At Its Core Price Inflation Still Running Hot

The Consumer Price Index (CPI) increased by the smallest annual amount in more than two years in May.

This means the inflation fight is over and inflation lost, right?

Not so fast.

As always, you need to look beyond the headline numbers. And when you drill down to the core, it’s clear that price inflation is still running hot.

The CPI was up just 0.1% month-on-month, with the annual increase coming in at 4%, according to the latest Bureau of Labor Statistics data. This is certainly a big improvement on the 1% month-on-month increase and the 8.3% annual increase we saw in May 2022. But price inflation still remains twice the Federal Reserve’s 2% target.

And when you dig into core CPI, the news isn’t nearly so good. In fact, it’s downright bad.

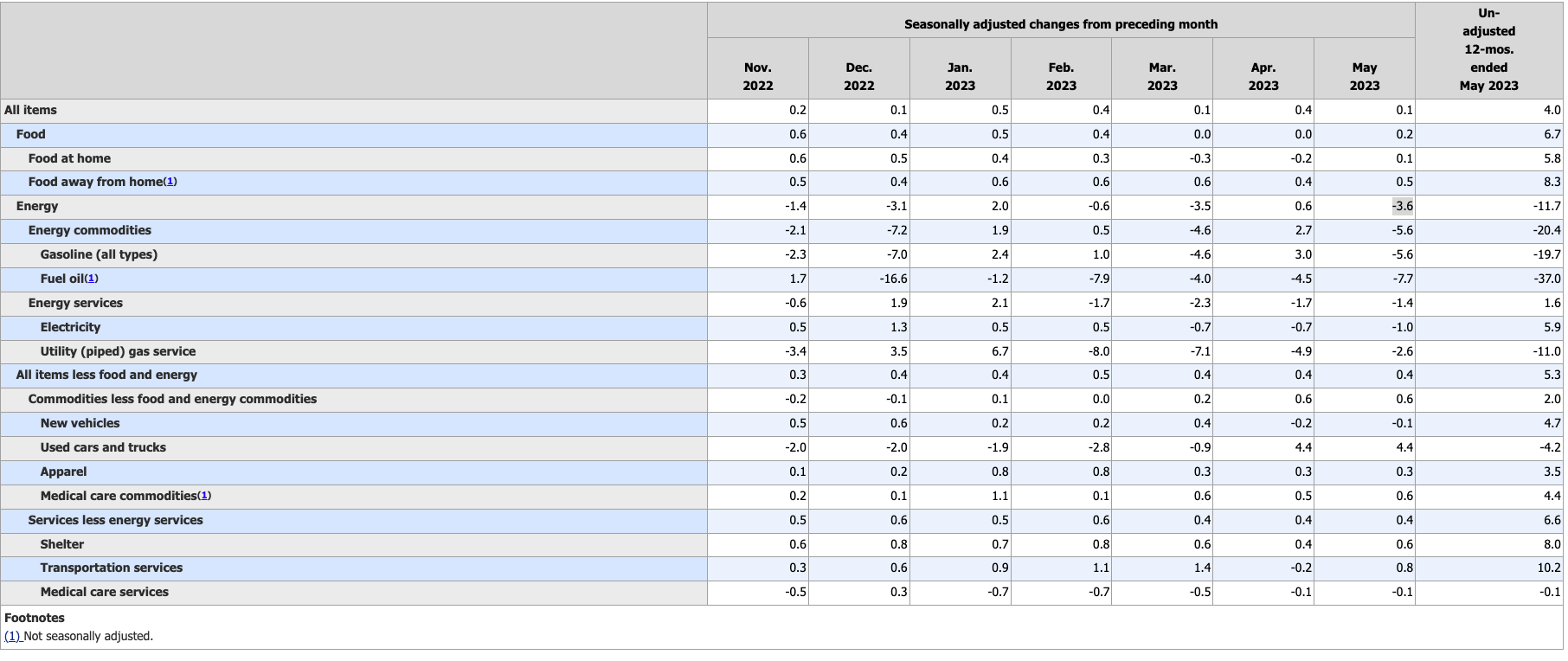

Core CPI, excluding food and energy prices, rose 0.4% month-on-month. On an annual basis, core CPI rose by 5.3%.

To put that number into perspective, the core CPI increase in May 2022 was 6%. That means the increase in core CPI has barely budged.

Looking at the monthly increases so far in 2023 confirms that core CPI remains sticky. It rose by 0.4% in January, 0.5% in February, 0.4% in March, 0.4% in April, and by 0.4% yet again in May. That averages to 0.42% per month or 5.4% annually.

If you go by the core CPI, and everybody swears it’s a better price inflation gauge because it is less volatile, then you have to conclude that inflation hasn’t budged.

And again – I can’t emphasize this enough – you will notice that all of these numbers are well above the Fed’s 2% inflation target.

Keep in mind, inflation is worse than the government data suggest. This CPI uses a formula that understates the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers.

DIGGING INTO THE NUMBERS

A deeper look at the data reveals more reasons to temper your optimism.

First, the drop in annual CPI this month was partly a function of math. A huge 1% month-on-month increase from a year ago dropped out of the calculation.

As we explained last month after the release of the April CPI data, math is about to turn on the CPI calculation.

The CPI last April was 0.4% which means the drop is due to a bigger number coming off the board. This will likely play into the May and June CPI especially as 0.92% and 1.21% fall off the YoY calculation. This will greatly help the CPI YoY come down further over the next two months.”

Second, a big drop in energy prices papered over increasing prices in other categories. Overall, energy costs were down a whopping 3.6% from April to May. On an annual basis, energy prices have dropped 11.7%. Gasoline prices are down over 20% from this time last year.

But the only non-energy categories to chart price decreases were new cars and medical services.

Food prices have moderated, but continue to increase every month. And notably, commodity prices charted a 0.6% month-on-month increase. These are raw materials, meaning these rising prices may ooze into other categories in the month ahead.

SUMMING IT UP

Price inflation isn’t dead.

It has certainly moderated from its peak a year ago if you only consider the headline numbers. But if you factor in the core, price inflation hasn’t moderated at all. It’s rising at almost the exact same pace it was one year ago.

And there is nothing in any of this data to indicate that the increase in CPI will fall to 2% in the near future.

The CPI data came out before the June Federal Reserve meeting kicked off. Most pundits think the Fed will pause rate hikes, although Powell and Company will almost certainly keep up the hawkish talk and try to convince everybody they are still in the fight.

They can do that now because they can plausibly argue the economy appears to still be humming along. The real question is what will the Fed do when the recession hits and something else big breaks in the economy or the financial system?

If the Fed holds true to form, it will pivot and start cutting rates to prop up the sagging economy. Moderating CPI data gives them the cover to make that pivot. But that will mean even more inflation coming down the pike.

Call 1-888-GOLD-160 and speak with a Precious Metals Specialist today!

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link