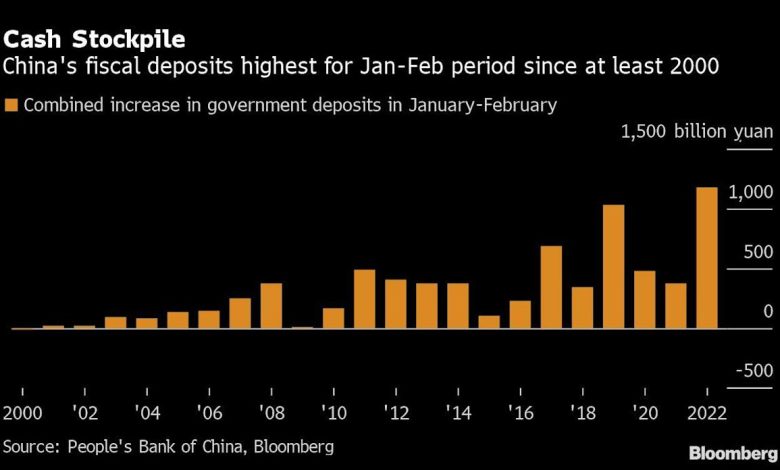

China Stockpiles Record Cash In Sign of Slow Fiscal Stimulus

(Bloomberg) — China’s government stockpiled a record amount of cash in the first two months of the year instead of spending it, despite numerous pledges by top officials to speed up fiscal stimulus to boost the economy.

Most Read from Bloomberg

Government deposits, which are listed under liabilities on the central bank’s balance sheet, rose by a combined 1.17 trillion yuan ($184 billion) in January-February, according to Bloomberg calculations of official figures. That was the biggest increase for the two-month period since comparable data going back to 2000.

The figures suggest the government is spending far less than the income it’s getting from sources such as local bond sales and tax revenue. It also contradicts the messages from senior leaders and pledges from the government’s own work reports to “front load” stimulus to bolster a faltering economy.

The build-up in savings means authorities have plenty of financial ammunition to deploy when they push up spending.

Xing Zhaopeng, senior China strategist at Australia and New Zealand Banking Group, attributed the record deposits to the fast pace of local government bond issuance, saying he expects a jump in expenditure soon.

“There will be plenty of room for further fiscal stimulus, and fiscal spending will be significantly accelerated from March,” he said.

China’s general budget spending rose 7% in January-February from a year ago, lagging the 10.5% growth in general fiscal income in the period, according to data from the Ministry of Finance. The pace is slower than the government’s target for an annual increase of 8.4% in general fiscal expenditure.

READ: China Signals More Tax Relief as Li Says GDP Goal Won’t be Easy

China’s top leaders have pledged to “properly advance infrastructure investment” as part of efforts to bolster an economy besieged by a housing market slump, a resurgence in domestic Covid cases, and spiking energy prices due to the Russia-Ukraine war.

Even though the economy got off to a stronger-than-expected start to 2022, concerns remain over whether Beijing’s ambitious growth target of around 5.5% growth for this year can be achieved. Bank lending slumped in February, pointing to still sluggish corporate demand for loans while home mortgages declined for the first time in at least 15 years.

Those risks make infrastructure spending, with its knock-on effect on construction and other sectors, even more important as an engine of growth in a politically sensitive year in which the Communist Party is making economic stability a top priority.

A key source of funding for infrastructure investment is local governments’ issuance of new general and special bonds, which climbed to more than 950 billion yuan in the first two months of the year. Aside from the pandemic-hit year of 2020, that was the highest amount of bonds sold ever in the two-month period, Bloomberg calculations show.

“Supporting infrastructure construction with fiscal money will remain the key to stabilizing economic growth,” said Qi Sheng, an analyst at Orient Securities Co. “Government deposits will drop in the coming months as fiscal spending accelerates while income growth slows.”

(Adds finance ministry’s data on Jan-Feb budget spending growth in the seventh paragraph.)

Most Read from Bloomberg Businessweek

©2022 Bloomberg L.P.

Source link