USD/JPY Technical Analysis: Preparing for Profit Taking

Despite the strong signals from the Federal Reserve about the future of raising US interest rates this year, the USD/JPY currency pair is subjected to selling operations that pushed it towards the level of 115.11. Attempts to rebound higher for the pair did not exceed the level of 115.88 this week. Forex investors wonder if the correction is higher based on this performance. The currency pair is preparing for a profit-taking sale and a change of direction.

There is no doubt that the financial markets have long priced the opportunity to raise US interest rates, especially with US inflation reaching its highest level in 40 years. This event changed the balance of markets and expectations. Fears of Russia’s desire to invade Ukraine contributed to investors’ desire to buy safe havens, and the Japanese yen is one of the most important ones because it is still a negative interest.

Most Fed officials agreed that faster US interest rates would be needed “if inflation does not move downward,” as the Fed’s policy-making committee expects, according to the minutes of the central bank’s monetary policy meeting in late January, which were released Wednesday.

The minutes underscore the urgency that the Federal Reserve under Jerome Powell feels to rein in the sharp rise in inflation, which has lasted longer and has expanded to more industries than policymakers expected. Most recently, in December, Federal Reserve officials projected that inflation, based on their preferred measure, would fall to an annual rate of 2.6%. It is currently at 5.8%. Most analysts expect US central bank officials to raise those expectations at their next meeting, in mid-March, to reflect acceleration in consumer prices. US inflation has reached its highest rate in four decades, undermining household budgets and eliminating the benefits of higher wages.

Federal Reserve officials are expected to raise the benchmark short-term interest rate several times this year beginning in March. Economists have increasingly pointed out that the Fed has waited too long to unleash its anti-inflation tools. “The Fed is behind the curve,” said James Orlando, chief economist at TD Economics. “It needs to catch up, which we hope will cool some bloated froth.”

At a news conference after their January 26 meeting, Powell said Fed officials would be “modest” and “smart” in their interest rate decisions. He also said at the time that policy makers were “considering raising the federal funds rate at the March meeting, assuming conditions are right to do so.” Several Fed officials have recently acknowledged that inflation has proven to be worse than they expected. The minutes of the January meeting noted that officials “noted that recent inflation readings continued to significantly exceed the (Fed’s) long-term target and that high inflation persisted for longer than expected.”

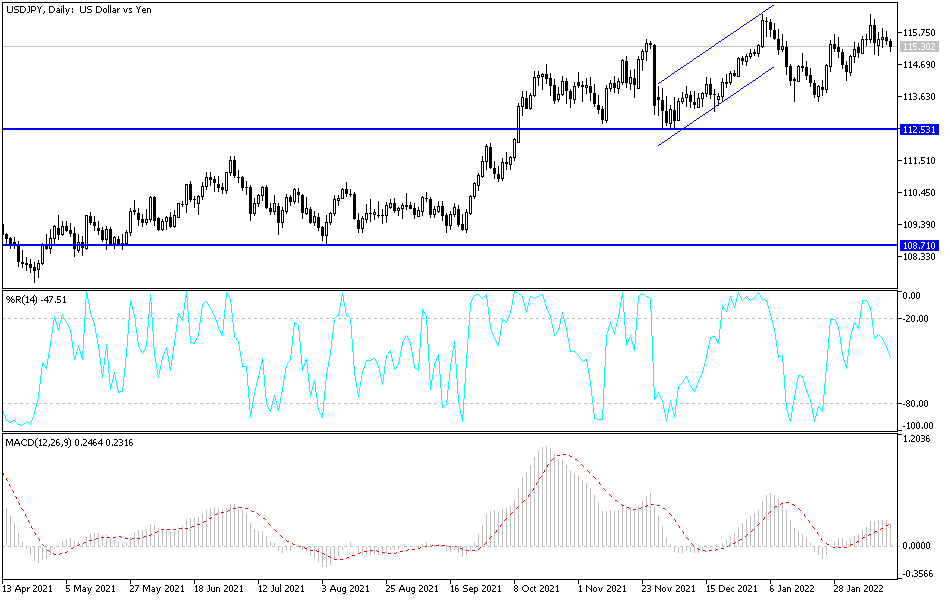

According to the technical analysis of the pair: The recent selling operations are still limited. The price of the USD/JPY currency pair has not exited the upward path so far as long as it is stable around and above the resistance 115.00. The direction of the currency pair stops with the bears moving towards the support levels 114.75 and 113.30 which will continue to be an upward trend. On the other hand, Russia’s abandonment of the idea of the invasion and the return of market focus on the future of tightening the global central bank policy will give the bulls a new opportunity to break through the most important 116.35 resistance on the daily chart.

The USD/JPY currency pair will be affected today by the risk appetite of investors, as well as the reaction from the release of US housing numbers, jobless claims, and the Philadelphia manufacturing index.

Source link