More Upside After strong Jobs Data

The pair will likely keep rising as bulls target the next key resistance at 0.7400.

Bullish view

- Buy the AUD/USD and set a take-profit at 0.7400.

- Add a stop-loss at 0.7250.

- Timeline: 1-2 days.

Bearish view

- Set a sell-stop at 0.7250 and a take-profit at 0.7200.

- Add a stop-loss at 0.7320.

The AUD/USD price continued rising on Thursday morning as investors reflect on the strong Australian jobs data and the Federal Reserve decision. It is trading at 0.7314, which is about 2% above the lowest level this week.

Fed Decision

The FOMC concluded its two-day meeting on Tuesday and decided to deliver its first interest rate hike since 2018. The bank also signaled that it would implement a series of rate hikes this year. Precisely, it hinted that it will hike rates in all the remaining six meetings of the year.

In a statement, Jerome Powell said that the committee had decided to hike rates at the backdrop of a tightening labor market and high inflation rate. He also said that the bank could even consider hiking rates by 50 basis points in a few meetings.

In addition to the six rate hikes it expects this year, the bank signaled that it will deliver additional three increases in 2023, bringing the official rate to 2.8%.

The decision came at a time when American consumer prices have surged to the highest level in over 40 years because of the ongoing supply chain challenges. Also, the labor market has tightened, with the unemployment rate falling to 3.8% from the pandemic high of 14%.

The AUD/USD pair also rose after the latest jobs data from Australia. According to the country’s statistics agency, the unemployment rate declined from 4.2% in January to 4.0% in February. That was the lowest it has been since the pandemic started.

The country added over 77.4k during the month while the participation rate rose to 66.4%. Therefore, these numbers signal that the Reserve Bank of Australia (RBA) will also start hiking interest rates in the near term.

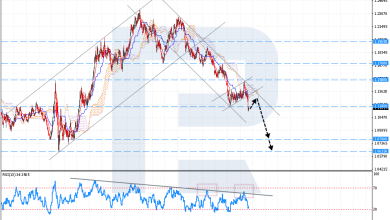

AUD/USD Forecast

The AUD/USD pair rose to a high of 0.7312, which was the highest level since March 11. As it did that, the price managed to move above the 25-day moving average, signaling that bulls are in control. It has also moved above the ascending trendline shown in black while the MACD has moved above the neutral level.

Therefore, the pair will likely keep rising as bulls target the next key resistance at 0.7400. On the flip side, a drop below the support at 0.7250 will invalidate the bullish view.

Source link