Fed’s ‘Favorite’ Inflation Indicator Hotter Than Expected At 40-Year Highs

Following December’s mixed bag (spending down, income up), analysts expected January to reverse that trend but instead, incomes were unchanged and spending rise by a shocking 2.1% MoM…

Source: Bloomberg

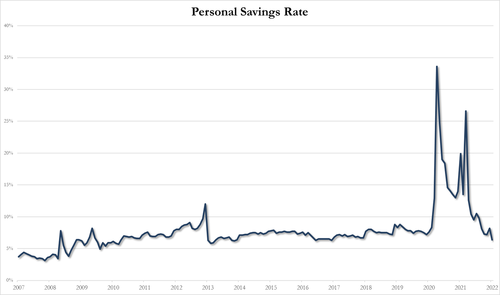

That is the biggest MoM jump in spending since March 2021 and given the lack of income gains, sent the savings rate plunging to just 6.4% of DPI – the lowest since Dec 2016!

However, Personal Income tumbled 2.1% YoY (largely thanks to stimulus/base effects), which is the biggest YoY drop since Nov 2009 (spending growth slowed but remains strong)…

Source: Bloomberg

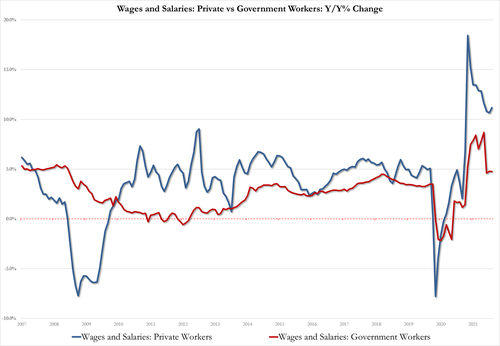

On the wages side, Private wages are up 11.2% YoY, highest since October (and up from +10.7% in Dec), while Govt wages are up 4.8%, unch from Dec.

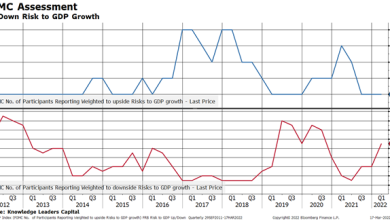

Finally, and probably most importantly, is The Fed’s favorite inflation indicator – PCE Deflator – printed at new cycle highs back to the early 80s…

Source: Bloomberg

Core PCE rose 5.2% YoY as expected (up from +4.9% YoY in Dec), but the headline PCE Deflator rose 6.1% YoY (up from +5.8% prio and above the 6.0% exp).

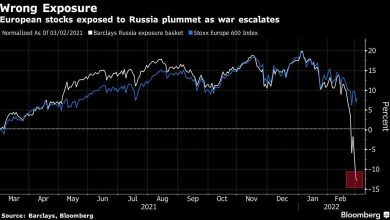

Not good news for those hoping the Russian ripples will slow The Fed’s roll.

Source link