$1800 Break May be Possible

The natural gains of the US dollar after the US Federal Reserve indicated the date for raising US interest rates. It caused gold prices to fall to the support level of $ 1810 an ounce at the time of writing the analysis. After the gains of the summit of $ 1853 an ounce before the announcement, which cited high inflation and a strong labor market, the US Federal Reserve indicated that he plans to start raising US interest rates “soon.”

The Fed left rates unchanged at levels close to zero as was widely expected but said the FOMC expects “it will soon be appropriate to raise the target range for the fed funds rate”. The Fed’s comments were largely in line with expectations, with CME Group’s FedWatch tool currently indicating a 91.4 percent chance of a quarter-point rate hike at the upcoming FOMC meeting in mid-March.

To combat the economic impact of the coronavirus pandemic, the Fed has left interest rates at zero to 0.25 percent since March 2020. The Fed previously pledged to leave interest rates unchanged until labor market conditions reach levels consistent with the Federal Open Market Committee’s assessments of the limit maximum employment. The US central bank also said it would reduce the pace of its bond purchases to $30 billion per month starting in February, as the Fed said it expects to end its asset purchase program by early March. The plans to tighten monetary policy come as the Federal Reserve said that indicators of economic activity and employment continued to strengthen.

The Fed has also continued to describe US inflation as “high,” citing supply and demand imbalances linked to the pandemic and the reopening of the economy. Noting the risks to the economic outlook, the Fed assured that it would be willing to adjust its monetary policy stance as appropriate.

In a separate statement, the Fed outlined plans to significantly reduce the size of its balance sheet, saying it expects the cuts to start after it starts raising interest rates.

On the US economic front, a report issued by the Commerce Department showed that US new home sales rose much more than expected to a nine-month high in December. The Commerce Department said new home sales rose 11.9% to an annual rate of 811,000 in December after rising 11.7% to a revised rate of 725,000 in November. Economists had expected new home sales to jump 2.2% to a rate of 760,000 from 744,000 originally reported for the previous month. With a much larger-than-expected increase, new home sales reached their highest annual rate since hitting 873,000 last March.

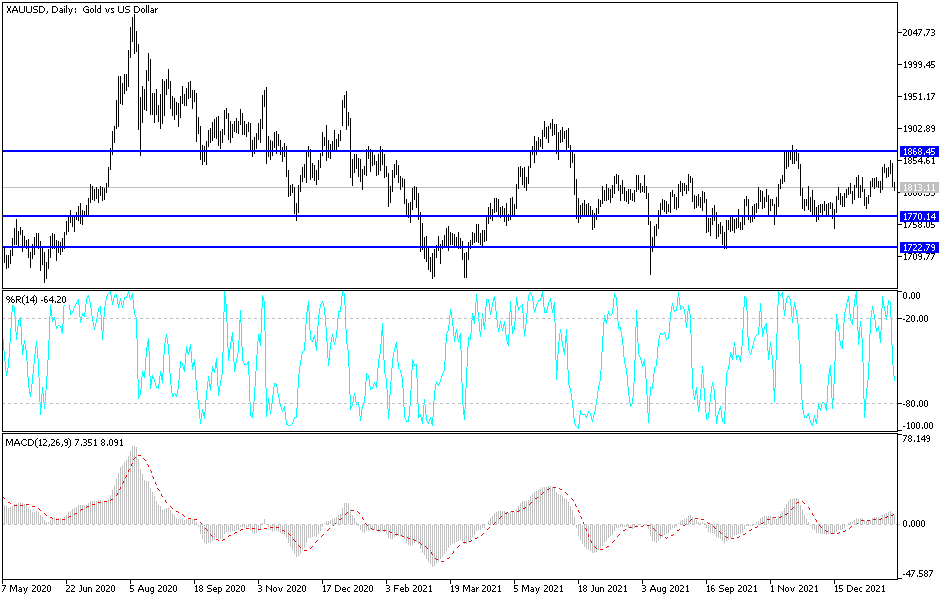

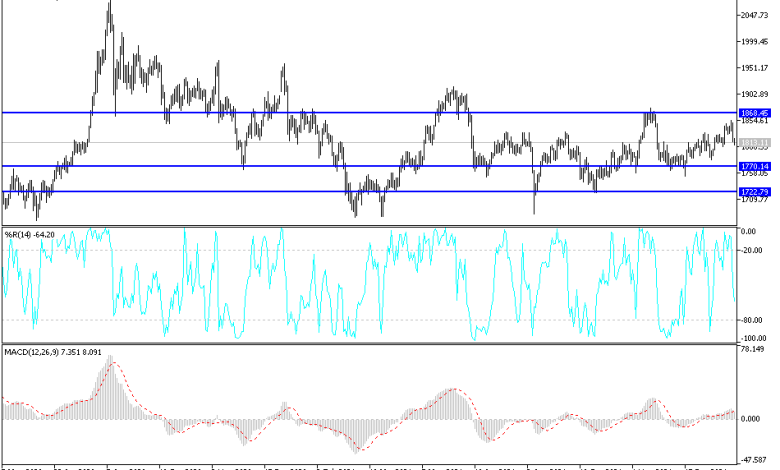

According to gold technical analysis: The recent correction of the gold price after the Federal Reserve’s announcement may collide with the important support levels of 1810 and 1800 dollars. It will break the last level which is important for the bears’ dominance again. I still think that the breach that contributed to the decline to the support level of 1775 dollars per ounce will be important to think In the return of buying gold again. The bulls still have to maintain the bullish outlook as long as prices are stable above the psychological resistance of $1800 an ounce. The price of gold will be affected today by the extent to which investors take risks or not, as well as the reaction of the US dollar from the announcement of the growth rate of the US economy, the number of jobless claims and orders for durable goods.

Source link