Triangle Pattern Forms After Fed

The pair will likely keep rising as bulls target the next key resistance level at 1.1100.

Bullish view

- Buy the EUR/USD pair and set a take-profit at 1.1100.

- Add a stop-loss at 1.0960.

- Timeline: 1-2 days.

Bearish view

- Set a sell-stop at 1.0990 and a take-profit at 1.0945.

- It has formed a stop-loss at 1.1125.

The EUR/USD pair was little changed after the Fed decision and as Ukraine and Russian negotiators moved close to a deal. It is trading at 1.1033, which is about 2% above the lowest level this month.

Fed Decision and Reduced Tensions

The Fed concluded its two-day meeting on Wednesday and decided to lift off. The committee decided to hike interest rates on the backdrop of a tight labor market and a high inflation rate.

The bank raised interest rates by 0.25% in the first time to do so since 2018. The dot plot showed that the members were open to 6 more rate hikes this year and three more in 2023. At the same time, the bank said that it will be open to hike by more than 0.25% in some of its meetings this year.

The EUR/USD tilted higher after the hawkish meeting because it was in line with expectations. For one, the unemployment rate has already dropped to 3.8%. Recent data also showed that the country had almost 11 million job vacancies that are yet to be filled.

At the same time, inflation is still rising and there are signs that the situation will worsen because of the crisis in Ukraine. Data published last month showed that the headline inflation surged to 7.9% while the core inflation rose to 6.4%.

The Fed has emerged as being more hawkish than the European Central Bank (ECB). In its meeting this month, the bank decided to lower the amount of asset purchases. It hinted that a rate hike will possibly come later this year.

The pair will react to the latest European inflation data. Based on the preliminary number published three weeks ago, analysts expect that the bloc’s inflation rose to 5.8%.

EUR/USD Forecast

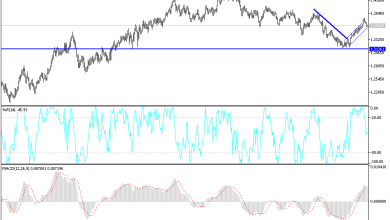

The four-hour chart shows that the EUR/USD held steady after the Fed decision and after signs emerged that a deal between Ukraine and Russia was possible. It is trading at 1.1036, which is higher than its monthly low.

The pair has formed a symmetrical triangle pattern and is currently at the upper side of this pattern. It has also moved slightly above the 25-day and 50-day moving averages while the MACD has moved above the neutral level.

Therefore, the pair will likely keep rising as bulls target the next key resistance level at 1.1100.

Source link