EUR/USD Technical Analysis: Rebound Attempts Have Stopped

The EUR/USD has maintained its recovery from November lows below the 1.12 support but has repeatedly turned away from technical resistance near the 1.1356 level, which could continue to keep the single European currency under wraps as the curtain closes for the 2021 trading year. The EUR/USD price is stable around the 1.1305 level at the time of writing. Market holidays and the reluctance of investors lead to poor liquidity, and therefore movements in very narrow ranges.

The euro has recently been supported in the Forex market by moderating the inflationary rise in natural gas prices and after several research studies indicated that the Omicron strain of coronavirus could pose less of a threat to public health than its predecessors, potentially making it less of an economic headwind. Commenting on the performance, David Sneddon, head of technical analysis at Credit Suisse, said in a note ahead of the holidays, “Near-term resistance remains at 1.1325/29, with 1.1356/60 ideally covered to keep immediate risks low.” The euro’s rally against the dollar above the 1.13 level was also helped by the six-month pause in the dollar’s rally, which was more pronounced against the higher-yielding and riskier currencies such as the British pound and the Australian dollar.

Juan Manuel Herrera, analyst at Scotiabank, said in a research note on Friday, “Price action does not show much directional bias in the short term but the chart overview is negative based on the Euro’s multiple failures to advance beyond mid/higher 1.13 during Last month. Risk/reward alone prefers to sell EUR here to retest the low/medium level of 1.2 (at least).”

There are no central bank policy events or major economic numbers scheduled this week, leaving only normally low trading volumes for holiday market conditions to determine if the EUR/USD rate remains awkward below 1.1356 as the new year approaches.

“The US dollar could benefit from negative Omicron news, although its position is still stretched and bare for further declines through the end of the year,” Valerie Bernstein, analyst at Citi FXWire, said in a market commentary last week. “Price action continues to be exacerbated by the liquidity conditions during the holiday, and with the CitiFX Flows & Positioning Report indicating that the US dollar is the most significant long into the end of the year. CitiFX strategy believes that the path of least resistance for the US dollar is lower in the near term.”

Overall, market appetite for the dollar and changes in expectations for the Fed’s interest rate policy will also be significant again in January as was the divergence between ECB and Federal Reserve policy that drove the EUR/USD down -7.14% over 2021.

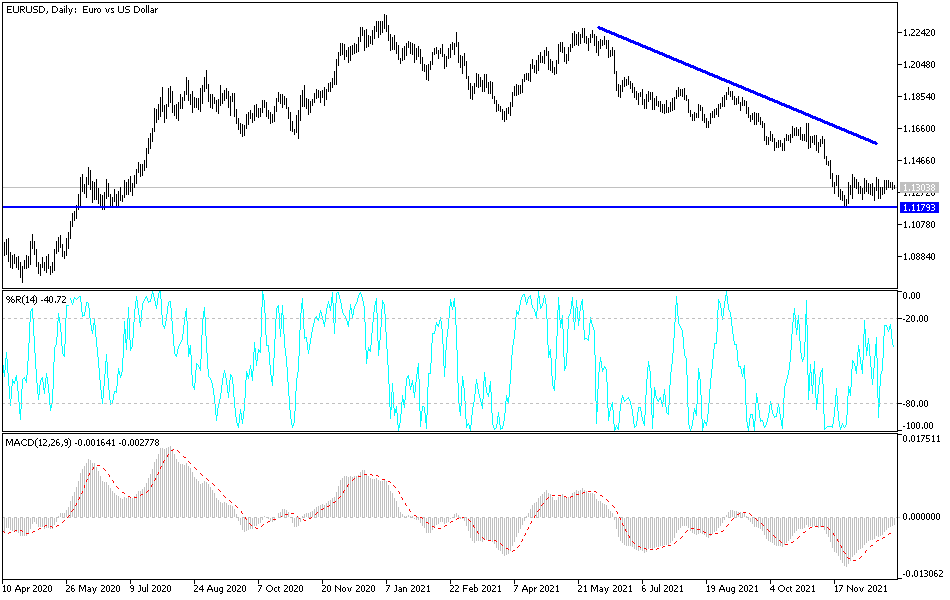

Technical Analysis

No change in the movement, so no change in expectations. The currency pair EUR/USD is in an attempt to rebound higher, but the correction path needs more momentum to strengthen these opportunities. The morale of investors towards the euro is still weak amid stronger European COVID restrictions. Accordingly, the EUR/USD may remain subject to selling every time it rises, and the closest resistance levels for the pair are currently 1.1375, 1.1420 and 1.1500. On the other hand, returning to the support area of 1.1250 will bring the bears momentum again. In general, the trend is still bearish.

Today, the money supply and special loans for the Eurozone will be announced. Then the announcement of US pending home sales.

Source link