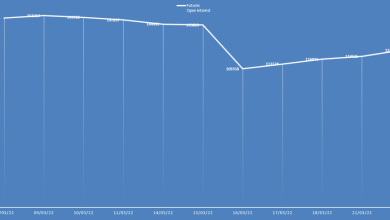

Index Gaps Lower and Falls Again

It is very likely that the NASDAQ 100 will be one of the worst performing indices as technology stocks tend to shun anything that shows signs of high valuation.

The NASDAQ 100 has gapped lower to kick off the trading session on Thursday, and then fell significantly to crash into the 14,600 level in the futures market. That being said, this is a market that I think continues to see a lot of noisy behavior and therefore volatility. Volatility picking up of course has a detrimental effect on the bullish aspect of the market, so would not be a huge surprise to see this market continue falling. However, you should keep in mind that the job summer comes out on Friday, so that should cause a lot of volatility overall.

One of the big considerations be whether or not the Federal Reserve continues to tighten its monetary policy and of course show signs of extending it. If that is going to be the case, then that will be toxic for market such as the NASDAQ 100, and of course it will sink all risk assets. That being said, the market is likely to continue in the opposite direction if we were to see a very negative jobs report, because that could have the market participants thinking that the Federal Reserve might ease its stance on doing anything as far as tightening monetary policy is concerned.

All things been equal though, I think we are going to continue to see traders bet on a tightening Federal Reserve, and of course we have had the Bank of England tighten during the session as well. Furthermore, we have the European Central Bank starting to acknowledge inflation, so there is also a possibility of tightening from that direction as well. If that is going to be the case, then risk appetite in general will continue to be an issue. As long as that is going to be the case, it is very likely that the NASDAQ 100 will be one of the worst performing indices as technology stocks tend to shun anything that shows signs of high valuation. After all, the leading stocks in this index of course are highflyers, such as Tesla, Amazon, and the like. As long as that is going to be the case, it is likely that we are going to see a lot of trouble at this point in time. I do think it is interesting to note that we pulled back from the 61.8% Fibonacci retracement level, and then gapped below the 200 day EMA.

Source link