EUR/USD Technical Analysis: Stronger Bearish Control

The EUR/USD started the week after giving up an important level of support, leaving it at risk of a crash on the charts when low liquidity could lead to big moves heading into the holidays. The EUR/USD currency pair gained momentum to move higher above the 1.13 level late last week when the US dollar fell broadly in the wake of the US Federal Reserve’s policy decision on Wednesday and after the euro was lifted by the European Central Bank decision last Thursday. The currency pair is stable around the 1.1280 level at the time of writing.

The European Central Bank’s plan to phase out a managed €1.85 trillion pandemic emergency purchase program between March and October next year was followed by a market bid for the euro, though the bid failed to push the euro against the dollar far enough from recent lows to alter its apparent course. Commenting on this, Chris Turner, an analyst at ING Bank said, “Governor Lagarde appears to have successfully conveyed the message that the ECB will continue to tolerate higher rates in 2022 without any significant tightening or acceleration of tapering. This is key to keeping peripheral spreads in check, but also indicates that the ECB will not close the gap with the Fed for the foreseeable future, which should keep the EUR/USD lid into the new year.”

While the European Central Bank raised its inflation forecasts across the board, the bank otherwise stuck to the view that recent increases in price growth to record levels are likely to fade on its own next year without the need for a monetary policy response. It came sharply on the heels of a “hawkish” Fed speed up scaling back its quantitative easing program to expire in March 2022 instead of June and warn that the interest rate could start to rise sooner than previously thought.

The Federal Reserve Board’s December forecast has suggested that a majority of US policy makers see the Fed as likely to raise interest rates three times in the next year, and the Fed funds rate range is likely to rise to between 0.75% and 1% by time.

While the dollar fell broadly after the Fed’s decision in December, the prospect of a growing gap between the Fed and the European Central Bank next year is something many analysts see as supportive of the US currency and likely to keep the EUR/USD rate under pressure for the coming months. Commenting on this, Jane Foley, FX Analyst at Rabobank said, “Overall, we expect the bullish trend of the US dollar to continue into the early months of 2022 as the Fed ends its bond-buying program and approaches its first rate hike of the cycle. As a result, we have revised our 6-month EUR/USD forecast to 1.10 from 1.12.”

The PCE inflation figures to be released Thursday from the US are the highlights of this week, and the dollar could be sensitive on whether the number rises more than 5% as this could push the market forward when you expect the interest rate to start lifting. This could be a downside risk for the EUR/USD this week which is otherwise devoid of major events in the economic calendar, but is also likely to be marked by volatile and unstable conditions.

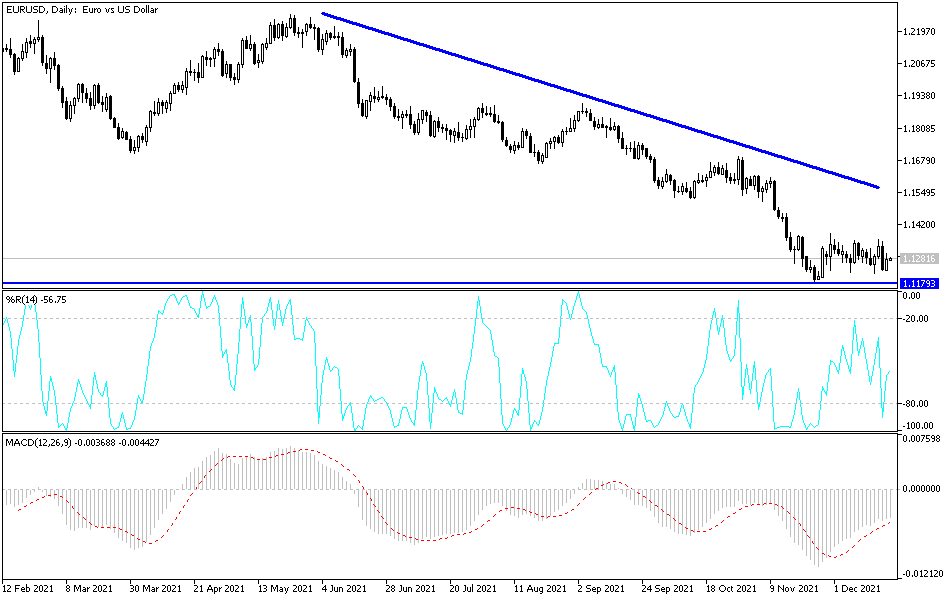

Technical Analysis

No change in performance, no change in expectations. The trend for the EUR/USD currency pair will remain bearish as long as it is stable around the 1.1300 support level, whch will open for a move to the 1.1245, 1.1180, and 1.1000 psychological support levels. On the upside, and according to the performance on the daily chart below, the bulls need to break through the resistance levels 1.1385 & 1.1525 to have a chance at changing the trend.

Today, the GFK index of German consumer climate and consumer confidence will be released in the Eurozone, and from the United States, current account numbers will be released.

Source link