Inventories of New Houses for Sale Highest since 2008, Worst Spike in Construction Costs in at Least 50 Years: What the Heck Is Going On?

A look at massive distortions and massive supply in the pipeline.

By Wolf Richter for WOLF STREET.

The index for construction costs of singled-family houses spiked 15.3% in November compared to a year ago, the worst year-over-year spike in the data going back to 1970, and by 21.1% compared to November two years ago, according to data by the Commerce Department on Thursday. This excludes the cost of land and other non-construction costs:

Builders are complaining about all kinds of shortages, including windows, while window makers complain about labor and materials shortages. Lead times are stretching into eternity by the measure of single-family housing construction projects that then get bogged down.

There is enough demand to allow builders to pass on those cost increases to buyers: The median price of single-family houses sold in November spiked 18.8% year-over-year and by 27.1% from two years ago to $416,900. That means, half the homes sold for over $416,900 and half sold for less.

The bottom has fallen out at the lower end with nearly no houses sold below $200,000. Only 13% of the houses sold below $300,000. But 57% of the houses went for over $400,000. The median price is skewed by this shift in mix to the high end, because that’s where the money is, and by the death of the low end:

Inventory of single-family houses for sale at all stages of construction combined – more on those stages in a moment – has been persistently rising for months and hit the highest level since August 2008:

Inventory for sale by stage of construction:

The number of completed single-family houses for sale – which means they have to have windows among other things – has been straggling along below 40,000 (seasonally adjusted) all year, a historically low range in the data going back to 1999, and setting several new record lows along the way. In November, 39,000 completed houses were for sale (red line in the chart below).

But the number of houses for sale where construction hasn’t started yet hit 110,000 in November, the highest in the data going back to 1999 (purple line).

And the number of houses for sale that were still under construction rose to 253,000 in November, the highest since 2007 (green line).

The shortage of completed houses.

Every month since May, completed houses for sale have accounted for less than 10% of total inventory for sale, which hasn’t happened since at least the early 1970s. The pre-pandemic low was 20% of total inventory, in May 2018.

There are few completed houses for sale as delays of all kinds see to it that builders are having a rough time completing construction. And as they’re trying to complete construction or shortly after they complete construction, the houses are sold and don’t linger in inventory:

Sales of New Houses, in Total and by Stage of Construction.

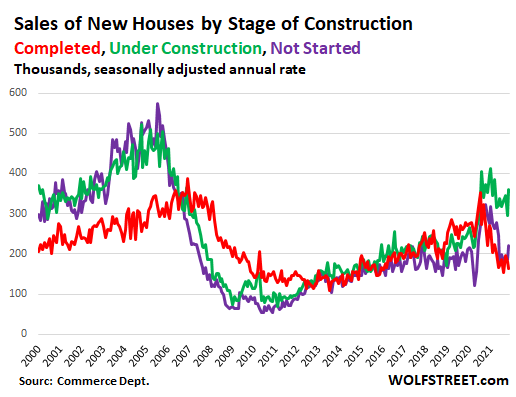

Total sales of new single-family houses in November, all stages of construction combined, fell 14% from a year ago, to a seasonally adjusted annual rate of 744,000 houses, having unwound the entire pandemic spike. Sales also remain far lower than during the boom years of 2002 through 2006 (this does not include apartment and condo buildings).

Sales of completed houses – where inventories have collapsed – have been hobbling along near the levels during the housing bust and in November dropped to a seasonally adjusted annual rate of 164,000 (red line in the chart below), as there wasn’t a whole lot to sell. And at 22% of total sales in November, their share hit lows not seen since 2005.

Sales of houses under construction jumped to a seasonally adjusted annual rate of 359,000 houses in November (green line), and has been running high ever since April last year. This was driven in part by the shortage of completed houses – and more buyers ended up buying a house that was still under construction. The share of sales of houses under construction surged to 48% of total sales in November, along with August and June, the highest in the data going back to 1999

Sales of houses where construction hasn’t started yet – when a homebuilder will build it after the buyer commits to buying it – rose to a seasonally adjusted annual rate of 221,000 houses (purple line), for a share of total sales of 30%, which is roughly in line with pre-pandemic years since 2012, but is down from the peak months during the pandemic:

Distortions… and a lot of supply stuck in the pipeline.

What we’re seeing here are large-scale distortions across the spectrum, from spikes in construction costs and shortages of all kinds, long lead times, and the inability to complete construction in a speedy manner, which leads to the huge build-up of inventory of unfinished houses for sale, while completed houses for sale have become scarce.

There is lots of supply, but – at the moment – it’s the wrong kind of supply: It’s further up the pipeline and some of it is stuck in the pipeline, while buyers are leery of getting tangled up in the potential delays and cost increases. But this supply is coming down the pipeline, and there’s a lot of it, and it’s pegged at very high prices, and it’s doing so as mortgage rates are rising from the ultra-low levels that made all this possible.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Classic Metal Roofing Systems, our sponsor, manufactures beautiful metal shingles:

- A variety of resin-based finishes & colors

- Deep grooves for a high-end natural look

- Maintenance free – will not rust, crack, or rot

- Resists streaking and staining

To reach the Classic Metal Roofing folks, click here or call 1-800-543-8938

Source link