GBP/USD Forex Signal: Double-Top Signals Short Pullback

Bearish View

Bullish View

The GBP/USD pair moved sideways in a low-volume environment as investors assessed the state of the UK and American economies. It is trading at 1.3400, which is a few points below Monday’s high of 1.3442.

US Holiday Sales Soared

The GBP/USD tilted slightly lower after the latest holiday sales data by Mastercard. In a report, the company said that retail sales jumped by about 8.5% in the holiday season, which is defined as between November 1st and December 24th. This was a stronger performance than what most analysts were expecting.

The report showed that e-commerce sales did better than estimated. They rose by about 11% in this period and represented about 20.9% of total sales. Before the pandemic, online sales represented about 14.6% of total sales.

These numbers showed that more Americans did their Christmas shopping a bit early this year because of the fears of the Omicron variant. Also, Americans were afraid that the ongoing supply shortages would lead to higher prices towards Christmas.

The strong American retail sales numbers signal that the American economy is doing well even as the Omicron variant spreads. Recent data shows that the country is recording more than 200k new cases every day and the number is expected to keep rising. Still, the positive thing is that the number of deaths has been relatively low in the past few weeks.

Later today, the GBP/USD pair will react to the latest US housing data. Analysts expect that the Case Shiller House Price Index cooled off a bit last month. Precisely, they expect that the index rose by about 18.5% in November, which is a bit lower than the previous month’s 19.1%. Home prices have surged in the past few months because of low-interest rates.

GBP/USD Forecast

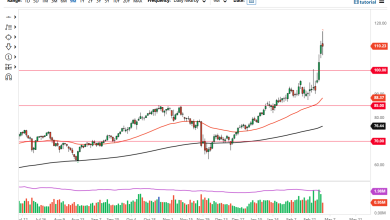

The four-hour chart shows that the GBP/USD pair has been in a bullish trend in the past few weeks. It has risen by about 1.92% from its lowest level this month. As a result, it has managed to move to above the 23.6% Fibonacci retracement level.

It is now about the 38.2% retracement point. Also, the pair rose above the key resistance at 1.3375, which was the highest level on December 16th. It has also formed a small double-top pattern. Therefore, while the overall trend is bullish, a short pullback cannot be ruled out.

Source link