Economics Professor Proposes Price Controls as a Powerful Weapon to Contain Inflation – Mish Talk

Isabella Weber, an assistant professor of economics at the University of Massachusetts Amherst, trots out proven economic nonsense in a Guardian article.

Please consider her economically illiterate proposal: We Have a Powerful Weapon to Fight Inflation: Price Controls. It’s Time We Use It.

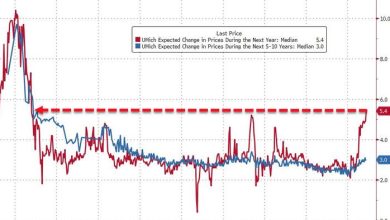

Inflation is near a 40-year high. Central banks around the world just promised to intervene. However, a critical factor that is driving up prices remains largely overlooked: an explosion in profits. In 2021, US non-financial profit margins have reached levels not seen since the aftermath of the second world war. This is no coincidence. The end of the war required a sudden restructuring of production which created bottlenecks similar to those caused by the pandemic. Then and now large corporations with market power have used supply problems as an opportunity to increase prices and scoop windfall profits.

The White House Council of Economic Advisers suggests that the best historical analogy for today’s inflation is the aftermath of the second world war. Then and now there was pent up demand thanks to high household savings.

President Truman was aware of the risks of ending price controls. On 30 October 1945, he warned that after the first world war, the US had “simply pulled off the few controls that had been established, and let nature take its course”. And he urged, “The result should stand as a lesson to all of us. A dizzy upward spiral of wages and the cost of living ended in the crash of 1920 – a crash that spread bankruptcy and foreclosure and unemployment throughout the Nation.” Nevertheless, price controls were pulled in 1946, again triggering inflation and a boom-bust cycle.

Today, there is once more a choice between tolerating the ongoing explosion of profits that drives up prices or tailored controls on carefully selected prices. Price controls would buy time to deal with bottlenecks that will continue as long as the pandemic prevails. Strategic price controls could also contribute to the monetary stability needed to mobilize public investments towards economic resilience, climate change mitigation and carbon-neutrality. The cost of waiting for inflation to go away is high. Senator Manchin’s withdrawal from the Build Back Better Act demonstrates the threat of a shrinking policy space at a time when large scale government action is in order. Austerity would be even worse: it risks manufacturing stagflation. We need a systematic consideration of strategic price controls as a tool in the broader policy response to the enormous macroeconomic challenges instead of pretending there is no alternative beyond wait-and-see or austerity.

Price Controls Never Work

Never. How many times do we have to prove this?

Nixon tried them, so did Venezuela, Argentina, and countless other nations.

There are however, conditions in which price controls might seem to work.

Conditions Under Which Price Controls “Seem” to Work

- Price controls are set high enough that they weren’t needed.

- The supply constraints or the issue resulting in higher prices was on the verge of being fixed by the market anyway.

Isabella Weber was soundly and repeatedly blasted on Twitter for her nonsense.

Shortages and Black Markets

If the government sets prices too low there will be shortages. Venezuela provides a huge case in point where the official price of gas is a dime.

Try getting any for a dime.

Not only do price controls lead to shortages, they lead to black markets where people are willing to pay a higher price and do.

Fundamental Issues

- Interest rates are too low

- We had three rounds of stimulus overkill

- Pandemic lockdowns cause labor shortage

- Productivity going to hell because of boomer retirements

- More regulations under Biden

Law of Bad Ideas

In 2014 I proposed a Law of Bad Ideas

Law of Bad Ideas: Bad ideas don’t go away until they have been tried and failed multiple times, and generally not even then.

Corollary One: Left alone, bad ideas get worse over time.

Corollary Two: The overwhelming desire to implement bad ideas leads to compromises guaranteed to make things worse.

Corollary Three: Those in positions of political power not only have the worst ideas, they also have the means to see those ideas are implemented.

Corollary Four: The worse the idea, the more likely it is to be embraced by academia and political opportunists.

Corollary Five: No politically acceptable idea is so bad it cannot be made worse.

Today I propose a couple new corollaries

- For every problem there is at least one economically preposterous idea on how to fix it!

- For every problem an economically illiterate person attacks the symptoms.

When I first saw the Guardian headline, I thought it was clickbait nonsense to generate reads. Unfortunately, Weber is serious as well as seriously delusional.

She did not mention any of the five fundamental issues. Instead she attacked prices, a symptom of the problem.

Weber is not fit to teach at the University of Massachusetts or anywhere else.

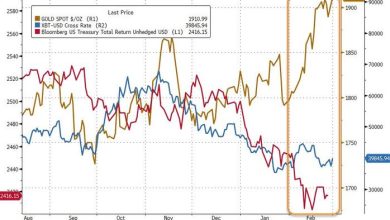

Every Measure of Real Interest Rates Shows the Fed is Out of Control

If you want to understand the key issue, please see Every Measure of Real Interest Rates Shows the Fed is Out of Control

You might also wish to consider Food! What’s in Your Basket and How Much is Inflation Eating?

Thanks for Tuning In!

Like these reports? If so, please Subscribe to MishTalk Email Alerts.

Subscribers get an email alert of each post as they happen. Read the ones you like and you can unsubscribe at any time.

If you have subscribed and do not get email alerts, please check your spam folder.

Mish

Source link