Playing into Putin’s hands – again

The Great Game of geopolitics faces a new challenge. The new hotspot is Israel and the Muslim Middle East. Ukraine is all but over, and the US is likely to abandon her to her fate — like Afghanistan.

We shall have to see how both will play out. Meanwhile, energy prices are set to keep inflation and interest rates high, undermining governments, banking systems, and businesses dependent on cheap credit.

This article concentrates on the consequences for currencies, which are simply unbacked credit valued by the public’s faith in them. To assist a proper understanding of money, the relationship between gold, which is universally accepted as legal money, and detached fiat currencies is explained as an objective/subjective relationship.

There are a number of moving pieces behind a gathering fiat currency crisis. Putting this jigsaw together reveals an increasingly certain crisis for G7 currencies. There is little doubt that both China and Russia are fully aware of this danger and are ready to defend their own currencies and economies by reverting to gold standards. And once the crisis for the fiat dollar and other G7 currencies starts, it could develop remarkably quickly and be unstoppable.

It all comes to he who waits…

According to NBC,[i] the US and the entire 50-nation Ukraine Defence Contact Group, is exploring the possibility of a ceasefire in Ukraine. These talks are reportedly about what Ukraine might have to give up in order to secure a deal with Russia. With Ukraine now little more than a footnote in news broadcasts, public and political support in the western alliance have fallen away.

And now there is Israel’s fight against Hamas, which for the western alliance is the new concern. Ukraine is being abandoned. With the US clearly signalling her changing military priorities, Putin is bound to stand firm. Not only does he want the US out of Ukraine, but out of Europe. He has always wanted to remove the US-led threat to Russia’s western border, and with the failure of the Ukraine campaign it now looks like he will succeed. Furthermore, both Russia and China want unfettered trade with Western Europe, which is prevented by the EU kowtowing to the US foreign policy.

The alliance will have no option but to simply walk away and leave Ukraine to its fate — just like Afghanistan. It will be two dramatic foreign policy failures in the Biden administration’s first term, only ameliorated by another new priority: rescuing Israel from Muslim oblivion. But America and her allies are now at a significant disadvantage in the Middle East, which in the last year or two has openly sided with the Russia—China axis. Having supported the Israelis against Hamas from the outset, the western alliance faces nearly the entire Muslim world of about two billion people strongly against any military intervention.

US Secretary of State Antony Blinken has an impossible task persuading regional forces to support Israel against Hamas. Hamas might not be popular around the Gulf, but the Gazan Palestinians are evoking world-wide sympathy while the Israelis are inviting condemnation. Blinken has trid to persuade the Israelis to use smaller bombs to limit collateral damage — not an approach likely to win respect and support in the region.

In short, the western alliance is getting entangled in an impossible situation through its support for Israel. Russia’s involvement has been limited to reassuring her Muslim population and the Muslim nations to her south by voicing the two state solution. Iran is taking a different view, as demonstrated by her Hezbollah mouthpiece, Hassan Nasrallah in a widely anticipated speech last week. He did not actually declare war, pointing out that Hezbollah was already skirmishing with the Israelis in Northern Israel. It was what Nasrallah did not say, which was important: Hezbollah was already at war, which is likely to escalate without a formal declaration.

Instead of just standing by, Iran is likely to become more directly involved. And in these circumstances, if the US is drawn into attacking Hezbollah or Iran, it is difficult to see how such an escalation can succeed. Iran has very sophisticated weaponry and knows the precise locations of US assets in Northern Syria and Iraq. Furthermore, it can easily block the Straits of Hormuz, depriving the world of oil and natural gas.

With the dying of American influence, Iran now counts among its supporters the Saudis, and pretty much the entire Muslim world. And it is not beyond the bounds of possibility that an escalation of these tensions would lead to the closure of either the Red Sea at Bab-el-Mandeb or Suez, or both.

Will the US risk provoking Iran and the Houthis in Yemen to close off these choke points? Common sense and Blinken’s attempts at diplomacy say no. But if that is the case, Israel’s very survival could be threatened. No wonder it will suit Putin and his partner President Xi to stay well clear of this dispute. Time will tell as to how this plays out. But it is the economic consequences which matter to us, and for that matter to the Asian hegemons as well.

Energy prices this winter

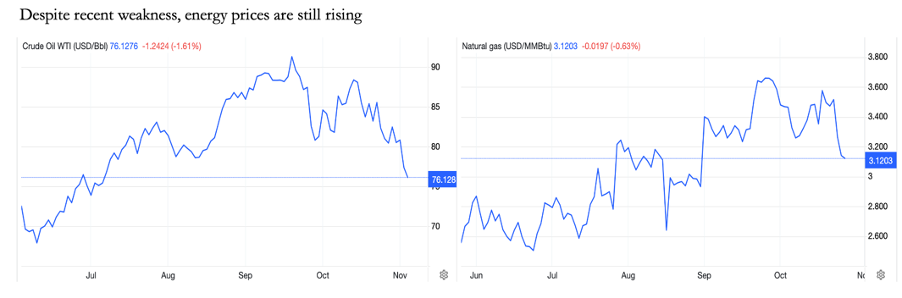

It would appear that an escalation of the crisis in the Middle East is increasingly likely, yet oil and gas prices are not yet reflecting it. The charts below are of oil and natural gas since the summer.

While it is true that over the last six months these prices have risen by a net 14% and 38% respectively, the outbreak of hostilities between Israel and Hamas have seen both oil and natural gas prices decline sharply. But if tensions mount, these prices are bound to rise strongly from current levels.

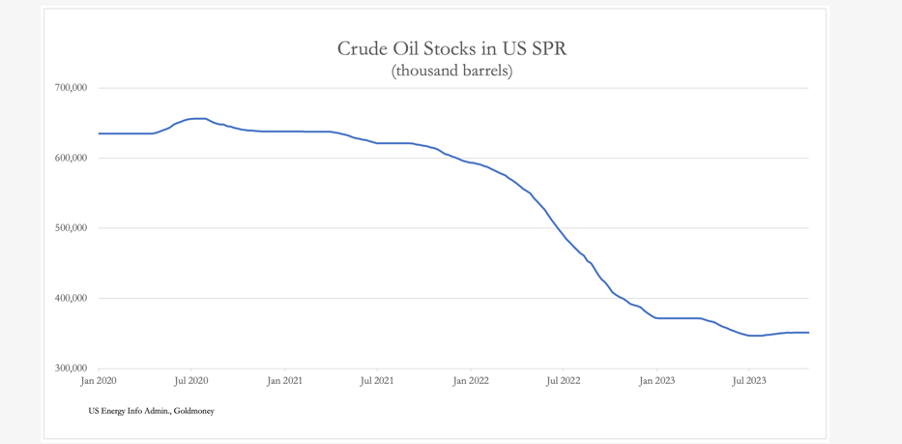

Furthermore, with US strategic reserves having declined by 40% since sanctions were imposed on Russia last year, the ability of the US to offset further price rises in oil is becoming limited. And as we enter the Northern Hemisphere winter, global demand for both energy sources will increase.

This matters because of the effect on the general level of prices and the credit accommodation G7 governments are bound to provide to accommodate higher prices. This accommodation will come in the form of increased budget deficits and possibly a resumption of QE because commercial bank credit is no longer expanding. But while governments are providing fiscal accommodation, their central banks will have no option but to increase interest rates from current levels, unless they abandon their inflation mandates.

However, other than Germany the other G7 nations are already in debt traps. Last week I described the US debt trap, concluding that debt interest in the current fiscal year could rise to nearly $1.5 trillion on a deficit to GDP of perhaps 14%. Japan’s condition is even worse, with its debt to GDP running at over 260% which means that for every 1% rise in funding expenses adds 5.7% to total government spending. No wonder Japan’s monetary authorities are desperately suppressing interest rates.

All this is counter to current market expectations. US Treasury yields have fallen from 5% to 4.5% in two weeks, and commentary is bullish, bullish, bullish. It is all rather surreal. Energy supplies are set to be less than demand for them in the coming months, hitting Europe particularly hard even without a deterioration in the military situation in Palestine. Any optimism over inflation and interest rates will almost certainly be replaced by pessimism — pessimism which is bound to spread to the condition of the entire G7 banking system.

While Putin’s Russia is likely to benefit from increasing disruption in the Middle East through higher energy prices, there is the question about what those prices will be worth in real terms, given the deteriorating outlook for the dollar and other payment currencies. In short, Putin will have to reform his own economy and currency in the wake of the G7’s self-immolation because of the consequences for Russia’s energy exports. We will return to this topic later in this article.

Valuing fiat currencies and their potential for collapse

It is time to explain why modern macroeconomists are mistaken in their mathematical approach, for which attention to reasoned economic theory is called for. While increasing numbers of economists and financial experts recognise emerging economic dangers, their understanding of them and why they have arisen is lacking. Dependence on statistical and mathematical economic modelling turned out to be a trap. And the assumption that the dollar is the risk-free replacement for gold is leading us into a rapidly emerging crisis that will destroy the entire fiat currency system.

We have the Austrian economist, Carl Menger to thank for a proper understanding of the value attached to a fiat currency. Menger was one of the three economists in the 1870s to develop the marginal theory of prices (the others being Jevons and Walrus). He was the only one who fully embraced human orders of priority and subjectivity as the basis for prices, rejecting cost determined price theory entirely.

Menger also understood that the function of money was to provide an objective value in transactions, while all the subjectivity was to be found in the goods and services subject to exchange. This line of reasoning was further developed by the economists who followed him, particularly Ludwig von Mises, who extended the analysis in his The Theory of Money and Credit, first published in 1912.

In Part Two, Chapter 1 Mises wrote the following:

“The central element in the economic problem of money is the objective exchange-value of money, popularly called its purchasing power. This is the necessary starting-point of all discussion; for it is only in connexion with its objective exchange-value that those peculiar properties of money that have differentiated it from commodities are conspicuous.

“This must not be understood to imply that subjective value is of less importance in the theory of money than elsewhere. The subjective estimates of individuals are the basis of the economic valuation of money just as of that of other goods.”

From his book’s own title, we can take it that for Mises money is gold and all else is credit. So how is it that gold can have a subjective value, as well as being objective in transactions?

The subjective value of gold modifies its objective value by changes in the level of money held unspent relative to goods and services. Even under gold standards, the savings and spending habits of consumers in national economies differ.

When people decide to increase their rate of saving, gold’s purchasing power tends to increase, and if people reduce their savings, its purchasing power will tend to fall. But because gold as money is internationally accepted and assuming no barriers to trade arbitrage, there will be a tendency to correct one nation’s general price level to an international norm. Due to this arbitrage activity, gold will tend to flow from where goods are dearest to where they are cheapest. The current difference in purchasing power parities is principally a fiat currency and trade barrier phenomena, where this arbitrage doesn’t happen.

When a currency is firmly tied to gold, even though it remains credit it adopts the highest degree of objectivity possible, because the value of gold as money is universally recognised, facilitating trade flows. Differences in interest rates between currencies on credible gold standards also lead to gold reserves flowing from one to the other, with gold values in the higher rate centre acting as the objective value in the arbitrage, with the gold valued in the lower interest rate centre being the subjective.

This is what Mises meant by saying that “the subjective estimates of individuals are the basis of the economic valuation of money just as that of other goods”.

Money’s objective and subjective values coincide with respect to its function as the intermediation between sellers and buyers of goods and services. It is its objective value which then matters, confining subjectivity in value to the economic goods being exchanged. It is this feature which defines money, and also that of its credit substitutes when they are exchangeable for gold on demand. With today’s world not using money, that is gold or its credible money substitutes, an additional factor for fiat currencies must be considered.

A fiat currency’s objective value for transaction purposes is modified by the faith in it of its users. But the true relationship between gold which is legal money and a fiat currency is that the subjective value lies with the fiat currency, and the objective with gold. This is the other way round from that commonly presented, which has arisen through the habit of quoting a gold standard in terms of currency units to the ounce, when the correct relationship should be expressed in units of gold by weight to a currency unit. Under the longstanding gold standard commonly expressed as $20.67 to an ounce of gold, the legal definition in America’s Gold Standard Act of 1900 was as follows:

“Be it enacted by the Senate and House of Representatives of the United States of America in Congress assembled, That the dollar consisting of twenty-five and eight-tenths grains of gold nine-tenths fine, as established by section thirty-five hundred and eleven of the Revised Statutes of the United States, shall be the standard unit of value, and all forms of money issued or coined by the United States shall be maintained at la parity of value with this standard, and it shall be the duty of the secretary of the Treasury to maintain such parity.”

Obviously, when using the dollar as a gold substitute it was cumbersome to describe the dollar consisting of 25.8 grains of a coin which is 90% gold: $20.67 to an ounce is easier in practice, as was $35 following the dollar’s devaluation from 1934 until Bretton Woods was suspended in 1971. To describe the gold price as subjective thereafter, in other words that the price of gold has risen over time subsequently while the dollar is the objective value is a gross error. It is a matter of fact that the dollar’s purchasing power has declined because gold, which is internationally accepted legal money has the objective value while that of the dollar is always subjective.

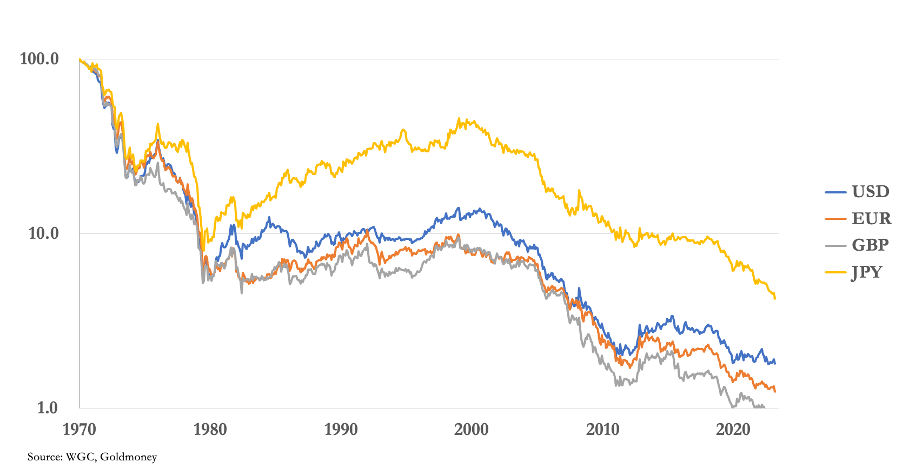

If further proof of the relationship is required, it should be noted that historical records show that prices in gold of many goods have remained remarkably stable over centuries, while no fiat currencies have survived for prolonged periods. The only exception so far is today’s fiat currency regime which has yet to fail. However, their loss of purchasing power since they totally became fiat even before an ultimate failure is illustrated in the chart below.

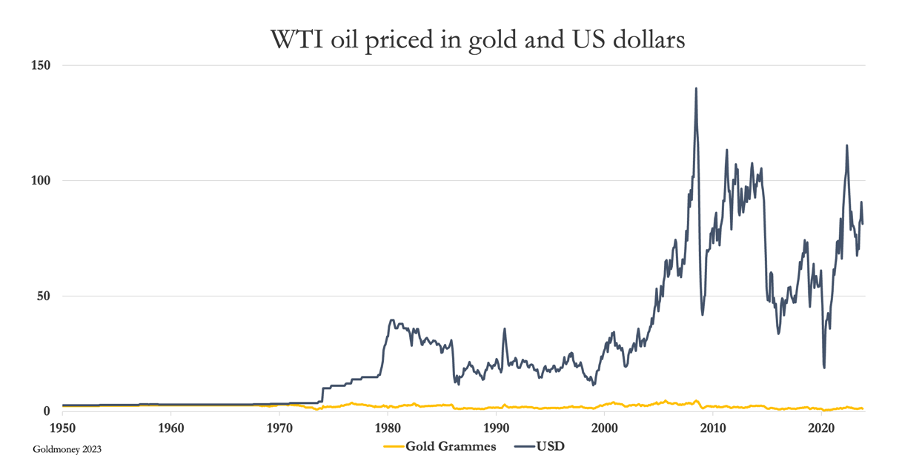

Since world currencies headed by the dollar suspended any form of gold convertibility in 1971, the US dollar has lost 98.2% of its value in gold, the pound sterling 99.1%, the euro (including its prior constituents) 98.8%, and the yen 95.8%. Furthermore, these currencies’ purchasing power have shown great volatility, as the chart of oil priced in gold and dollars over the last seventy-three years illustrates.

Some of the very low volatility of oil priced in gold reflects the volatility in the fiat dollar’s purchasing power, without which it would have undoubtedly been even more stable. It is the instability of the fiat dollar which is the problem, and it is clear that relative to legal money, it is legal money in the form of physical gold which is the objective value, and the fiat dollar subjective.

For now, habit and anti-gold propaganda conceals this true relationship, but history informs us that the error will eventually be recognised. When it is, then the charade that fiat currencies led by the dollar are the new true money and gold just an historical curiosity will be fully exposed. And the fate of today’s fiat currencies will follow that of their predecessors: a collapse in their purchasing power entirely.

The factors undermining faith in unbacked currencies

How rapidly that collapse will be and the consequences for both corporeal and incorporeal assets are of great interest to those wishing to preserve their wealth. I have written a series of articles in recent months detailing individual aspects of a gathering currency crisis, so the following is just a short summary of them.

- Interest rates. With or without Middle Eastern tensions, higher energy prices will undoubtedly result in higher prices of everything. The reality is that it is the purchasing power of fiat currencies being undermined, and the authorities will have little alternative but to permit interest rates to continue to rise to prevent an early collapse of their currencies’ purchasing power.

- Commercial bank credit. Commercial bank credit is contracting due to bankers now concerned about the prospect of non-performing loans, falling values for financial assets, and the lack of buyers for collateral such as commercial real estate. Their operational leverage increased substantially when interest rates were zero and negative, and now that they have risen, bankers are desperate to reduce their risk profiles. The shortage of available credit for economic activities is driving up interest rates irrespective of central bank monetary policies.

- Government debt traps. G7 governments comprising the US, UK, Japan, France, Italy, and Germany with the exception of Germany are all in debt traps. These traps are being triggered by the sharp rise in interest rates, which will be intensified when rates are forced even higher. Notably at risk in the global context is Japan, whose debt to GDP ratio exceeds 260%, and the US whose ratio is at 121%. These ratios are set to soar through a combination of increasing deficits and debt interest costs. They are likely to lead to a loss of public faith due to their respective debt traps.

- Global recession or slump. Confirmed by numerous business surveys, G7 nations face a deepening economic crisis as over-leveraged businesses which were profitable when interest rates were far lower are driven to the wall through current and higher interest rates. Commercial property and private equity debt are examples of sectors and business models being destroyed by the new interest rate environment.

- Financial asset values. With bond yields having risen causing substantial falls in bond prices, the change in the valuation basis has yet to be reflected in equity markets. Consequently, equities are liable to crash on the next rise in bond yields, if not before. Not only does this impoverish investors, but the reduction in their values as collateral has destructive consequences for the entire banking system, which faces having to liquidate financial assets held against loans going sour in a falling market.

- G7 Central banks are technically bust. Balance sheet losses from quantitative easing in all G7 central banks are multiples in excess of their equity. It is possible to recapitalise them, with the likely exception of the ECB. The ECB will require its “keyholders”, being the network of national central banks in the euro system to subscribe for new equity at a time when the NCBs are also deeply in negative equity. Legislative approval will be required in multiple jurisdictions to recapitalise the NCBs and the ECB, the process of which could heighten the crisis in the euro system and probably threaten the euro’s existance.

- Commercial banks are likely to fail. Having maintained profits by using high levels of leverage when credit margins were compressed by negative interest rates, major banks in both the Eurozone and Japan have a legacy of asset to equity ratios of twenty times or more. This high level of gearing has never been seen before on a widespread basis. Rising interest rates are rapidly turning the bank lending cycle from bankers seeking profitable lending into a growing fear of losses. By their own collective actions, in an attempt to individually survive they are forcing a credit squeeze on borrowers who depend on bank lending for liquidity. This contraction of bank credit always leads to a systemic crisis for the entire banking sector and a slump in economic activity.

- Russia and China are successfully wresting global influence away from the US and her dollar. The western alliance abandoning Ukraine seems increasingly certain, with public attention diverted to the Palestinian situation for political cover. If that escalates towards a confrontation between America and Iran, then energy prices can be expected to rise strongly, undermining the dollar-based currency system and its purchasing power even more rapidly than other inflationary factors.

- Foreign holdings of dollars. According to the US Treasury, foreigners own about $33 trillion in financial assets and bank deposits. To this must be added an estimate of foreign owned dollar balances in non-US banks and shadow banks. On the basis of foreign exchange positions where one leg is in dollars, the Bank for International Settlements estimates these offshore eurodollar balances to amount to a further $85 trillion[ii], plus there is a further $10 trillion in eurodollar bonds. When a bear market in financial assets becomes obvious, expect massive foreign liquidation of dollar denominated financial assets and dollars.

The rehabilitation of gold as credit’s anchor

The last bullet in the list above is poorly understood by domestic Americans. There is nothing unusual in this because currency crises are almost always triggered by foreign currency and asset liquidation. Furthermore, the mistaken view that the dollar is money and not physical gold leads to an expectation that in a crisis other currencies will be sold for dollars. And indeed, when a global financial crisis hits, that is the initial reaction as we saw in the run-up to the Lehman failure.

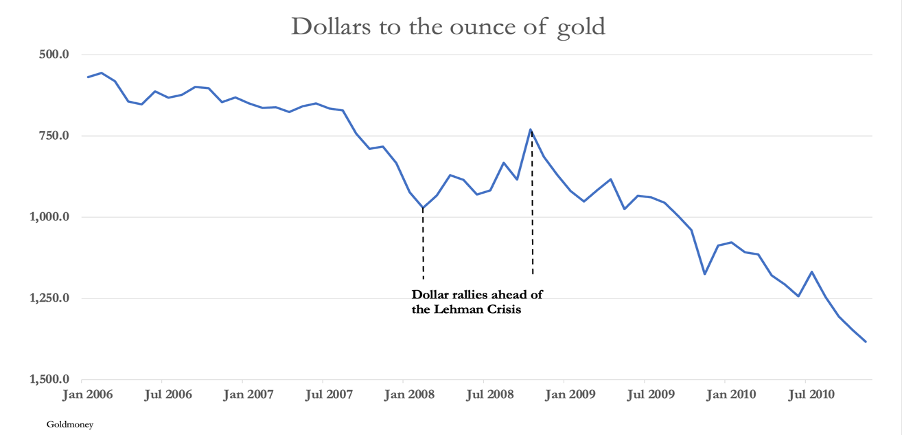

This was reflected in the subjective dollar’s purchasing power relative to objective gold, which is shown in our next chart.

Ahead of the Lehman failure, there was a flight into the dollar, which drove it higher by 25%. But when Lehman filed for bankruptcy in September 2008, the dollar resumed its downtrend measured against real money — gold.

Similarly, as markets become increasingly aware of factors leading up to the current crisis, the dollar rallied sharply against gold. Whatever form the crisis takes, support for the dollar can be expected to reverse, this time threatening to destabilise the colossal quantity of dollar balances in foreign hands, which with eurodollar balances outside the US banking system amounts to some $128 trillion.

The problem for foreign holders of the dollar is that it is the reserve currency for the entire fiat currency system. A collapse in the dollar will not lead to any lasting protection in other fiat currencies. The only refuge from what will amount to a worldwide currency and credit collapse will be to return to true, legal, longstanding money, which is physical gold — paper gold is credit and offers no protection in an existential currency crisis. Enhanced by modern technology, the speed of events could become extremely rapid, with sellers of credit trying to secure physical gold in their panic, and failing to do so.

How this actually evolves and the speed with which it does can only be guessed at. But there is no doubt that both China and Russia have taken steps to protect themselves from a dollar currency and credit collapse. China has enhanced her gold mining operations so that she is now the largest nation by output. Furthermore, it is clear that first the state, and then her citizens have been accumulating large quantities of physical gold; the state from 1983 and Chinese nationals since 2002 when the Shanghai Gold Exchange was opened. And only last June, state-controlled banks began offering gold accounts to depositors, allowing even those with meagre savings to possess some real money.

With China’s gold policy forty years’ old, we can be certain that there are plans in place to rapidly secure the yuan’s value by linking it to gold. Russia came to the same conclusion rather later, but with her official reserves standing at 2,360 tonnes, she is already the fifth largest holder. Furthermore, Russia has two wealth funds which are said to contain a further 10,000—12,000 tonnes, sufficient reserves to link the rouble to gold on a fully operational gold exchange standard.

It is not in either nation’s interest to destabilise the dollar-based fiat currency system. But China appears to be more patient in this regard than Russia. Russia was actively promoting a first step in a return to gold standards by proposing a gold-linked trade settlement currency for the BRICS membership. It failed to make the agenda in the Johannesburg meeting last August, presumably due to opposition from China and India. Instead, in their attempts to de-dollarise trade settlements they have agreed to accept each other’s currencies. This can only be a stopgap.

While a move to protect their currencies by reverting to gold standards can be activated at short notice, it would surely be another hammer-blow for the fiat currency regime. It is this which will concern the Chinese in particular, which is another reason they will respond to rather than front-run developments. However, in the geopolitical sense, the death of the dollar will also be the end of US hegemony, leaving China and Russia, the entire Shanghai Cooperation Organisation, and an expanding BRICS to pursue a new era of gold-backed trade.

Putin will have then achieved his objective of driving the US out of Europe. If he plays his cards right, with China Russia could become Europe’s economic salvation.

[i] See https://www.nbcnews.com/news/world/us-european-officials-broach-topic-peace-negotiations-ukraine-sources-rcna123628

[ii] See Dollar Debt in FX Swaps and Forwards: Huge, Missing, and Growing by Claudio Borio, Robert McCauley, and Patrick McGuire: https://www.bis.org/publ/qtrpdf/r_qt2212h.pdf

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link