IPOs Had a Record 2021. Now They Are Selling Off Like Crazy.

Looming behind a record-breaking run for IPOs in 2021 is a darker truth: After a selloff in high-growth stocks during the waning days of the year, two-thirds of the companies that went public in the U.S. this year are now trading below their IPO prices.

Traditional initial public offerings raised more money than ever before in 2021, as startup founders and early investors tried to cash in on sky-high valuations. In the first eight months of the year, IPO shares rose. In November, 2021’s class of IPOs were trading up 12% on average, according to Dealogic. By late December, they traded 9% below their IPO prices.

The IPO market, full of volatility and companies of all shapes and sizes, is hard to track as a whole. So we plotted every traditional IPO of 2021 and mapped out how they performed for the entire year to illustrate what happened with the market. Here is what the data show.:

A selloff is underway in IPO stocks. Investors fear interest-rate increases on the horizon for next year could curb the appetite for riskier assets. Reversing a trend from earlier in the year, nearly two out of three stocks that went public in 2021 are now trading below their IPO price.

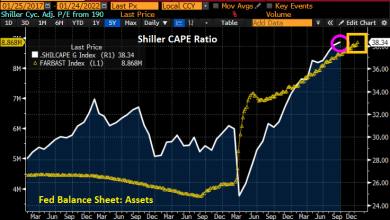

IPOs’ decline accelerated late in the year after Federal Reserve Chairman Jerome Powell hinted at a faster pullback of stimulus. As of Dec. 28, Coupang, Oatly, Didi and Robinhood and Toast were trading below their offer prices. Rivian remains above but has fallen from its peak.

Investors, bankers and traders say there are two main culprits for the slide into the end of the year.

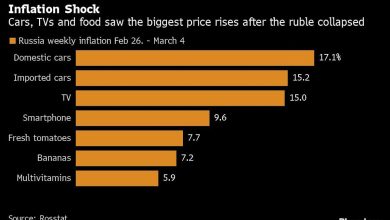

On the heels of soaring inflation, central banks signaled they will raise interest rates next year, prompting a broad selloff in technology stocks. The allure of many IPOs is that the companies can one day deliver big profits. But they also could flop. Higher available interest rates change the opportunity-cost calculus for investors who are betting on growth companies’ profits far into the future. When rates are near zero, it may make more sense to pay a premium for the potential of big future returns. When rates rise, the proposition becomes less appealing.

SHARE YOUR THOUGHTS

What was your approach to IPOs this year? Are you making any changes for 2022? Join the conversation below.

Another drag on 2021 IPO performance is the unprecedented supply of IPOs flooding the market and increased interest and participation by individual investors.

Nearly 400 traditional IPOs—along with an additional 600 special-purpose acquisition company launches—inundated fund managers and analysts this year, with many saying not a day went by without a formal call or pitch.

“While it’s a boon for the bankers to have a record number of IPOs, it’s an environment to tread very cautiously as an investor,” said

Denny Fish,

portfolio manager at Janus Henderson Investors. The $7.2 billion Janus Henderson Global Technology and Innovation Fund that Mr. Fish manages bought shares of

Toast Inc.

and

GitLab Inc.

in their 2021 IPOs. Toast has fallen 8% from its IPO while GitLab is up more than 20%.

Investors, bankers and executives say the market’s reaction has caused them to rethink what makes an IPO a success. It also has introduced a possible speed bump after a spectacular year and a half for companies going public.

The pipeline is strong for 2022 IPOs, with more than 900 private companies globally that are worth $1 billion or more. Several companies looking at early 2022 stock-market debuts are re-evaluating the price they are trying to fetch, but few are abandoning their plans to launch, lawyers and bankers say.

“None of the companies we’re working with have gone pencils down,” said

Josh Bonnie,

co-head of Simpson Thacher & Bartlett LP’s Global Capital Markets Practice.

Some large investors say they prefer more muted IPO performance in the early days of a company’s debut. Portfolio managers at big funds tend to receive fewer shares than they desire in an IPO, and to build up their position they need to buy more stock in the early weeks and months following the IPO. If the stock doubles right out of the gate, that becomes harder to do.

But big pops and solid performance help pull companies and investors into IPOs. When that is replaced by a downdraft in IPO stocks, it may cause a chill going forward.

“When deals haven’t been profitable for investors, naturally they’re going to be more skeptical of the next deal,” said

Daniel Burton-Morgan,

head of Americas Equity Capital Markets syndicate at Bank of America Corp.

—Mike DeStefano contributed to this article.

Write to Corrie Driebusch at [email protected]

Copyright ©2021 Dow Jones & Company, Inc. All Rights Reserved. 87990cbe856818d5eddac44c7b1cdeb8

Appeared in the December 30, 2021, print edition as ‘IPOs’ Big Year Ends Low With 11th-Hour Selloff.’

Buka akaun dagangan patuh syariah anda di Weltrade.Source link