NASDAQ 100 Forecast: Index Rolls Back Over

It would take an enormous change in attitude and fundamentals to turn this thing around.

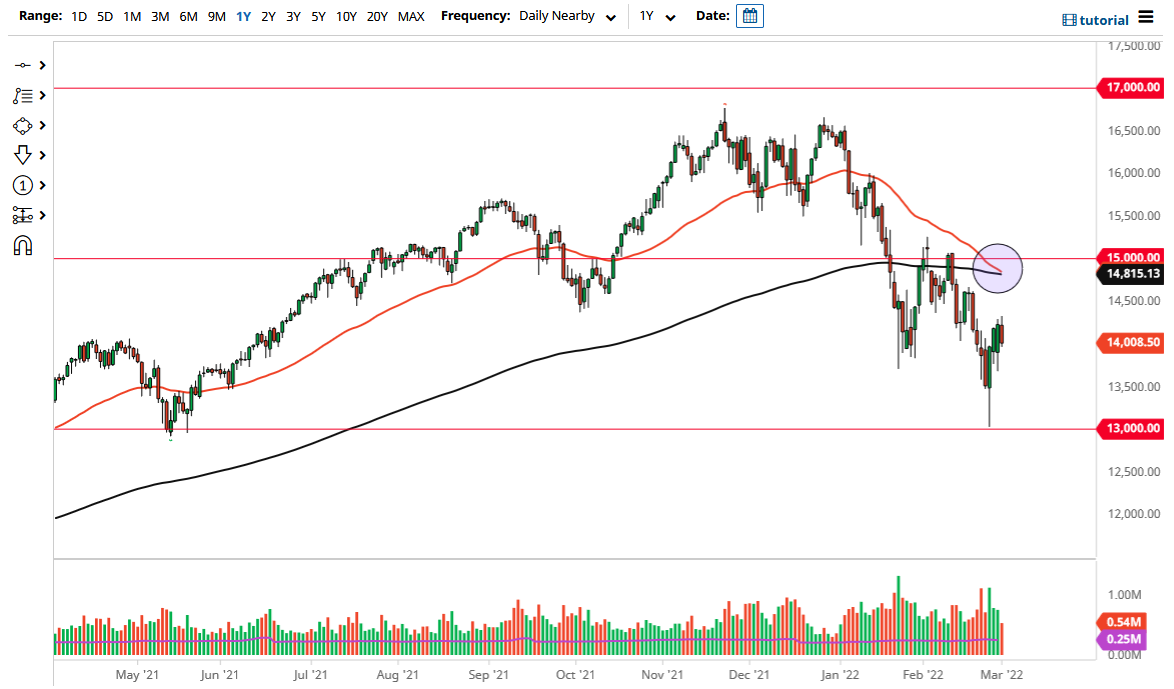

The NASDAQ 100 initially tried to go higher on Tuesday but pulled back rather significantly to close towards the bottom of the candlestick. That being said, you should also pay attention to the fact that we are getting ready to form the well-known indicator known as the “death cross” when the 50 day EMA is getting ready to break below the 200 day EMA.

Current volatility is making great stock trading opportunities – don’t miss out!

The size of the candlestick is not necessarily noteworthy, other than the fact that it is almost as big as the real body of the previous session. Because of this, everybody who bought into the end of the session on Monday is now starting to lose money again. The market has been drifting lower for a while, and there is so much in the way of risk out there that it is not a huge surprise to see that the NASDAQ 100 would suffer. The NASDAQ 100 is a highly volatile index at times, and you need to be cautious about getting overly aggressive right away. That being said, there is almost no way to buy this market in this environment. In fact, I would need to see this market break above the 14,500 level to think about it.

The fact that the market has turned around as much as we have, it looks likely that we are going to test the bottom of the candlestick for the trading session on Monday, near the 13,700 level. If we break down below there, it is likely that we could go looking towards the 13,000 level. Breaking down below that level would open up quite a bit of negativity and perhaps downward pressure yet again.

Keep in mind that the market does not like higher interest rates, which of course is something that is being threatened by the Federal Reserve. Furthermore, if the markets are going to have to deal with the slowing economy, it is difficult to imagine a scenario where high-flying technology stocks are going to suddenly take off. Markets continue to make “lower highs”, as well as “lower lows.” The overall composition of this market looks as if it is going to continue to struggle as we have seen so much in the way of selling pressure. It would take an enormous change in attitude and fundamentals to turn this thing around.

Source link