EUR/USD Technical Analysis: Oversold Levels

At the end of last week’s trading, the EUR/USD exchange rate fell by a full percentage to reach the 1.0885 support level, its lowest since May 2020. After this performance, analysts say that it could decline significantly amid a significant deterioration in the conflict in Ukraine. EUR/USD closed the week’s trading stable around the level of 1.0930. Stock markets and the euro tumbled while the dollar and commodities were bought following reports of a fire at Europe’s largest nuclear power plant in the early hours of Friday morning.

For its part, Ukraine said that the fire broke out during a Russian attack to seize the main part of the infrastructure and served as a reminder of the extremely dangerous nature of the conflict. Accordingly, analysts say that further losses in the value of the single currency of the eurozone are likely to continue, as Russian President Vladimir Putin is on the path of destruction. US Secretary of State Anthony Blinken has warned that the threat of an escalation into a broader conflict is now very real.

“Our alliance is a defensive alliance,” Blinken told reporters. We do not seek conflict. But if the conflict reaches us, we are ready for it and we will defend every inch of NATO territory.” Jonathan Petersen, an analyst at Capital Economics, says, “Amid the ongoing war in Ukraine, the US dollar in general has strengthened; And the US dollar index DXY, for example, reached its highest level since June 2020.”

The Eurozone and EU economy in general is expected to suffer a major blow to growth and increased inflation due to its geographic proximity to the conflict scene, as well as highly integrated energy linkages. Accordingly, analysts say, the rapid and widespread rise in commodity prices has caused major shifts in countries’ terms of trade. In addition to close economic ties with Russia, most European countries are net commodity importers, so some weakness in their currencies may reflect deteriorating terms of trade.

The deterioration in the eurozone’s economic outlook is likely to lead to a dose of caution in upcoming ECB policy decisions, with economists saying the Governing Council will certainly delay plans to “normalize” policy. Recently an analysis from ING Bank N.V. The war in Ukraine will dampen the pace of the eurozone recovery and push inflation to around 4% for the year. As a result, ING economists say the ECB will run into more trouble during the storm, although they still expect quantitative easing in the third quarter and a rate hike for the first time at the end of the year.

In the United States, by contrast, the tightening of policy appears to be going ahead as planned; Indeed, Fed Chair Powell has indicated in Congressional testimony that the central bank will “proceed with caution” in tightening policy this year. As a result, the gap – interest rate outlook between the US and the Eurozone has shifted more in favor of the dollar over the past few weeks.

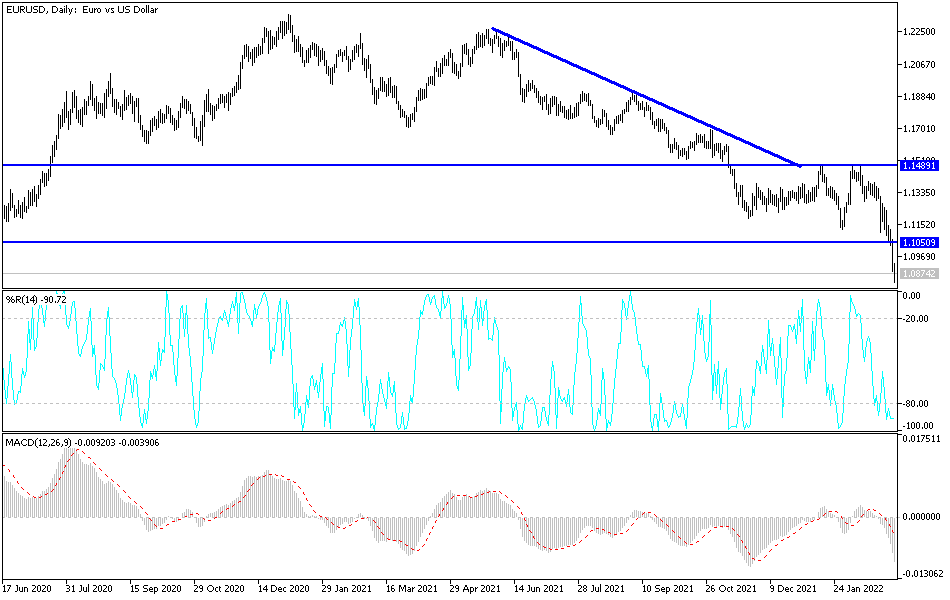

According to the technical analysis of the pair: The main general trend of the EUR/USD is still bearish, and the collapse below the 1.1000 psychological support confirms the bears’ control of the trend and warns of a broad bearish move as long as the Russian war continues. According to the performance on the daily chart, the support levels will be 1.0880, 1.0790, then 1.0630, respectively, the most prominent in the coming days. On the other hand, breaking the resistance 1.1220 will stimulate the bulls to express their survival.

So far, the euro dollar gains will remain a target for sale.

Source link