GBP/USD Daily Outlook – Action Forex

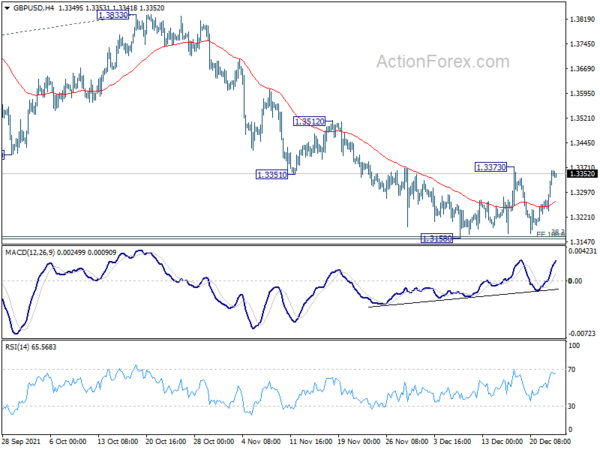

Daily Pivots: (S1) 1.3276; (P) 1.3320; (R1) 1.3398; More…

GBP/USD is still staying in range of 1.3158/3373 and intraday bias remains neutral first. On the upside, break of 1.3373 will resume the rebound from 1.3158 to to 55 day EMA (now at 1.3423). Sustained break there will be an early sign of bullish reversal and target 1.3570 support turned resistance next. On the downside, however, firm break of 1.3164 medium term fibonacci level will carry larger bearish implication. Fall from 1.4248 should resume and target 161.8% projection of 1.4248 to 1.3570 from 1.3833 at 1.2736.

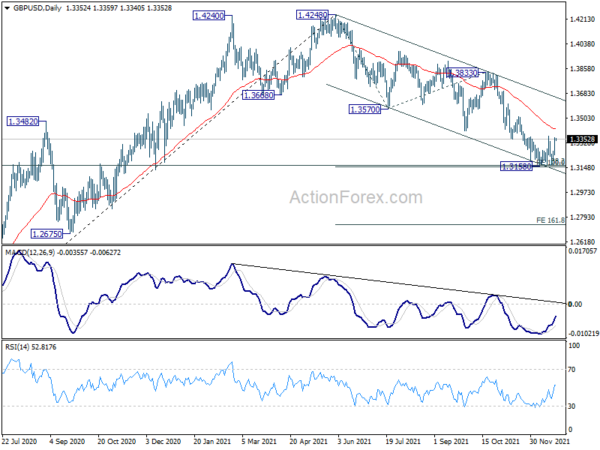

In the bigger picture, focus remains on 38.2% retracement of 1.1409 to 1.4248 at 1.3164. Sustained break there will argue that whole rise from 1.1409 has completed at 1.4248, after rejection by 1.4376 long term resistance. That will revive some medium term bearishness and and target 61.8% retracement at 1.2493. However, strong rebound from current level will revive argue that up trend from 1.1409 is still in progress, and probably ready to resume.

Source link