US financial conditions remain easy even as Fed pulls back on stimulus

US financial conditions are nearing their most accommodative ever, even as the Federal Reserve begins ramping up its exit from stimulus measures in the era of the coronavirus crisis in an effort to combat high inflation.

Measures of financial conditions have only marginally tightened since the Federal Reserve’s meeting last week, according to economists at Goldman Sachs, who produce a closely-watched index that takes into account shifts in the US stock market, corporate borrowing costs, and moves in the dollar and financing. US government costs.

Despite the hawkish pivot, US stocks remained bouncing around record highs, while yields on US Treasuries remain stubbornly low by their historical standards.

The fact that companies have had little trouble listing shares publicly, or tapping lenders for new credit, underscores the extraordinary levels of liquidity flowing through the global financial system and presents a mystery to federal policymakers seeking to calm the economy and tame inflation.

“The goal is to slow things down and hope inflation comes down,” said Laura Rosner-Warburton, chief economist at MacroPolicy Perspectives. “To do that, you need financial terms to be a little tighter.”

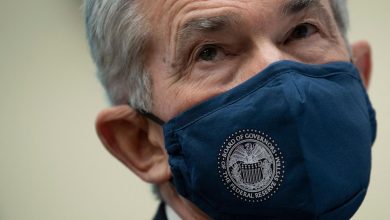

The Federal Reserve is highly sensitive to financial conditions, since it provides a barometer of how shifts in central bank policy and global economic prospects are transmitted to the real world. Jay Powell, its president, admitted this last week. He stressed that the economy no longer needed such massive emergency aid, but that despite the central bank’s new plans to scale back the asset purchase program faster, financial conditions would remain “favourable.”

The stimulus is now set to stop completely by the end of March – a milestone for the Federal Reserve, which has more than doubled the size of its balance sheet as it sought to bolster financial markets and support the economy through the crisis.

An earlier end to so-called “tapering” has led the central bank to raise interest rates sooner — something officials now believe they can do three times next year to try to tackle inflation, which is running at its fastest pace in nearly 40 years. This is a much more aggressive approach than it was just three months ago, when the FOMC and other regional Fed chairs were evenly divided over the prospects for just one rate hike in 2022.

Further interest rate hikes of three-quarters of a point are now scheduled to begin in 2023, and further hikes are expected in 2024. These interest rate increases usually portend tighter financial conditions and reduce the strength of the economy, leading to a higher Mortgage and corporate loan costs or interest on a credit card bill.

One of the main reasons financial conditions remain so loose is that investors have been betting that the Fed may not be able to raise interest rates as much as it had hoped if economic growth slows more than it had, said Brian Nick, chief investment analyst at Novin and a former. expected. An employee of the New York branch of the Central Bank.

That possibility came into focus this week after Democratic Senator Joe Manchin of West Virginia blocked the Biden administration’s landmark $1.75 trillion social spending bill. An alarming rise in Covid-19 cases linked to the emerging Omicron variant has also clouded expectations.

“Given the spending bill is publicly lower and growth forecasts moderated somewhat in the first quarter due to Omicron, the Fed may not be as drawn into the tightening as it thinks,” Nick said. “The Fed will have plenty of reason to be patient if it wants to.”

Market measures of interest rate expectations are already pointing to deep doubts about the Fed’s expected path forward. Guaranteed funding rate futures, which traders use to hedge against interest rate movements, suggest the Fed will raise interest rates less than three times next year before finally stopping at 1.4 percent in 2024. That’s well below 2.1 percent . The cent level is suggested in the “point chart” of the individual interest rate forecast published by the Federal Reserve this month.

Some investors warned that higher inflation readings in the coming months could rock financial markets, with stocks approaching record territory despite the Federal Reserve’s move to tighten policy. This is particularly fearful for some, given how low yields on Treasuries are and the fact that short-term funding markets are pricing in a relatively shallow rally cycle. If interest rates rise in either one, it may send waves through the credit and stock markets.

“If inflation remains elevated, the Fed will have to move faster,” said Steve Keane, chief investment officer for fixed income at TCW. “This is where financial conditions can tighten very quickly and it can really upset the apple cart.”

The argument was made by Christopher Waller, a Fed governor, for the central bank to raise interest rates in March, several months earlier than what futures markets are currently suggesting. Other senior officials may soon support the move if price pressures continue to show clear signs of expansion outside sectors most sensitive to pandemic-related disruptions.

“If you start to see an accelerated tapering of Fed purchases and a face-to-face meeting in March for a potential rate hike… [and] “Financial conditions start to tighten, and you will see that translate into significant volatility in the markets,” said Eric Knutzen, chief investment officer at Neuberger Berman.

Source link