EUR/USD Technical Analysis: Attempts to Recover

For the second day in a row, the price of the EUR/USD currency pair is trying to recover from the recent collapse that pushed it towards the 1.0806 support level, its lowest since May 2020. This is due to the continuation of the Russian-Ukrainian war and its negative impact on the future economic recovery of the euro area. The rebound attempts for the EUR/USD pair stopped around the 1.0985 level, and it is settling around the 1.0915 level at the time of writing the analysis. The single European currency fell further at the opening of this week’s trading as financial markets responded to the sharp rises in oil and gas prices that appear to be weighing on global stock markets and a wide range of other currencies.

The euro rebounded strongly in the final hours of trading and extended that recovery along with European stock markets during Tuesday’s session. It saw energy prices corrected lower despite suggestions from Moscow that Russian gas supplies to Europe could soon be scaled back. Commenting on the performance, Kenneth Brooks, strategist at Societe Generale says, “The 5.4% or drop since last week is the steepest since the first quarter of last year and leaves the EUR/USD in technically oversold territory. Buyers are likely to remain on the sidelines ahead of the US CPI and European Central Bank meeting on Thursday.”

The European single currency’s recovery was only outperformed by the Norwegian krone and currencies from the Central and Eastern European region, which were all lower than the euro during the tough sell-off last week. “Importantly, the smaller adjustment in the value of the euro compared to other European currencies is partly due to the higher level of liquidity in the EUR/USD exchange rate,” says Stephen Gallo, analyst at BMO Capital Markets.

The background indicates a period of declining inward investment in Europe from abroad, weak economic growth due to high inflation, and further deterioration in the trade balance due to high oil prices. Therefore, we will not judge the EUR/USD movement as overextended yet from a fundamental perspective.”

All safe haven currencies were sold off massively in the last week of February after Russian military forces crossed the border into Ukraine, although European currencies were by far the lowest; Led by those in Central and Eastern Europe. As for the euro, the dollar, and other euro exchange rates, much now depends on the European Central Bank’s latest inflation forecast and its assessment of what the conflict in Ukraine means for its monetary policy outlook, both of which are due to be revealed on Thursday.

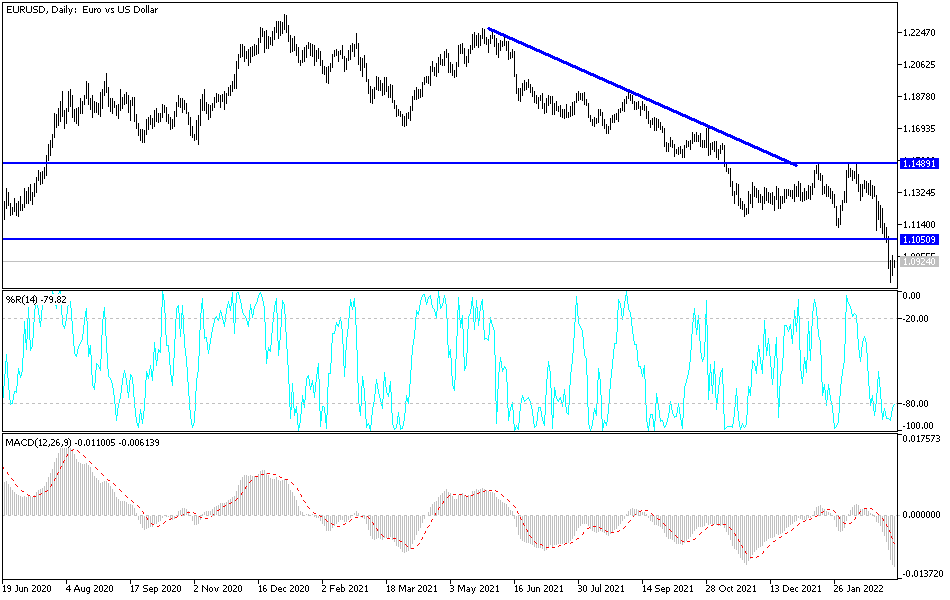

According to the technical analysis of the pair: The price of the euro currency pair against the dollar EUR/USD will remain set to decline if the Russian-Ukrainian war continues. This threatens the future economic recovery of the eurozone and threatens the plans of the European Central Bank and the euro pairs all on an important date tomorrow, with the European Central Bank announcing its policy update cash. According to the performance on the daily chart, the return of stability below 1.0900 supports the bears for a stronger bearish move towards the next most prominent support levels 1.0820 and 1.0700, respectively.

On the upside and over the same period, the pair needs to move above the resistance 1.1120 as a first stage to get out of the current sharp bearish channel.

Source link