Stimulus checks are coming in 2022 for one group that’s still due COVID relief

With another year of pandemic life approaching a close, the economy continues to try to revive and bring more Americans to a financially stable state.

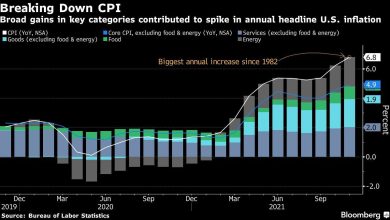

No one expects Washington to give out more wide-reaching stimulus checks, but many people remain worried about paying all their monthly expenses as COVID surges again with the omicron variant and inflation drives up prices.

Much of the remaining government COVID relief is aimed at more targeted groups, and one of those smaller sets of Americans will have stimulus payments coming in 2022. Surely, many households that can expect the money will need it to cover the bills or deal with debt.

Here’s who can expect more stimulus payments

As background, the federal government is still giving select workers stimulus payments, and states have used some of their federal relief to provide teachers bonuses, with some issuing stimulus checks to state residents who meet income requirements.

But another group eligible for stimulus payments might surprise you: babies born in 2021. The newest Americans qualify for payments up to $1,400 from the third (and probably final) round of federal stimulus checks that millions of people received in March. To qualify for the full amount, your household must meet income requirements: $150,000 for married people who file a joint return or $75,000 for individuals.

Eligible new parents who inform the IRS they had a baby — or babies — when they file their 2021 taxes next year will still receive a stimulus check for those children.

Plus, people with 2021 newborns might not realize that they’re eligible for the expanded child tax credit that’s part of the government’s COVID stimulus package.

You could have opted to inform the IRS this year about your new family member to get the early monthly tax credit installments that the agency paid in 2021. If you didn’t, you’ll get the full $3,600 credit when you file your next tax return in 2022 and claim the baby as a dependent for the first time.

Make your own stimulus

Whether or not you have more stimulus money coming your way, you can help yourself by finding new savings. A few ideas:

-

Are you carrying a lot of student loan debt? If your school loans are from a private lender and not the government, a federal pause on payments doesn’t apply to you. But you might have an option to pay off your student loan sooner. A refinance can lower your interest rate and possibly shave years off your payments.

-

If you carry multiple credit card balances and other high-interest debt, you might want to roll them into a single debt consolidation loan. You’ll have only one payment to budget around, the lower interest rate will slash the cost of your debt, and you may pay it off faster.

-

Prices can be all over the place when you shop online, so make sure you don’t overpay. A tool to compare prices automatically hunts for better deals and coupons before you click “buy.”

-

You don’t need another stimulus check — or much money at all — to put a toe in the stock market or broaden your investments. A popular app helps you build a diversified portfolio by investing your “spare change” from everyday purchases.

This article provides information only and should not be construed as advice. It is provided without warranty of any kind.

Source link