NZD/USD Rebound Aims Higher After Upbeat Consumer Confidence Data

New Zealand Dollar, NZD/USD, Consumer Confidence, USD/TRY – Talking Points

- Asia-Pacific markets may see a risk-on session today after gains across Wall Street

- New Zealand consumer confidence improved in December as Covid threat looms

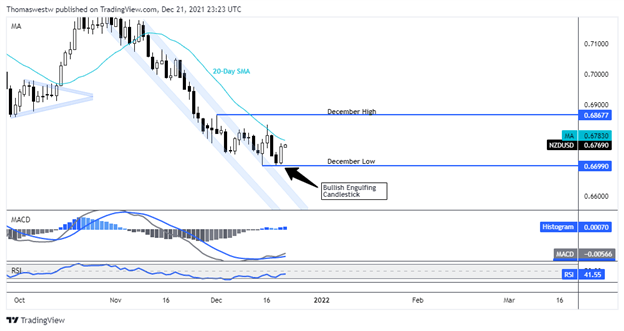

- NZD/USD forms Bullish Engulfing candlestick overnight as prices near 20-day SMA

Wednesday’s Asia-Pacific Forecast

The New Zealand Dollar surged higher against the US Dollar overnight as risk aversion pulled back. US equity markets rallied, with the Dow Jones Industrial Average (DJIA) gaining 1.60%. That revived some hope for a Santa Claus rally headed into the New Year. Investors are cautious about the Omicron variant, but President Biden assuaged concerns over possible new restrictions to battle the new variant saying people are safe to celebrate the holidays given they received their booster shoot. Indeed, evidence is starting to show that a booster is required to provide robust protection against Omicron.

This morning, New Zealand’s ANZ Bank released its December consumer confidence survey results, with the index showing an increase to 98.3 from 96.6 in November. That is a 1.8% increase on a month-over-month basis. The survey showed virtually no change for inflation expectations, but expectations on house prices fell to 5.3% from 5.9%. Overall, the data is a positive sign for the Kiwi economy, but the Omicron variant represents a big question mark for a country that has so far taken a rather strict approach over Covid restrictions.

Elsewhere, the Turkish Lira continued to strengthen versus the Greenback, with USD/TRY falling almost as low as the 11 mark before trimming some weakness. Turkish President Erdogan announced a rescue plan for the embattled currency on Tuesday. The plan will guarantee returns on Lira deposits for investors. The government will offer a special account that aims to compensate the holder against Lira depreciation. Despite the Lira’s recovery, the currency remains severely depressed versus the US Dollar on a year-to-date basis.

The Bank of Japan’s monetary policy minutes crossed the wires this morning, but the Japanese Yen failed to show any reaction given the lack of surprised within the statement. Australia’s Westpac Leading Index rose 0.12% for November m/m, down from 0.27% in October. Later today, the Philippines will report October retail sales; Thailand is due to release an interest rate decision; and Taiwan’s unemployment rate will see an update. Also, keep in mind that many markets are closed on Friday for the Christmas holiday, which may lead to increased volatility amid a reduction in liquidity.

NZD/USD Technical Forecast

NZD/USD appears set to continue higher from its overnight gain when the currency pair formed a Bullish Engulfing candlestick, which puts a bullish bias on the short-term technical outlook. The falling 20-day Simple Moving Average (SMA) may provide resistance, but a break higher would see the December high at 0.6867 shift into focus. Alternatively, a break back lower puts the December low at 0.6699 on the table.

NZD/USD Daily Chart

Chart created with TradingView

— Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or @FxWestwateron Twitter

Buka akaun dagangan patuh syariah anda di Weltrade.

Source link