hence I struggle to see why growth should collapse next year.

What signals do you read in the equity market?

On the face of it, the equity market is doing fine. The S&P 500 has hit new all time highs. But The Russell 2000 Growth Index didn’t get anywhere last year. We have seen a massive dispersion in the market. If you owned the top ten stocks, like Google, Microsoft or Nvidia, you have done awesomely. But at the same time, we have 35% of Nasdaq stocks that are down 50% or more from their recent highs. Under the surface, more and more stocks are rolling over hard. It feels a lot like the early 1970s, when we had the Nifty Fifty stocks: The broad market was being held up by around 50 large cap stocks, like IBM or Xerox. These companies were seen as the best of the best, they were not being impacted by inflation because of their pricing power, and every money manager sheltered there. Their valuations rose to crazy levels. In the end, the rise in labor costs broke their back and the bubble burst.

Are we back in a Nifty Fifty type market?

Today, we don’t have the Nifty Fifty, we have the Nifty Ten. Nvidia, Google, Apple, and so on. It’s much more concentrated. And now what we are starting to see is that some of them are rolling over, think Tesla or Salesforce or Netflix, and we have gone from the Nifty Ten to the Nifty Five. The bottom line is we see a very strong deterioration of market breadth. It’s looking pretty darn menacing.

What does that tell you?

Let me put it to you like this, as we have just celebrated new year’s: Before Covid, you would have been invited to different parties. Small cap stocks are like being invited to an intimate dinner for four. If it sucks, you are stuck there. You can’t leave. Apple, Google or Microsoft on the other hand are like your 200 people parties. You can go and drink your champagne, and when you get bored, you can leave and nobody would notice. This is the difference between small caps and large caps: Small caps take conviction. You would think twice about accepting an intimate dinner with a couple you don’t know very well. The fact that small caps are rolling over shows a lack of conviction in the market. The fact that everybody is clustering in Google or Microsoft tells me that people want to be invested, but they want to be able to get out at any time.

Why is this happening now?

Let’s start with the fact that deteriorating market breadth is never a good sign. But I don’t know the reason. Is it Omicron? Is it fear of Fed tightening to the point of a policy mistake? Or could it simply be that a lot of these stocks have gone up too far, too fast on the back of massive money supply growth? This, to me, is the most probable explanation. Now liquidity supply slows, and these stocks fall. It’s just gravity. You see this phenomenon of deteriorating market breadth in the US, but you don’t see it as much in Europe or in Japan. So maybe it’s the start of a global rotation, moving away from the US.

A year ago, pretty much everyone, you included, was bearish on the dollar. And yet, the dollar has strengthened. Why?

The dollar has strengthened against the euro, the yen and other currencies. But it has weakened against the renminbi, for example. This goes back to the financial repression thing. When everybody has negative real rates, what’s the point in moving from the dollar to the euro or the yen? The one outlier is China, which offers positive nominal and real rates, and where you are seeing capital inflows. The renminbi last year massively outperformed the dollar, the euro, the yen, even the Swiss franc. If you invested in Chinese government bonds, you were up double digits this year, in dollar terms.

You’ve been saying for quite some time that Chinese government bonds are the new antifragile asset to own in a portfolio context.

Yes, they are the new German Bund. The new Bundesbank – by that, I mean the role that the Bundesbank used to play in following a sound money policy – in the global financial system is the People’s Bank of China, and the new store of value is the Renminbi. To fight the effects of Covid, everybody was doing crazy fiscal and monetary policy – except China. China has tightened quite significantly, its economy has been slowing down hard, and they’re still not really stimulating. The focus of policy in China is no longer creating jobs at any cost, which it has been for 30 years. The new focus in China is de-dollarizing at any cost. And to de-dollarize, they have no other choice than having a strong renminbi. The dollar, the euro, the yen, they are all being managed to depreciate. Over the next ten years, these currencies will go down against real assets like real estate, gold, or equities. And they will go down against the renminbi.

Why has Beijing chosen that path?

The key thing to understand is that policymaking in China is now about de-dollarization. This is significant, and it started with Huawei in 2019, when China started to feel that the US is out to destroy them. When you see a government that tells you they want to have a strong currency and that wants to internationalize their bond market, then you ask yourself whether this is credible. Well, this hurdle is not that hard to clear when everybody else is debasing their currency. If Germany, Switzerland and the US were following sound money policies, China would have a hard time attracting capital, but today it’s not that hard. That means Chinese bonds, and by extension broader Asian bond markets, because they are more and more linked to China, are the more attractive bond trades out there.

The extent of policy tightening in China has surprised many last year. What happened there?

By now, every time in the past they would have stepped in and meaningfully stimulated the economy. The fact that they haven’t tells you that it’s different this time. I think they haven’t done it because their main policy goal now is to de-dollarize. To achieve that, they need the renminbi to be structurally stronger than the dollar. When the dollar is going down, that’s easy enough. But when the dollar is going up, Beijing can’t stimulate, because otherwise the renminbi would go down. So, 2021 was a year where the dollar was decently strong, because we continued to have massive US tech outperformance, attracting equity capital, and also because the US was the one part of the world that accepted Covid and went on with it, letting the economy recover without new lockdowns. Now, if in 2022 we get a weaker dollar…

…would that be your outlook, a weaker dollar?

Yes, partly because I think the Fed will back down from its hawkish stance. As expectations for a dovish pivot by the Fed get priced in, the dollar will go down. Having said that, the one bullish argument for the dollar would be if we get a big political crisis in Europe: A bad result in the French election, or big uncertainty heading into the Italian elections. Provided we sail through these, the euro could have a decent 2022. So, if the dollar depreciates in 2022, then China could stimulate much more easily.

How would they do it?

«What you want to own in this kind of world is commodities, where a lack of supply will be met by roaring demand.»

They tell their banks that they can lend money to property developers again. When they get that signal, every property developer in China with a credit line can turn around and buy their distressed debt at 40 cents to the dollar. They will buy their outstanding bonds and book 60 cents per dollar in profit, going straight to the bottom line. Then we’ll get a big rally in all these beaten down property names. Right now, the Chinese high yield space is yielding 22%. All it takes for it to go from 22 to 5%, is for the bank lines to be reopened.

Let’s think this scenario through: The dollar will roll over some time in 2022, and we’ll see more stimulus in China. This sounds like a good environment for emerging markets and commodities, right?

I think so, yes. What’s been fascinating about the commodity complex is that it has been pretty strong for the past 18 months in spite of a slowing China. I think the reason is that this bull market is not so much driven by roaring demand, but by a lack of supply. We have massively underinvested in all sorts of commodities, including energy, since the last commodity boom went bust in 2011. If you think of a world in 2022, where the coronavirus becomes endemic and we learn to live with it, we’ll have the release of pent-up demand in the US and Europe, and we’ll have some stimulus in China, with good growth around the world: First, I don’t see inflation coming down that much, and second, what you want to own in this kind of world is commodities, where a lack of supply will be met by roaring demand.

What will need to happen for gold to rise?

At the end of the day, gold is a derivative of emerging markets. A third of the physical demand for gold in the world is from India, almost a third from China, 20% from the Middle East and another 6 or 7% from Russia. People who buy gold are in emerging markets. When they get richer, the demand for gold far outstrips supply. One of the frustrations of 2021 was that gold did nothing. But remember that China has been slowing hard, while India had a really bad Covid wave. If you think that 2022 is a year where the dollar stops rising because the Fed will turn out to be not as hawkish as people think, that China stimulates some, emerging markets will do pretty well, plus a rising commodity demand, I think gold will break 2000 $.

As an investor, looking into 2022: Which bets would you place today?

You know rugby is a big part of my life. I look at building a portfolio pretty much like you would build a rugby team, where you need different guys for different jobs. You need short, fat guys pushing the scrum, you need short, fast guys out in the wing, you need tall, lanky guys to jump in the line-outs, and so on. A portfolio is the same. You need antifragile assets, defensive assets, income producing assets, growth assets.

Going through these categories, what are the antifragile bedrocks of your portfolio?

To me, only two make sense: Gold and Chinese government bonds.

What about the income producing part?

Finding anything that produces good quality income today is difficult. There is one sector that I’m very fond of, and that’s energy, where companies have massively underinvested in the past years. Energy stocks offer high dividend yields. I think their yields are secure, because I don’t see energy prices coming down anytime soon. My main concern though is in the ability of the energy companies to keep that yield. My fear is that governments will come in and try to put a special tax on their profits to fund the energy transition. But I don’t see that political risk coming just yet, so my income producing stuff in the portfolio right now is all energy.

«I am bullish on Japan.»

What more?

You need a contrarian basket to make life exciting and fun, and that for me today would be Chinese high yield bonds, on the premise that we’ll see a lot of the high yield debt going from 40 cents up to 80 cents to the dollar once Beijing decides to open the credit spigot.

What about growth assets?

In my growth basket today there are some financials, on the premise that we’ll see some yield curve steepening, and therefore banks will be able to make a lot more money. I also own some of the Chinese tech names that have been slaughtered and I think can deliver decent growth.

On the premise that all the bad regulatory news is out now?

Yes. The crackdown by Beijing has been to get the tech companies to toe the line following Huawei: to help China build hard tech infrastructure. All of them are now toeing the party line, I don’t think they need to be punished anymore. They have been reminded of who the boss is.

What about US tech stocks?

It gets really difficult there. There are some growth names that have been beaten up but still have good franchises, think of Paypal as an example. So you could try and go fishing there. Or you choose the crowd in the Nifty Five, the Microsofts and Apples. I just worry that those stocks are now so over-owned and crowded. It all depends on my Fed call: If the Fed pivots to a dovish stance again, you can keep owning them. But if I am wrong, if the Fed does turn out to be hawkish, and if they do want to put the inflation genie back in the bottle, the Nifty Five will get crushed.

Anything else you’d buy?

I think Japan is a great growth play. After 25 years of consolidation, balance sheets have been cleaned up. Japan is involved in a lot of sectors that will be important in the future: Think of robotics, battery technology, semiconductors, hydrogen cars, automobiles in general. So looking at all this, I am bullish on Japan. A lot of good companies, trading at not too demanding valuations.

Louis-Vincent Gave

Source link