GBP/USD Technical Analysis: Gains Threatened

After a strong bearish start for the GBP/USD when it moved towards the 1.3173 support level, the pair returned to rebound upwards towards the 1.3270 resistance level. This came after Britain abandoned imposing restrictions, though the government still threatens the measures. The state of reassurance contributed to gains for the pound sterling against the rest of the other major currencies, but these gains may remain a target for selling, with the emphasis that the markets are on the verge of a holiday that may affect liquidity and investors’ appetite for risk.

The Office for National Statistics said Britain’s budget deficit widened to the second-highest level for November since records began in 1993, largely due to the rise in the cost of debt. Public sector net borrowing was 17.4 billion pounds in November, down 4.9 billion pounds from the same period last year. This was also greater than economists’ expectations of £16 billion.

Current revenues grew by 4.3 percent on an annual basis, while expenditures decreased by 6.9 percent. In the fiscal year to November, the budget deficit narrowed by 115.8 billion pounds from last year to 136.0 billion pounds. It was also the second highest financial borrowing recorded in the fiscal year through November. During the fiscal year through November, interest payments increased sharply by 54.1 percent year on year. At the end of November, net public sector debt excluding public sector banks was £2,317.7 billion, or about 96.1 per cent of GDP. This was the highest since March 1963. Moreover, the data showed that the central government’s net cash requirement was £13.1 billion in November, £10.9 billion lower than in November 2020.

British Prime Minister Boris Johnson has finally announced that he will not impose any new restrictions on the coronavirus before Christmas – but new measures may be taken after the holiday if Omicron cases continue to rise. Johnson said on Tuesday that given the uncertainty about the severity of the stress, the rate of hospitalizations in the UK and the impact of booster vaccines, “we do not believe today there is sufficient evidence to justify any tougher measures before Christmas”.

“We continue to monitor omicron closely and if the situation deteriorates, we will be ready to take action if necessary,” he said in a video message.

Earlier this month, Johnson’s government reinstated rules requiring face masks in stores and ordering people to show evidence of vaccination or test negative for coronavirus before entering nightclubs and other crowded places. He said people can go ahead with their Christmas plans, but added: “I would urge everyone to be vigilant and continue to protect yourselves.”

Omicron is spreading rapidly in Britain and has replaced Delta as the dominant alternative to the virus.

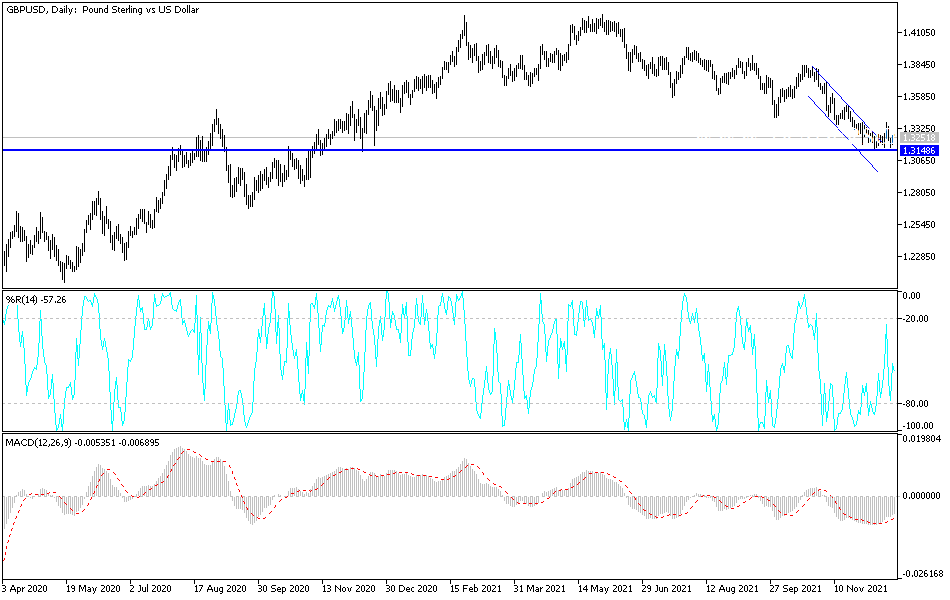

Technical analysis

Attempts to rebound upwards for the GBP/USD currency pair will remain a target for selling as long as there are fears of a rapid spread of the Corona variant. The political concerns of the British government is also adding pressure on the sterling. Currently the closest resistance levels for the currency pair are 1.3320 and 1.3400. I still prefer to sell the pair from every bullish level.

On the downside, and according to the performance on the daily chart, the breaking down below the 1.3175 support will support a move towards the 1.3000 psychological support. Today, the currency pair will be affected by the announcement of the economic growth reading for both the United Kingdom and the United States of America, then the announcement of US consumer confidence and US existing home sales.

Source link