COVID Restrictions to Hurt Pound

Threats from the British government to re-impose COVID restrictions increased the pressure on the British pound in the Forex market. The GBP/USD fell to the 1.3174 support level, near its lowest of the year, before settling around the 1.3215 level at the time of writing. The currency pair’s gains quickly evaporated after the Bank of England suddenly announced an interest rate hike, when it reached the 1.3375 resistance level. The British pound is entering the new week’s trading as one of the best performing major currencies in recent days with competition coming only from the US dollar which seemed to find its feet before the weekend when losses incurred in the wake of the Fed’s decision last Wednesday began to be reversed.

The Bank of England (BoE) surprised markets with its decision to raise the bank interest rate from 0.1% to 0.25% last Thursday, and the currency pair quickly fell as the dollar appeared to draw a line under the broad losses that followed the Federal Reserve’s decision on Wednesday. This means the US central bank could start raising US interest rates as soon as possible in the second quarter of next year and at the same number, three times in 2022.

Commenting on this, Lee Hardman, currency analyst at MUFG, says: “Events this week reinforce our view that when normal trading resumes in January, the US dollar is likely to remain well supported and rise further – especially against the lower-yielding G10 currencies. The Fed is set to be more active in tightening policy against many of the other G10 central banks, while withdrawing liquidity would also be helpful in supporting the dollar.”

The December point chart of Fed policy makers’ expectations indicated that the Fed could raise the US interest rate more and faster than the Bank of England next year, a result not fully priced in by interest rate markets that could act as headwinds for the pound-dollar rate in the coming weeks. This comes after inflation rose more than six percent in the United States in November, prompting the Federal Reserve to accelerate the end of the quantitative easing program last week so that it expires next March instead of June, and also to warn of the possibility of higher interest rates, sooner than previously thought.

Bank of America analysts comment, “We don’t think the sterling rebound is a game changer. We continue to favor sterling weakness until 2022, as we believe the cyclical and structural background will deteriorate, making the BoE’s job more challenging to meet market rate hike expectations. Thus, we tend to fade the bullish rally but recognize the build-up of bearish sentiment/positioning.”

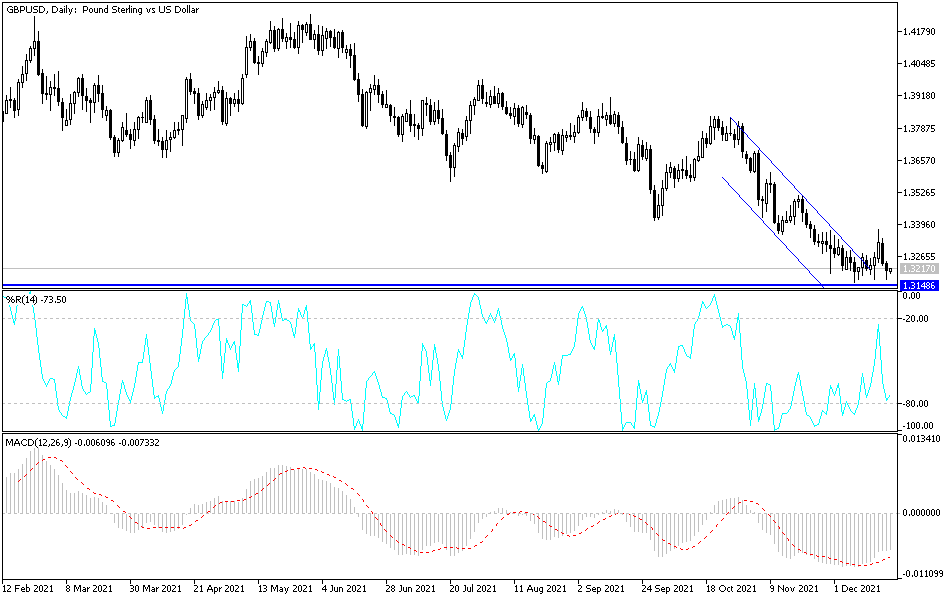

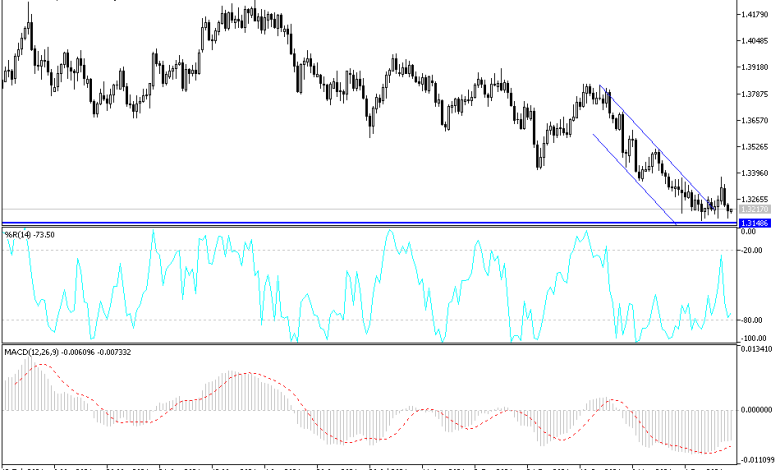

Technical Analysis

More downside pressures are expected for the GBP/USD currency pair due to the strength of the dollar and the pandemic rise in the UK. We may eventually witness a retest of 2021 lows and a key level of support around 1.3167 within the coming days, which paves the way for a test of the 1.3000 psychological support. It is worth noting that we may have less liquid market conditions due to the holidays. To get out of the current descending channel, the bulls must break through the 1.3400 resistance.

Source link