Even Fed’s Lowest Lowball Inflation Measure Spikes Relentlessly: Parallel Isn’t 1982, but 1974, When Powell was in College

But even the comparison to 1974 fails because back then, the Fed had already pushed short-term rates to 9%. Today: most reckless Fed ever.

By Wolf Richter for WOLF STREET.

The Fed purposefully uses a special price index for its 2% inflation target: “core” PCE, which excludes food and energy. The core PCE and the headline PCE are the two lowest lowball inflation measures that the US government produces, understating actual inflation even more than other measures that the government produces, such as CPI-based measures.

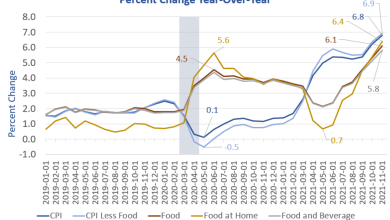

And this “core PCE,” which understates inflation by the most, spiked to 4.7% in November, the worst inflation reading since February 1989, according to the Bureau of Economic Analysis today. Over double the Fed’s inflation target. And the trend doesn’t look good either:

Inflation is shooting higher even as this Fed is still repressing short-term interest rates to near 0% and is still printing money hand over fist, though less than it did two months ago. And the Fed has finally backed off its ridiculous claims that this inflation, caused by enormous historic amounts of money printing and interest rate repression, is just temporary and due to bottlenecks and supply chains.

The overall PCE inflation index that includes food and energy, the second-lowest lowball inflation measure the US government produces, spiked by 0.6% in November from October, and by 5.7% year-over-year, the worst reading since 1982.

For having triggered this inflation, and for having refused to acknowledge it, and then for refusing to deal with it for a year-plus, this Fed will go down in history as one of the most reckless Feds ever.

But it’s not like 1982:

Today, the Fed is still repressing short-term interest rates to near 0% and is still printing money. “Real” (CPI adjusted) short-term interest rates are negative 6.7%, and this inflation is spiking straight into the sky.

In July 1982, inflation was coming down, short-term interest rates were over 12%, and coming down, “real” rates were a positive 6%, and the Fed wasn’t printing money at all.

More like 1974…

The comparison should be between inflation today and inflation in 1974, when inflation was spiking just like it is spiking today, and when Powell was still in college. There is practically no one left at the Fed or on Wall Street with any professional experience in this type of inflation spike.

But even that comparison isn’t valid because in January 1974, with the same core PCE inflation reading as today, and spiking as today, the Fed had already pushed short-term interest rates to over 9%, compared to near 0% today.

In 1974, the Fed was fighting inflation. Today, the Fed is still fueling inflation.

That’s why this Fed will go down in history as one of the most reckless ever. Despite this massive spike in inflation, the Fed is still printing money and repressing interest rates to near 0%. It had been jabbering all year about this inflation going away on its own, and all year, this inflation has gotten worse and worse, driven by massive historic money printing and interest rate repression.

Markets know how to deal with bottlenecks and supply chain issues: Prices rise until demand for those goods collapses and shifts to other goods and services, and prices revert.

But inflation from money-printing and interest rate repression isn’t going away on its own – it’s going to continue until short-term interest rates are pushed above the level of inflation, with long-term interest rates substantially above the level of inflation. And that cannot happen in the current environment until the Fed engages in substantial Quantitative Tightening and massive rate hikes.

And you know what’s coming…

An image of Fed chair Jerome Powell, confronted with the consequences of his reckless monetary policies that he will now have to deal with, as imagined by cartoonist Marco Ricolli for WOLF STREET:

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Classic Metal Roofing Systems, our sponsor, manufactures beautiful metal shingles:

- A variety of resin-based finishes & colors

- Deep grooves for a high-end natural look

- Maintenance free – will not rust, crack, or rot

- Resists streaking and staining

To reach the Classic Metal Roofing folks, click here or call 1-800-543-8938

Source link