Astrologers Would Likely Beat the Fed at Inflation Forecasting – Mish Talk

When Theory Ends

Eurointelligence has an interesting column on “When Theory Ends“.

They refer to the ECB, but if you substitute the Fed for ECB the article is just as accurate.

One of most egregious cases of where theoretical models fail is inflation forecasting. As we keep writing, they have no hope in hell of capturing underlying trends because they exclude too many interlocking factors, and because they do not take account of structural societal shifts. The ECB’s inflation forecast has been so appalling that it would have been beaten not only by the proverbial dart-throwing monkey but probably even by astrologers. This is for the simple reason that the model is biased towards a return of inflation back towards the status quo. Any method without such a bias will outperform it. The rise of modern statistical tools has also started to impact economic policy making and economic research. We would expect central banks and governments of the future to hire more data analysts and statisticians and fewer paper-writing economists.

We have also witnessed the theory-versus-statistics debate in our own line of work. As observers of European media, we have been relying on translation services, without which we would not have been able to read Finnish or Greek newspapers. When we started 15 years ago, the world of translation software was dominated by services using structural linguistic models. The linguists scoffed at the statistical translation techniques developed by Google and others at the time. Statistical translation ended up winning the battle. Things in life that are too complex and too chaotic to be subjected to linear structural models. Language is one of them.

The issue is not only that computers are better at finding relationships between data than humans. Perhaps the bigger issue is their lack of cognitive biases. We have never met an economist who admits that his or her framework is wrong on the grounds that it is not supported by empirical.

The more beliefs creep into your model, the more prone your profession is to meet the same fate as the first generation of translation modellers. If you believe that money and debt are the same thing, the central premise of modern monetary theory, no data will ever get you out of this belief system. Macroeconomics in particular is closer to language translation where error correction is important, as opposed to areas where scientists are constantly updating their understanding of reality.

The Fed tried and failed for years to produce inflation and now they claim to have tools to stop it.

Former Fed Chair Ben Bernanke was a real hoot just ahead of the housing bubble bursting.

Bernanke in His Own Words

- February 15, 2007: Chairman Bernanke said: “Overall economic prospects for households remain good. The labor market is expected to stay healthy. And real incomes should continue to rise. The business sector remains in excellent financial condition.”

- March 28, 2007: Chairman Bernanke said: “The impact on the broader economy and financial markets of the problems in the subprime markets seems likely to be contained.”

- May 17, 2007: Chairman Bernanke said: “We do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.”

- February 27, 2008: Chairman Bernanke said: “By later this year, housing will stop being such a big drag directly on GDP … I am satisfied with the general approach that we’re currently taking.”

- February 28, 2008: Chairman Bernanke said: “Among the largest banks, the capital ratios remain good and I don’t expect any serious problems … among the large, internationally active banks that make up a very substantial part of our banking system.”

- June 9, 2008: Chairman Bernanke said: “The risk that the economy has entered a substantial downturn appears to have diminished over the past month or so.”

- July 16, 2008: Chairman Bernanke said that Fannie Mae and Freddie Mac are “adequately capitalized” and “in no danger of failing.” Since then, Fannie Mae and Freddie Mac have received a $200 billion bailout and have been taken over by the federal government.

Fed Misunderstands Inflation

For a decade, the Fed was on a foolish mission to achieve 2% inflation.

The Fed now has the reverse problem.

In reality, the Fed produced massive inflation all along but did not know then and still doesn’t now understand how to measure it.

And they still have faith in their flawed models.

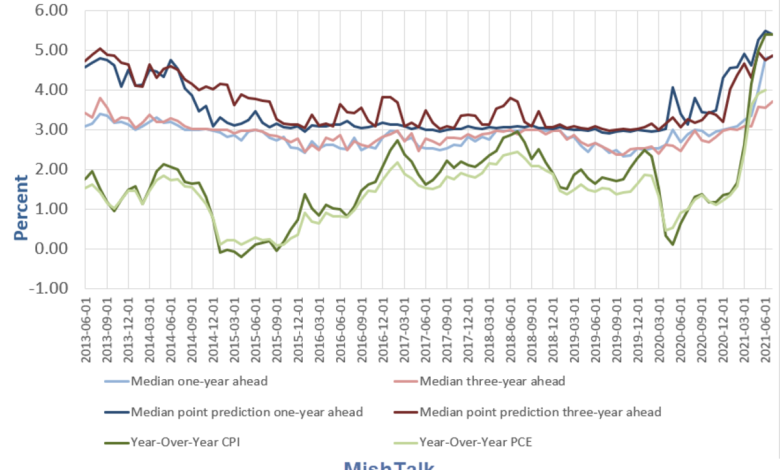

How Bad are Inflation Models?

Fed Chair Jerome Powell is a big believer in inflation expectations. So were previous Fed Chairs Janet Yellen and Ben Bernanke.

It is all part of the groupthink nature of the Fed.

Monkeys and astrologers would be right half the time, far better than the Fed and ECB because they do not have the Fed’s ego and bias.

For further discussion of the Fed’s models are, please see How Bad are Inflation Models, Expectations, and Forecasts vs Reality?

Also see my comments on retail sales, earlier today: Retail Sales Unexpectedly Flop in December, Down 1.9 Percent.

Thanks for Tuning In!

Like these reports? If so, please Subscribe to MishTalk Email Alerts.

Subscribers get an email alert of each post as they happen. Read the ones you like and you can unsubscribe at any time.

If you have subscribed and do not get email alerts, please check your spam folder.

Mish

Source link