The Fed is still acting too slowly

During the Federal Reserve’s December meeting, Chairman Jerome Powell Jerome PowellThe Fed is still acting too slowly Chief Justice Roberts receives highest approval rating among federal leaders: poll The politics of an independent Fed MORE announced plans to reduce the Fed’s purchases of government bonds more quickly in response to rising inflation. He also indicated that the Fed is planning to raise interest rates three times in 2022, instead of the previously announced two. The plan is to finish winding down its bond purchases in March and begin increasing interest rates after that. But in light of the high rate of inflation we are experiencing, the Fed is still acting too slowly.

Jerome PowellThe Fed is still acting too slowly Chief Justice Roberts receives highest approval rating among federal leaders: poll The politics of an independent Fed MORE announced plans to reduce the Fed’s purchases of government bonds more quickly in response to rising inflation. He also indicated that the Fed is planning to raise interest rates three times in 2022, instead of the previously announced two. The plan is to finish winding down its bond purchases in March and begin increasing interest rates after that. But in light of the high rate of inflation we are experiencing, the Fed is still acting too slowly.

If the Fed were going to act aggressively, rather than buying fewer government bonds each month, it would stop buying them altogether. It would also increase the interest rate it pays on bank reserves without hesitation.

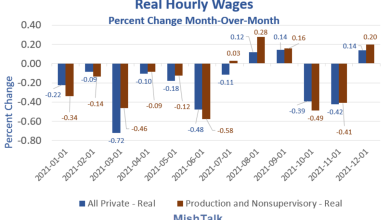

Buying government bonds even for a few more months means further increasing the money supply, which will further stoke price inflation. And the artificially low interest rates it’s been encouraging give households and businesses continued incentives to borrow to bid up prices of houses, cars and other durable investments. Meanwhile, banks pay almost no interest on savings because the interest rate the Fed pays on bank reserves is only slightly above zero.

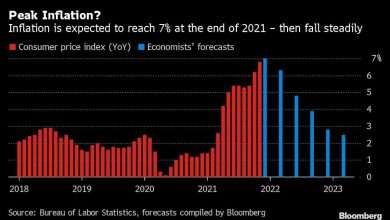

In other words, we should not expect to see inflation fall much from its November level of 5.5 percent. Although the Fed is forecasting only 2.6 percent in 2022, there is good reason to expect a much higher rate. Americans are still spending the stimulus payments they received during the last two years. Even if the policy changes bring inflation down in the second half of 2022, the rate for the calendar year is likely to be well above the Fed’s 2 percent average target.

If our bout of inflation was caused entirely by transitory supply chain problems, it might fall back to pre-pandemic levels. But we have no reason to expect that to happen within the next month or two. The enormous monetary expansion since March 2020, which paid for the trillions of dollars in government stimulus (which has not all been spent), continues to suggest that increased demand for goods is a serious problem regardless of what happens to supply.

Several considerations may be behind the Fed’s decision to continue monetary expansion for at least a few more months. Chairman Powell has repeatedly emphasized a desire to lower unemployment further below its current 4.2 percent. But the large number of unfilled jobs suggests that more spending would do little to reduce unemployment. Census Bureau data show that millions have not returned to work because they are caring for their children, “suffering from Covid symptoms, caring for someone who is sick, or concerned about getting or spreading the virus.”

Here’s the problem with delaying monetary tightening: The longer inflation stays high, the more people will expect it to continue in the future. That creates more problems.

If workers expect this year’s cost-of-living increase to continue in the future, they’ll demand coinciding wage increases going forward — say, 5 percent. But if workers get such large wage increases, that will feed into future inflation. When inflation is higher, it tends to be more unstable. As was the case in the 1970s and early 1980s, high and unstable inflation may, for example, cause higher average unemployment.

Inflation and current Federal Reserve policy are following a pattern that too closely resembles what happened during the 1970s. As inflation rates rose, the Fed gradually increased its target interest rate. The problem was that inflation increased more quickly. As a result, borrowing increased and the money supply expanded rapidly, leading to even more inflation. It was only after Paul Volcker took over as Fed chairman and raised interest rates from under 12 percent to almost 20 percent in one year that inflation started to come down, precipitating the most severe recession since the Great Depression.

Fortunately, bringing inflation under control in 2022 shouldn’t be so painful. We cannot be sure what will happen if the Fed tightens more aggressively, but the consequences of failure are more serious than those of inflation dropping more than the Federal Reserve anticipates. Even an inflation rate of 3 percent can cut the value of money in half in 24 years. It’s an insidious tax on savings — one which makes it more difficult for people to accumulate a nest egg without incurring the risks of putting most of their money in the stock market.

By acting quickly and decisively, the Federal Reserve may be able to prevent a recurrence of an extended period of high inflation similar to the 1970s, when inflation rose to almost 12 percent, as well as the severe recession that followed.

Tracy C. Miller is a senior policy research editor with the Mercatus Center at George Mason University.

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link