USD Powers Higher Against JPY

I do think that you will probably get a bit of volatility over the next couple of days, but you are going to be better off looking for some type of dip to buy.

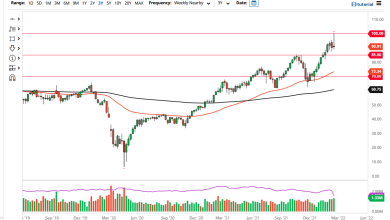

The US dollar rallied again on Monday to reach the crucial ¥118 level. The latest move has been somewhat parabolic, and therefore it would not be a huge surprise to see a little bit of a pullback. Ultimately, I think that is probably a good thing, especially as the ¥118 level is a major resistance barrier on the monthly charts. This means that the market needs to take a bit of a breather in order to break out, mainly because we got there too quickly.

The yen is a popular asset during turbulent times.

The interest rate differential continues to favor the US dollar as the 10-year note has been sold off rather viciously. We have a Federal Reserve meeting this week, and a lot of people will be paying close attention to what the Federal Reserve is going to do about asset purchases and the overall balance sheet. The more aggressive that they are going to be about fighting inflation, the more likely we are going to continue to see this interest rate differential between bond yields in both countries diverge further, thereby driving the US dollar farther up against the yen.

On the downside, the ¥116 level should be supported, as it is the top of the previous consolidation area. After that, we have the 50-day EMA that is sloping higher, and then the ¥115 level. All of these areas could offer value for traders on some type of pullback.

However, if we were to simply slice through the ¥118 level, that cannot be overlooked. That opens up the possibility of the pair trading at the ¥120 level, which is another area where we have seen a lot of resistance in the past. It is interesting to see how this has been behaving because interest rates have taken focus, and this is probably the one place where the Japanese yen is really getting hammered, due to the fact that even with negative headlines, people are okay owning the US dollar. This is why it has performed much better than the NZD/JPY pair, AUD/JPY pair, and so on. I do think that you will probably get a bit of volatility over the next couple of days, but you are going to be better off looking for some type of dip to buy.

Source link