GBP/USD Mid-Day Outlook – Action Forex

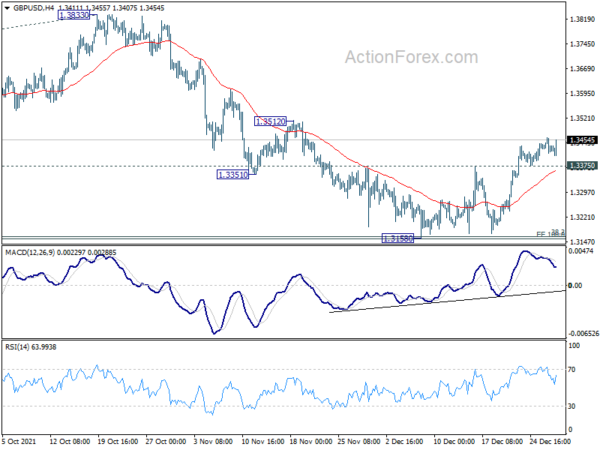

Daily Pivots: (S1) 1.3411; (P) 1.3437; (R1) 1.3457; More…

GBP/USD’s rise from 1.3158 is still in progress. Sustained trading above 55 day EMA (now at 1.3426) will be an early sign of bullish reversal. That is, correction from 1.4248 might have completed with three waves down to 1.3158, after hitting 1.3164 medium term fibonacci level. Further rally would be seen to 1.3570 support turned resistance next. On the downside, break of 1.3375 minor support will turn intraday bias neutral first.

In the bigger picture, focus remains on 38.2% retracement of 1.1409 to 1.4248 at 1.3164. Sustained break there will argue that whole rise from 1.1409 has completed at 1.4248, after rejection by 1.4376 long term resistance. That will revive some medium term bearishness and and target 61.8% retracement at 1.2493. However, strong rebound from current level will revive argue that up trend from 1.1409 is still in progress, and probably ready to resume.

Source link