Lower Moves Now Must Test Important Support Levels

The USD/MXN has continued to incrementally decrease and is now bouncing against important mid-term support ratios as the holidays loom.

Latin American currencies can give great price movements.

Trade them with our featured broker.

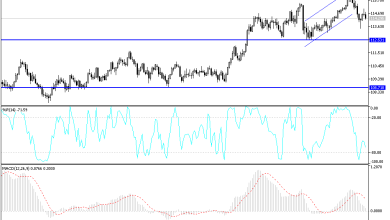

The USD/MXN is near the 20.71000 level in early trading this morning as the Forex pair has continued to demonstrate an incremental ability to traverse lower. Speculators who have been pursuing selling positions of the USD/MXN since it hit apex highs of 22.15000 approximately on the 25th of November may think the Forex pair remains attractive from a bearish perspective.

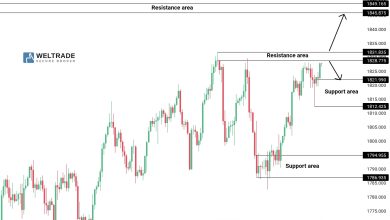

Support levels now in sight could prove to be important near term. Traders may have their eyes on the 20.65000 marks as a rather intriguing inflection point when long-term charts are glanced at based on the belief the USD/MXN may be slowly working its way back to a lower known range which was traded for much of 2021.

However, traders may not want to get too optimistic quite yet. As the Christmas holiday gets ready to start, trading volumes will become quite thin and the lack of large transactions in Forex could cause the USD/MXN to stall. The trading to come may see volatile spikes in price up and down, but these will likely be demonstrated because of imbalanced positions which could make for choppy conditions which are often unpredictable.

Day traders who want to participate with the USD/MXN are urged to use stop losses, which protect their positions against sudden fluctuations that can be dangerous when too much leverage is being used. The downward trend in the USD/MXN may also actually begin to experience a reaction if financial institutions believe the bearish trajectory within the pair has been too fast. Traders who continue to believe selling the USD/MXN is the right decision should monitor resistance levels near the 20.76000 to 20.79000 levels; if these are sustained this could prove important.

Traders should not be overly ambitious within the USD/MXN in the coming days. Tight range trading should be expected with the very real potential for a sudden spike to take place periodically. Traders wagering on the USD/MXN should also use solid take profit orders to make sure if a sudden run in value occurs, that they can be cashed out and the profits accounted for within their accounts. Traders who believe the holiday season will provide an opportunity to simply take advantage of tight ranges which will develop in the coming days cannot be faulted.

Mexican Peso Short-Term Outlook

Current Resistance: 20.79800

Current Support: 20.68000

High Target: 20.89700

Low Target: 20.47000

Source link